The traits you need to lead a company through a recession

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Economic Progress

The global economic cycle has taken us on many roller coaster rides. From boom to bust, investors have watched trillions of dollars appear and then disappear even more quickly.

As the economic landscape continually changes, the type of leader needed to guide a company also changes.

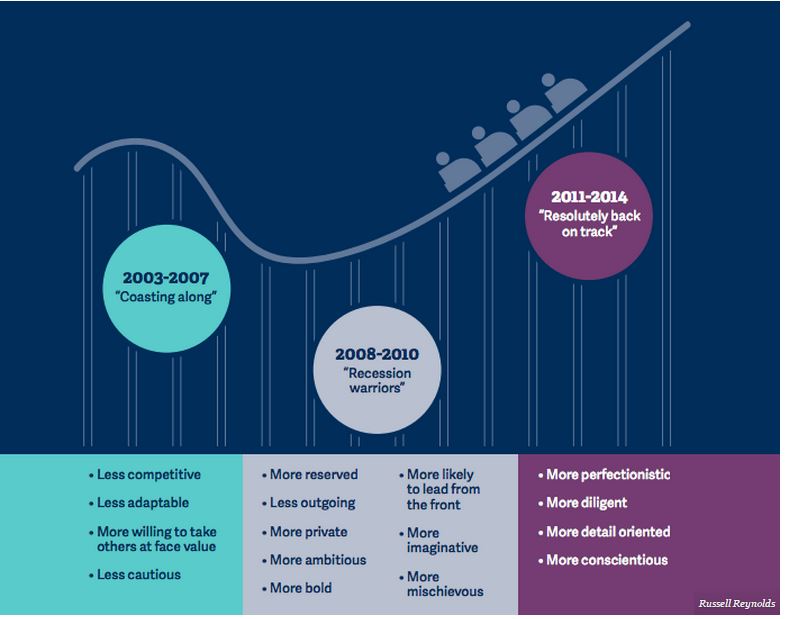

The team at executive search firm Russell Reynolds examined the type of characteristics needed by CFOs during times of economic booms and busts.

The survey compared 129 CFOs against a broader database of executives. Researchers examined 60 commonly accepted psychological scales from well-validated leadership assessments to “understand on which scales the CFOs showed statistical differences from the other populations.”

Using that information they put together a list of traits that demonstrates how different types of CFOs work best during certain economic conditions.

“When we looked at the psychometric data from CFOs we’d assessed at different points in the economic cycle, some fascinating observations emerged,” Russell Reynolds CFO expert Jenna Fisher told Business Insider. “From 2003 to 2007, when the waters were relatively smooth, the CFOs being hired were fairly low-key and not averse to taking a bit of risk. During the recession, though, firms recruited a new breed of take-charge CFO — a bolder, more ambitious, more imaginative, more dynamic leader.”

She added, “Interestingly, though, post-recession organizations are targeting CFOs with more conservative DNA — more perfectionistic, detail oriented, and diligent — hoping to prevent a recurrence of the oversights that led us into the financial crisis in the first place.”

The report concludes that we may attribute this trend to the recent rise of the qualified accountant as CFO. “However, we see this characteristic manifested even among advisor CFOs (former bankers, consultants, and the like) and thus also attribute this movement to ever greater regulatory pressure for CFOs to be absolutely crisp on the details.”

If you want to effectively lead your company for years, it’s clear you need to be adaptive in various economic climates.

This article is published in collaboration with Business Insider. Publication does not imply endorsement of views by the World Economic Forum.

To keep up with the Agenda subscribe to our weekly newsletter.

Author: James Kosur is the C-suite editor at Business Insider.

Image: A Businesswoman is silhouetted. REUTERS/Christian Hartmann.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Economic ProgressSee all

Joe Myers

April 19, 2024

Joe Myers

April 12, 2024

Joe Myers

April 5, 2024

Pooja Chhabria

March 28, 2024

Kate Whiting

March 28, 2024

Joe Myers

March 28, 2024