How Norway’s sovereign wealth fund made $130 billion in one year

Norway's sovereign wealth fund is the largest in the world. Image: REUTERS/Nerijus Adomaitis

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Future of the Environment

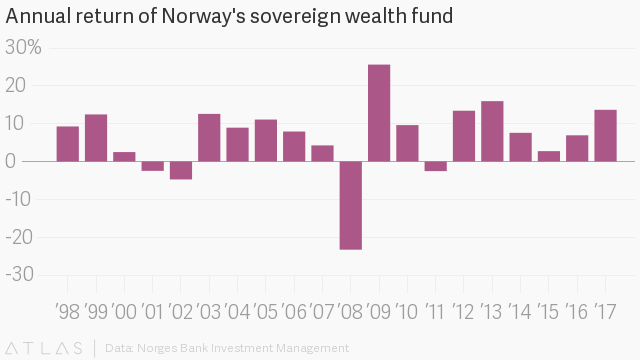

2017 was a big year for Norway’s sovereign wealth fund, already the largest in the world. After surpassing $1 trillion in assets, the fund announced today that it made an annual return of 1,028 billion kroner ($131 billion), the largest amount in the fund’s 20-year history.

Last year’s record-breaking performance for the fund, created to invest Norway’s surplus oil revenue, was down to “unusually” strong markets, particularly in equities. This resulted in a 14% return for the fund (pdf), in which the equity holdings returned almost 20%, compared to just 3% for bonds and 8% for real estate. The fund currently invests 67% of its money in equities, but last year it decided to increase this allocation to 70%. It’s not to be underestimated how many stocks this fund already owns: 1.4% of all listed stocks in the world.

The decision to up the fund’s equities holdings was made in the midst of a blockbuster year for global stock markets, which experienced their best year since 2009 as the MSCI all-country world index gained more than 20%.

Norway’s oil fund is invested in 9,146 companies around the world, but its biggest boost last year came from Apple. It has a 0.9% stake in the US tech company, which has a market value of more than $8 billion. Last year, Apple’s share price rose 46%.

The next largest contributions to the fund’s return came from Tencent, a Chinese tech company, and Microsoft. The worst-performing investments were GE, Exxon Mobil, and Israeli health care company Teva Pharmaceutical Industries.

The chart below shows the share price performance for the largest holdings of tech companies in the Norwegian fund. Even though Amazon’s returns were higher than Microsoft’s, the fund owns about $1.4 billion more in Microsoft stock than in Amazon.

The fund has now made more money in investment returns than was put into it. The cumulative return since inception in 1997 was 4,151 billion kroner at the end of 2017, exceeding the 3,337 billion kroner put into the fund from surplus revenues from Norway’s oil and gas production. This is the second year of withdrawals from the fund by the Norwegian government.

As the amount of stocks in the fund increases, Norges Bank Investment Management, which controls the fund, is warning that there might be “substantial fluctuations in the value of the fund.” Such volatility came quickly in 2018, as US stock markets briefly entered into a correction—falling more than 10% from the recent peak—early in the year. The fund is also trying to reduce volatility by getting out of oil and gas stocks, an ironic move for a fund whose wealth comes from oil. That said, oil and gas stocks were the worst-performing sector for the fund last year.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Future of the EnvironmentSee all

Shruthi Vijayakumar and Matt Sykes

April 19, 2024

William Austin

April 17, 2024

Victoria Masterson

April 17, 2024

Rebecca Geldard

April 17, 2024

Johnny Wood

April 15, 2024