Did the Federal Reserve just reduce inequality?

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Financial and Monetary Systems

This article is published in collaboration with Project Syndicate.

The US Federal Reserve has finally done it, raising interest rates for the first time in almost a decade. The ramifications for interest-rate spreads, emerging-market equities, and housing demand, among much else, are the subject of widespread debate. But, as markets learn to cope with a less accommodative monetary policy, there could be an important silver lining, which most people have ignored.

Income and wealth inequality in the United States has grown steadily since the global financial crisis erupted in 2008, but monetary-policy normalization could mark the beginning of the end of this trend. Indeed, it should serve to accelerate its reversal.

Consider a few dismal statistics reflecting the current state of affairs. Real (inflation-adjusted) median household income in the US is about the same as in 1979. A recent study by the Pew Research Center noted that Americans earned 4% less income in 2014 than they did in 2000, and for the first time in more than 40 years, middle-class Americans no longer constitute a majority of the population.

America’s 20 wealthiest people now own more wealth than the bottom half of the entire population The wealth gap between America’s high-income group and everyone else has never been more extreme; rich households account for more than one in five of the entire US population. Strikingly, one hour north of Wall Street, in Bridgeport, Connecticut, the Gini coefficient – a standard measurement of income distribution and inequality – is worse than in Zimbabwe.

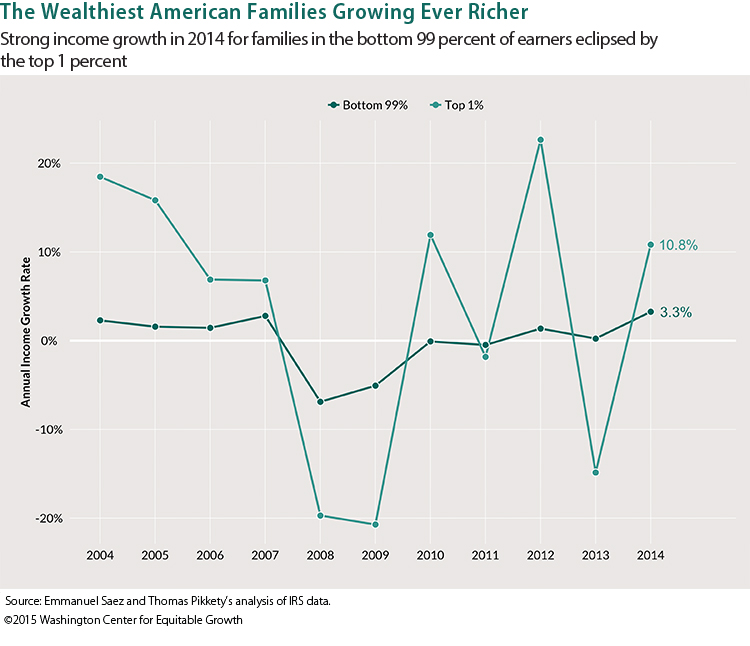

Ironically, this trend was exacerbated by the policy response to the financial crisis. While the recession of 2007-2008 caused higher-income groups to suffer more than lower-income groups (because the former tend to derive relatively more of their income from more volatile sources of capital income, as opposed to labor income), the opposite has been true since 2009. Since then, about 95% of all income gains have gone to the top 1%.

The causes of rising income and wealth inequality are multiple and nuanced; but the unintended consequences of the recent unprecedented period of ultra-loose monetary policy deserves a chunk of the blame. Negative real interest rates and quantitative easing have enforced financial repression on holders of cash, hurting savers, while broadly boosting prices of riskier financial assets, most commonly held by the rich. When there is no yield in fixed income, even the most conservative pension fundspile into risk assets, driving prices higher and higher.

Corporations have benefited massively from these stimulus measures, but at the expense of the working population. Profit margins have expanded to record highs as companies have cut costs, delayed infrastructure investments, borrowed at ultra-low rates, and taken advantage of weak labor markets to avoid raising wages.

But are we now on the verge of a trend reversal? The S&P 500 has rallied 150% since its 2009 lows, and valuations look rich given weakening growth dynamics (the Shiller price/earnings ratio stands at 26, compared to 15 in 2009). Against this backdrop, the wealthiest Americans are unlikely to enjoy substantial further profits from their financial investments in the near term.

At the same time, we should see meaningful upward pressure on wages for the first time in many years. The unemployment rate has dropped to 5%, just above the Fed’s current median estimate for the non-accelerating inflation rate of unemployment (NAIRU). While the true NAIRU level is probably lower, and we are likely witnessing a secular decline in the workforce participation rate, the US labor market should still tighten in 2016.

Indeed, the number of those “not in the labor force, currently want a job” category dropped 416,000, to just above 5.6 million, in November; historically, this kind of change has been closely associated with rising wage pressure. And the average hourly wages for all employees on private non-farm payrolls posted an annual increase of 2.5% in October, the biggest since 2009.

As the Fed slowly raises interest rates, those middle-class families holding their hard-earned savings at the bank will finally start realizing some return on their deposits. The long-term effects should not be underestimated, given the helpful impact of compound savings.

During the last tightening cycle between 2004 and 2006, households’ interest income rose 29%. Although this time, the gains presumably will be smaller and slower to arrive, owing to the likely pace and extent of Fed tightening, interest paid on savings will move household income in the right direction: up.

Of course, a multitude of political reforms, each with potential positive implications for welfare, could reduce the extent of inequality further. But the barriers to such measures – say, to make the tax system more progressive – are well known, especially against the backdrop of a presidential election campaign. This means that an increase in real wages for workers will have the most immediate impact, even if the downside is lower profit margins for corporate America.

The Fed’s decision to raise rates is a historic moment for financial markets and is already ushering in a period of increased volatility for asset prices worldwide. Although this may be challenging for investors, we should take comfort in the implications for the real economy.

The social contract in the US has frayed badly, and this is likely to play an important role in the upcoming presidential election, as voters express anger that the American Dream is increasingly out of reach. No economic recovery can sustain itself without rising wages and higher consumer spending power. The Fed may have just signaled that the beginning of this necessary dynamic, perhaps the key inflection point of the inequality trend, is finally here. And it may also have done its part to speed its arrival.

Publication does not imply endorsement of views by the World Economic Forum.

To keep up with the Agenda subscribe to our weekly newsletter.

Author: Alexander Friedman, Group CEO of GAM Holding, was Global Chief Investment Officer of UBS Wealth Management and Chief Financial Officer of the Bill & Melinda Gates Foundation.

Image: The United States Federal Reserve Board building is shown in Washington. REUTERS/Gary Cameron.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Financial and Monetary SystemsSee all

Joe Myers

April 19, 2024

Libby George

April 19, 2024

Valérie Urbain

April 19, 2024

Spencer Feingold

April 16, 2024

Joe Myers

April 12, 2024