It’s time to put the climate at the top of corporate board agendas

Climate competence will soon be essential to all boardrooms. Image: Reuters

Dominik Breitinger

Project Lead, Climate Governance and Finance, Global Leadership Fellow, World Economic Forum

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Climate Crisis

Over the last five years, corporate leaders have, in the World Economic Forum’s annual Global Risks Report, rated climate change and extreme weather as top macroeconomic risks in terms of both impact and likelihood. Last year was another record period of unprecedented weather-related disasters, causing worldwide macroeconomic damage worth $320bn; the cost burden of 2018’s scorching heatwave is yet to be tallied up.

Between now and 2100, the potential financial losses arising from climate change could run from $4.2 trillion to as much as $43 trillion, versus a total global stock of manageable assets worth $143tn.

However, at the same time, climate change is also predicted to generate investment opportunities worth up to $26 trillion between now and just 2030. Unsurprisingly, therefore, it is now starting to make its way up to the top of policy and corporate agendas.

Despite all the attention, many if not most boardrooms are still grappling with how exactly to frame the risks and opportunities and embed a viable transition strategy into their business models. The release of the Task Force on Climate-related Financial Disclosure's (TCFD) recommendations, as well as several legislative initiatives at EU-level and in other key jurisdictions (eg revised concepts of fiduciary duty), are key in bringing climate risk management to the attention of boards, and are creating a new urgency to present an integrated picture to stakeholders, particularly investors. But it is also fair to say that, at this early stage, the issue is still largely being addressed as a compliance requirement rather than as a strategic challenge and opportunity.

One especially knotty challenge facing board directors lies in how to define their legal obligations vis-à-vis a phenomenon of the complexity, scale and inherently systemic nature of climate change. Firstly, key external drivers such as the emergence of disruptive technologies and climate-friendly regulation are very difficult to model. Second, the impacts of climate change – whether direct, through the physical disruptions it causes, or indirect, through the policy responses that aim to avert it – will play out over time horizons that far exceed the typical business planning cycle; a phenomenon Bank of England Governor Mark Carney has labelled the “Tragedy of the Horizon”. Third, the penalties imposed by climate change extend often indiscriminately to companies whether or not they act to address it – the so-called “free-rider effect”. As such, individual corporate action, however ambitious, is unlikely to be sufficient to “climate-proof” any one company; rather, a powerful collective response is necessary for any action on climate to be genuinely effective.

These three factors alone are enough to present boards with a real conundrum – and that is before a fourth potential headache: the prospect of legal challenge for failing to manage climate risk adequately. National legal regimes, codes and cultures vary, but all share one core principle: that board directors have a fiduciary duty to understand and prudently manage the potential risks and threats of the companies they oversee. Failure to act in light of generally available information, or failure properly to disclose the potential impact on their businesses, may expose them to legal action.

Institutional investors have also joined the debate: prompted at least in part by warnings from the International Energy Agency that oil and gas assets worth $1.3 trillion are at risk of “stranding” by 2050, they are demanding climate-smart board governance. The world’s largest sovereign investor, the $1trillion Norwegian Government Pension Fund, expects that boards “integrate relevant climate change challenges and opportunities in their business management, such as investment planning, risk management and reporting. Boards should ascertain that the ensuing responsibilities are clearly defined within the organisation and they should effectively guide, monitor and review company management’s actions in carrying out these efforts.”

State Street Global Advisors, the world’s third-largest investor with $2.5tn in assets, issued a Climate Change Risk Oversight Framework for Directors guide that sets out expectations for board members to evaluate climate risk and preparedness. The California Public Employees’ Retirement System’s revised governance and sustainability principles expect corporate investees to recruit boards of directors with sufficient climate competence – i.e. with explicit “expertise and experience in climate change risk management strategies”.

Where exactly does this lead? As evidence mounts of the risks and complexities posed by climate change, investors are expecting the directors they elect to take ownership of this issue by ensuring that climate risks and opportunities be systematically embedded in strategic planning as well as routine board processes.

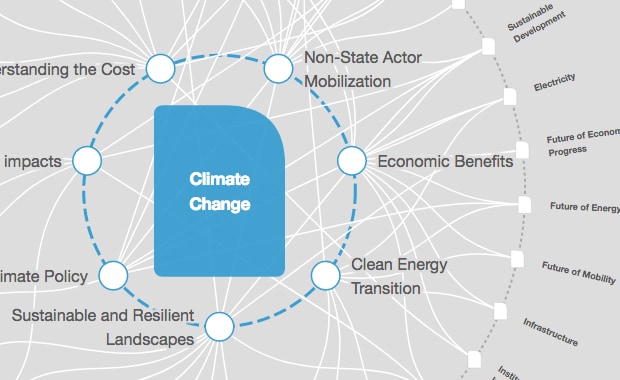

Climate change is not a standard feature of the board director rulebook – as a still-emerging field, it will require new interdisciplinary approaches to board governance that bridge the divide between traditional board oversight processes, macroeconomic analysis, climate science, investor expectations and public policy engagement. As yet, there appears to be no readymade guidance to assist directors in their duty to understand and act on climate, while director awareness and attitudes vary, often depending on sector, geography and, most of all, the guidance (or lack thereof) offered by their executive leadership.

The good news is that, as non-executive directors increasingly come under pressure to demonstrate a mastery of the subject, many are beginning to “know what they don’t know” and acknowledge the need for more hands-on management.

Faced with this gap between need and preparedness, the World Economic Forum has set out to help develop a body of guidance and practical tools to enable the emergence of truly climate-effective boards. This involves assessing existing resources, identifying what is needed to fill gaps and facilitating networking between interested directors across borders and industry sectors. Ultimately, the aim is to enhance the climate competence of directors in a way that is relevant to, and embedded in, normal board processes, thereby enabling better-informed investment decision-making, more systemic thinking and, most importantly, an integrated approach to crafting and implementing a low-carbon business strategy in both the short and long term.

To this end, the Forum will – together with a rapidly growing community of climate experts – design the tools and principles that boards need, beginning with a first set of governance principles that is currently being developed. These build upon existing corporate governance frameworks, as well as other approved risk and resilience/governance concepts and investor guidelines for boards – such as the TCFD’s recommendations on climate-related financial disclosure or the new Climate100+ investor initiative.

Corporate boards should be the stewards and catalysts for change and climate action. “Business [leadership] has a duty to employees to act responsibly and positively on climate change. An organisation must reflect the principles of its members, and act accordingly,” says Unilever CEO Paul Polman.

It is time to address the climate risks and, even more urgently, to embrace the underlying climate opportunities. We invite an urgent call to action, from and for the most prominent custodian agents and fiduciaries in corporations: their boards of directors.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Climate CrisisSee all

Mette Asmussen and Takahiro Furusaki

April 18, 2024

Laia Barbarà and Ameya Hadap

April 17, 2024

John Letzing

April 17, 2024

William Austin

April 17, 2024

Rebecca Geldard

April 17, 2024