Where should we look for clues to China’s economic future?

Image: A customer holds a 100 Yuan note at a market in Beijing. REUTERS/Jason Lee.

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

China

With the Shanghai Stock Exchange Composite Index down more than 40% since last June, investors worldwide are watching the decline with growing concern – but not because they are invested in the plummeting market (China’s stocks are overwhelmingly held by Chinese). Rather, the fear is that plunging equity prices mean that China’s economy is going down the tubes. But those seeking compelling clues about China’s economic future should look elsewhere.

Of course, it is true that China’s growth rate has slowed substantially, and there are plenty of reasons to believe that the deceleration is not temporary. But none of those reasons has much to do with the stock market.

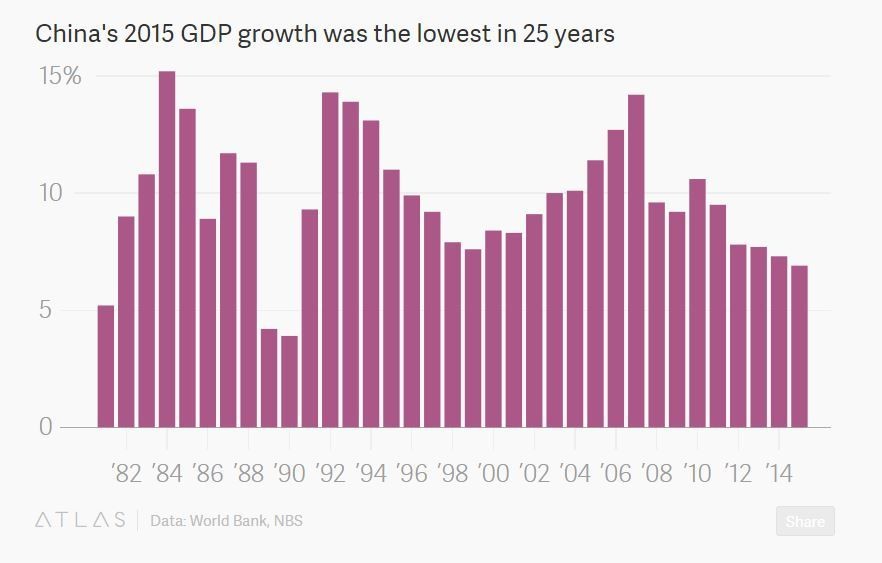

This disconnect is apparent in the fact that market prices are higher today than they were in 2014, the year when China surpassed the United States to become the world’s largest economy (in terms of purchasing power parity), a development that spurred bullish expectations. What observers at the time did not seem to recognize was that China’s economy was already slowing. According to official statistics, the growth rate averaged 10% in 1980-2010, but fell to 7-8% in 2012-2014.

At first, the slowdown actually contributed indirectly to a rise in stock prices, by spurring the People’s Bank of China to begin cutting interest rates in November 2014. But by the spring of 2015, the market’s boom was looking a lot like a credit-fueled bubble. The Shanghai index peaked on June 12, when the China Securities Regulatory Commission tightened margin requirements.

The truth is that China’s economic slowdown should not have surprised anyone. The country’s three-decade run of 10% annual GDP growth was already unprecedented. The question is why no country, not even China, managed to prolong its economic miracle? Some offer broad explanations: countries fall into the middle-income trap or experience a regression to the mean in growth rates. But, in China’s case, a number of specific factors may be at play.

The first factor is diminishing returns to capital, which weakened the growth-enhancing effects of, say, investment in transport infrastructure and residential construction. Another is that urban land prices have been bid up, while the environment’s “carrying capacity” has been exhausted.

Then there are demographic challenges. The working-age population has peaked, and the share of retirement-age population is rising fast – not least because of the country’s 35-year-long one-child policy, which was only recently rescinded.

Moreover, China’s once seemingly inexhaustible surplus of rural labor willing to migrate to urban areas has largely disappeared, causing wages to rise and the country’s competitive advantage in labor-intensive manufacturing to weaken. The economy has shifted from manufacturing toward services, where there is less scope for productivity growth. Moreover, room for catch-up gains with the developed economies in terms of technology, production processes, and management practices is shrinking, undermining productivity growth further – and leaving it up to China to do some innovating of its own.

Against this background, a shift to a trend annual growth rate of 5-7% is natural. But that shift can happen in two ways: a soft landing, in which China continues to grow at the slower-but-sustainable trend rate, or a hard landing, involving a financial crisis and more severe economic recession.

Like Japan after the 1980s or South Korea in 1997-1998, China has depended significantly on investment and debt financing during its high-growth phase, raising the risk that excess capacity could lead to financial crisis as the economy slows. And, indeed, excess capacity is already a serious problem in many sectors.

Still, it is unclear what kind of landing China faces – not least because official statistics may be overstating current GDP growth considerably. With official growth data usually aligning a little too closely with government targets to be credible, skeptics are turning to other, more tangible measures of economic conditions, pointing out that energy consumption, freight railway traffic, and output of industrial products like coal, steel, and cement has slowed sharply.

These statistics could, as many infer, indicate that China’s economy is growing at a rate much lower than the 7% the government claims. But, as Nicholas Lardy persuasively argues, they could also reflect the economy’s shift from heavy manufacturing toward services – a shift that is highly desirable in helping China’s natural transition to the more sustainable trend.

It is still possible, then, that China is on track for a soft landing. But success presupposes less reliance on investment spending and export demand, and more on domestic household consumption, to support growth.

Moreover, China must increase the flexibility of land and labor markets. For example, insecure land rights in the countryside and the hukou (household registration) system in the cities continue to impede labor mobility. More generally, markets’ role in shaping the economy must continue to grow. State-owned enterprises must be reined in. The health-care, social-security, and tax systems must be reformed and strengthened. And better environmental regulation is crucial.

Chinese leaders and economists already know all of this. They adopted a list of reform objectives covering these areas in 2013. And in the last two years, they have made progress in implementing some of them. But there is still a long way to go, and success is by no means guaranteed. As Shang-Jin Wei, the chief economist of the Asian Development Bank points out, progress on these reforms – not what happens in the stock market – is what will determine the fate of China’s economy.

Author: Jeffrey Frankel, a professor at Harvard University's Kennedy School of Government, previously served as a member of President Bill Clinton’s Council of Economic Advisers.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Geographies in DepthSee all

Andrea Willige

April 23, 2024

Libby George

April 19, 2024

Apurv Chhavi

April 18, 2024

Efrem Garlando

April 16, 2024

Babajide Oluwase

April 15, 2024

Rida Tahir

April 9, 2024