4 major challenges facing boardrooms in 2016

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Future of Work

1. Shareholder Activists

Shareholder activists are globally expected to continue challenging the boardroom dynamics in the U.S, Canada, Europe, Japan, Australia and India. Growth is coming from Shareholder Activist funds that grew to $112 Billion in 2014.

The latest data from Insights suggests 2014 could be the busiest year on record for shareholders activists. Boards across the US, Canada, Europe, Australia and India will continue to face more involvement from shareholders in the form of shareholder activism.

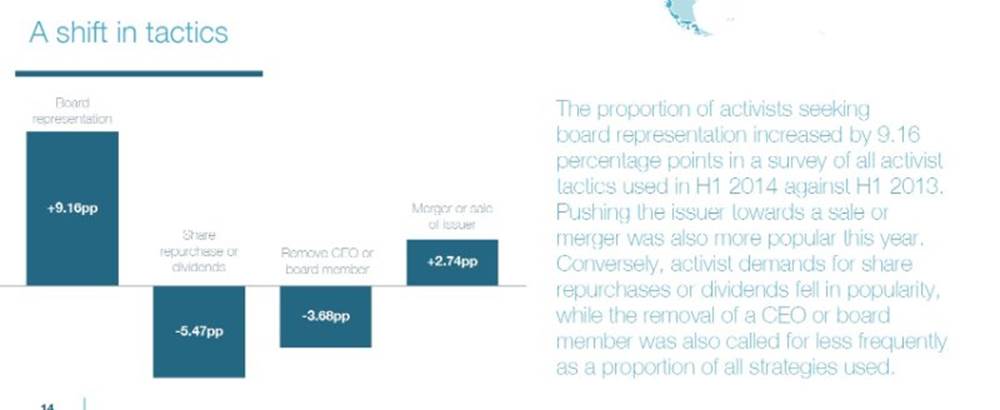

What did Shareholder Activists focus on in 2014?

2. Rise In Cyber-Attacks

Income inequality and lack of employment is expected to grow globally, and this will add a new dimension in securing the key “data assets” of the enterprise from both outside hackers and internally disgruntled employees. Forcing many directors to question their fiduciary responsibilities in an era of shareholder activism and growing securities litigation.

According to IBM-commissioned studies of eleven countries by the Ponemon Institute, the average cost of data breach increased by 15% globally. Global chairmen are faced with the reality that no country or industry is safe from cyber-attacks today. Household names such as Apple, Sony and UPS are victims to hackers stealing sensitive customer data. This is followed by loss of customer loyalty and brand reputation. Certain industries, such as pharmaceutical companies, financial services and healthcare, experience a high customer turnover after the breach.

Directors are searching for answers on how to provide effective oversight in this area. In the United States, 65% want more focus on IT risks including cybersecurity. While in the UK, according to a survey of FTSE 350 firms, 62% of companies think their board members are taking the cyber risk very seriously, and 60% understand what their key information and data assets are.

In the United States, nearly half of directors have not discussed their company’s crisis response plan in the event of a security breach, and more than two-thirds have not discussed their company’s cybersecurity insurance coverage. Global chairmen should understand cybercrimes are waged against “Data information” of key assets within the company. It is not only the IT department’s issue rather across multiple business lines. All employees need to ensure data integrity of key assets within the modern enterprise. This can only be combated through an Enterprise Wide Risk Management framework.

3. Innovation & Technology

Strategy in delivering innovation and understanding of technology as an enabler of growth will be a key factor for many boards. Chairmen will have to figure out how disruptive technologies of mobile, information security, robotics, nanotechnologies and modern medicine will impact their own industries, companies and products.

A 2014 Corporate Board Survey indicated that 52% of directors ranked technology-savviness as the number one skill set underrepresented in the boardrooms. Innovation using technology as an enabler to long term strategic growth is a major challenge for global chairmen. Our lives are becoming more digital and technology affects every industry. Companies that can utilize technology in innovating strategic growth will have competitive advantage to peers. Global chairmen need to understand that consumer, client, competitor, regulator fillings and investor data are all digital “data.”

Social media has opened the communication channels for instant dialogue with large audiences and boards have been slow to adopt to this global phenomena.

Global boards in 2015 will need to enhance their understanding of opportunities of “Big Data” and should request more meaningful metrics in the boardroom. Possible threats caused from cloud computing, Bring Your Own Device (BYOD), information security internal controls around key assets of the company. Disruptive & emerging technologies of robotics, nanotechnologies and modern medicine are changing and shaping the future of all enterprises and industries.

4. Diversity & International Markets

Diversity has become more main stream thinking in the modern enterprise. More than a dozen countries have legislated diversity initiatives to increase gender diversity in the boardroom.

32% of directors ranked diversity and international experience as the most underrepresented skills in today’s boardrooms. Dealing with international markets and globalisation pressures has prompted the best companies that have grown over time to become more diverse in the boardrooms. Nomination committee chairs are realizing the best chances of a good decision being made comes from diverse people.

A greater demand of senior executives with international markets, technology and social media expertise are in high demand for nomination committee chairs. People originating from different cultural and ethnic backgrounds add different demographic perspectives to strategic discussions.

Many gender-based research organizations, non-profits, academia and groups are trying to correlate stock performance with diversity. However, diversity brings different group dynamics together, and people are realizing that diverse teams are the best suited to tackle difficult problems.

One challenge with diversity in the boardroom is finding qualified board-ready candidates. A UK, non-political and non-profit group “Board Apprentice LTD” is raising the numbers of diverse board-ready candidates. The group encourages boards to be the educators of diversity candidates by inviting qualified candidates onto the board through a one-year apprenticeship. The group is already having success placing candidates in Europe with JP Morgan Funds and Fidelity Investments and is launching in several countries.

Author: Yusuf Azizullah CEO & Chairman, Global Board Advisors Corp (GBAC)

Image: German cabinet members attend an extraordinary working session at the chancellery in Berlin. REUTERS/Fabrizio Bensch

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Future of WorkSee all

Kate Whiting

April 17, 2024

Andrea Willige

February 29, 2024

Kara Baskin

February 22, 2024