How will the new Asian Infrastructure Investment Bank boost development?

Image: A security guard stands in front of the signboard of Asian Infrastructure Investment Bank (AIIB) at its headquarter building in Beijing. REUTERS/Kim Kyung-Hoon

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Infrastructure

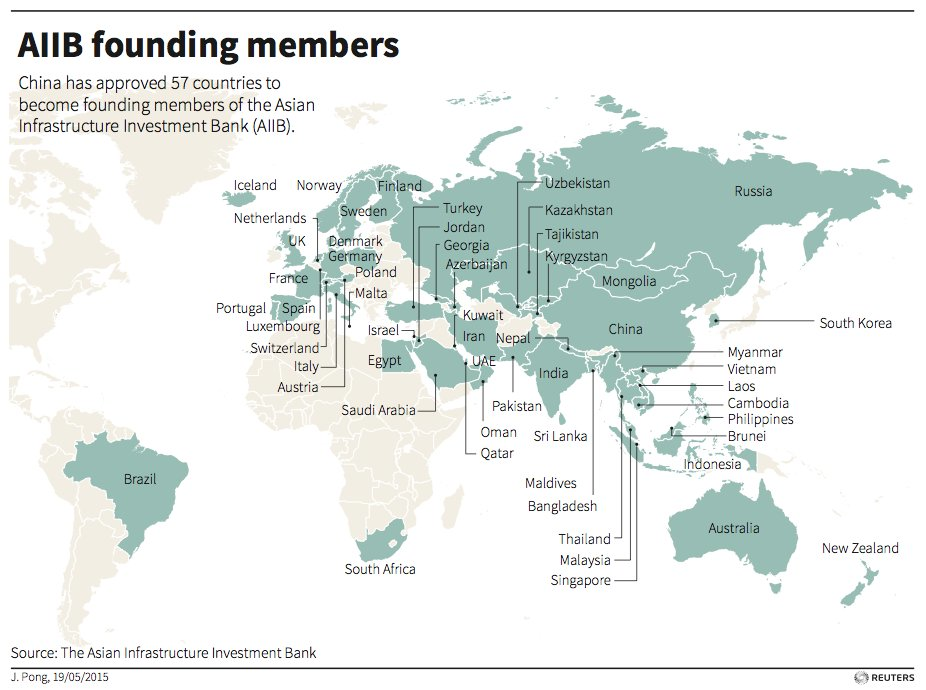

The recent historic launch of the Asian Infrastructure Investment Bank has been highly anticipated – and rightly so. With the start of operations, the AIIB joined the family of multilateral financial institutions in supporting broad-based economic and social development in Asia. Sound and sustainable infrastructure investment will lead to better development outcomes, improve the lives and livelihoods of Asia’s citizens, and generate positive spillover effects in other parts of the world.

Over the past year, meeting with people from around the world and various walks of life, I have frequently been asked to explain why another multilateral development bank is needed, and how the AIIB will be different from, say, the World Bank or the Asian Development Bank.

The answers are clear. The role and importance of Asia in the international arena have increased, yet the region faces severe infrastructure gaps and thorny bottlenecks. Asia’s infrastructure investment needs have grown exponentially, and the AIIB’s resources, quite simply, will increase the pool of multilateral resources available to help meet them.

There is, moreover, ample space for the AIIB to help its members to modernize roads, rails, and ports; enhance access to electricity; expand telecommunications services; advance urban planning; and provide clean water and sanitation services. We will do it well. We will do it right. And we will do it collaboratively, as a reliable and complementary development partner.

The AIIB’s founding members have a clear management vision: We will set a clear and high bar for organizational performance and governance, by upholding openness, transparency, accountability, and independence as its core institutional principles.

Our charter places direct accountability with the AIIB’s management to ensure that these principles become organic values, not simply slogans. I embrace this challenge, and I am firmly committed to fostering an institutional culture grounded in the highest principles and ethical standards.

How will we do this? In drafting the AIIB’s Articles of Agreement and policy framework, we have worked with a diverse group of international experts to draw lessons from the existing multilateral institutions and from successful private-sector companies. We have held extensive rounds of technical discussions with our shareholders to ensure that the Bank reflects its owners’ goals and aspirations in both its lending activities and internal operations. I am confident that the Bank’s policy foundation meets world-class standards. We are now recruiting a top-caliber management team and expert staff to ensure their effective implementation.

In executing our mandate, our shareholders will see to it that the Bank learns from the past and recognizes the possibilities of the future – to do things differently and to do different things. Several of the AIIB’s distinguishing features will facilitate this.

For starters, the AIIB’s unique ownership and shareholding structures reflect the institution’s regional character and provide members with a greater voice in policy direction and decision-making. The rich dialogue among founding members during the development of the AIIB’s Articles of Agreement and policy framework attests to our shareholders’ strong ownership of, and commitment to, the Bank’s mandate and mission.

Moreover, the AIIB’s specialized geographic and sectoral mandate will enable it to offer niche skills, focused expertise, and concentrated market knowledge, and its organizational structure, staffing flexibility, and efficient decision-making processes will position it to respond with agility to client demand and emerging needs. Our approach to research will be selective and strategic, and our results-focused business model will allow us to deliver state-of-the-art knowledge and tailored financial services.

The AIIB will play a catalytic role. We will leverage and mobilize public and private financing, including from institutional investors, and help clients to enhance project “bankability” by promoting transparency, efficiency, and adherence to accepted standards – including environmental and social standards – thereby reducing risk.

The Bank’s integrated organizational design and governance will ensure efficient and effective operations in alignment with its strategic goals and organizational values. Its non-resident Board will promote accountability, efficiency, and cost effectiveness, while playing an enhanced role in setting strategy, establishing policy, and exercising oversight.

Ultimately, the AIIB’s reputation and credibility will depend on the caliber of its staff. We will recruit the best talent on the market through merit-based competitive processes, without regard to a candidate’s nationality. Likewise, there will be no nationality restriction on procurement of goods and services for AIIB-financed operations.

Our operations will be lean, clean, and green. That means keeping a check on bureaucracy and maintaining a relatively flat organizational structure; managing costs and using modern technology effectively; and avoiding duplication and overlap of functions. The AIIB will build its professional staff gradually, supplementing in-house expertise with specialized consultant skills. Staff positions will be carefully defined to avoid both underemployment and future redundancies.

It also means fostering an institutional culture based on professional integrity and exemplary governance, with no tolerance for corruption. The best policies on paper are meaningless unless they are implemented rigorously, impartially, and transparently.

Finally, it means concern for sustainability. The AIIB subscribes to the principles of sustainable development in the identification, preparation, and implementation of projects. The management of environmental and social risks and impacts is central to successful development outcomes. We will support our clients in managing these risks appropriately through knowledge, experience, and resources.

The AIIB is an institution of great promise in a region with great needs. As it opened its doors for business in 2016, I am fully confident that it will realize its potential, meeting – and striving to exceed – the goals and standards set by its shareholders.

Author: Jin Liqun is President-designate of the Asian Infrastructure Investment Bank.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Geographies in DepthSee all

Andrea Willige

April 23, 2024

Libby George

April 19, 2024

Apurv Chhavi

April 18, 2024

Efrem Garlando

April 16, 2024

Babajide Oluwase

April 15, 2024

Rida Tahir

April 9, 2024