How mobile money can lead a fintech revolution in Africa

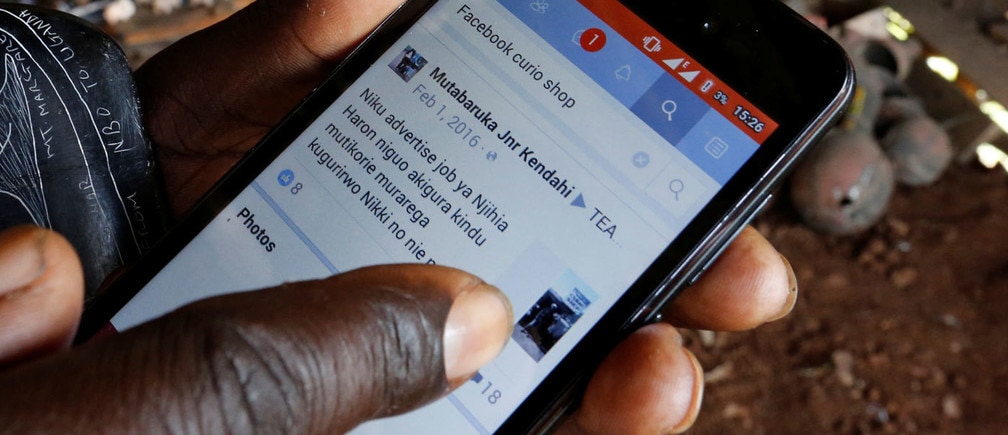

Mobile money accounts for 10% of GDP in transactions in the region. Image: THOMAS MUKOYA/REUTERS/NEWSCOM

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

The Digital Economy

If you are reading this blog—drawn by current buzz around financial technology and the "fintech” reference in the title, and its promise to democratize financial services—then it is probably a safe bet to assume that you have heard of M-Pesa. This mobile payments system started in Kenya in 2007 now boasts 30 million users in 10 countries, with other competitors, such as MTN Money and Orange Money, also operating around the continent.

The use of mobile money has grown exponentially over the past 10 years, making the region the global leader in mobile money innovation, adoption, and usage. M-Pesa services are now offered in countries as diverse as Albania, D.R. Congo, Egypt, Ghana, India, Kenya, Lesotho, Mozambique, Romania, and Tanzania. Prospective agreements with MTN Group will allow both Orange Money and M-Pesa services to cover an even larger number of countries across the continent.

"Mobile money accounts now surpass bank accounts in the region and greater financial inclusion has benefited large swathes of the population."

”Mobile money and greater financial inclusion

While access to traditional banking services remains almost a mirage for most Africans, the near-universal availability of mobile phones has allowed millions to access mobile money services. Mobile money accounts now surpass bank accounts in the region and greater financial inclusion has benefited large swathes of the population that remain unbanked including the poor, the young, and women.

Sub-Saharan Africa is the only region in the world where close to 10 percent of GDP in transactions occur through mobile money. This compares with just 7 percent of GDP in Asia and less than 2 percent of GDP in other regions.

Most African users now rely on mobile payments to send and receive money domestically. Increasingly, they are taking advantage of new services to also send and receive money internationally. In addition, they use mobile money to pay their bills, receive their wages, and pay for goods and services.

Moving up the financial services value chain

Innovation is allowing Africans to move up the “financial services value chain.” From mobile payments, customers in sub-Saharan Africa are gaining access to mobile banking and other services as they open saving accounts, take out loans, purchase insurance, and invest in Government securities or in stock markets with a few touches of their mobile phone. They can even “borrow” electricity and pay later instead of sitting in the dark.

New innovations in fintech are proceeding rapidly. New technologies are being developed and implemented on the continent, and they have the potential to yield significant benefits for Africa. Recognizing this, foreign investors have stepped up their backing for African fintech firms, while those firms develop solutions adapted to the region, for example, to cater for the relatively lower internet speed in some areas. The falling price of smartphones will also help the region reap the rewards of internet-based solutions.

Greater digital inclusion and innovation

In our new paper, we suggest that the challenge now is for the continent to leverage this success in mobile money. It needs to transition to other fintech services and a digital economy. Greater digital inclusion and innovation will not only spur economic growth but a growth that comes with new jobs—the number one preoccupation on a continent that will see more than half the world’s population growth by 2050.

Africa is well positioned to meet its fintech and digital challenges, and with the right policies in place, it could reap a “digital dividend.” But first, policymakers need to address the existing large infrastructure gap in the region, starting with electricity and internet services.

Second: Africa will need to balance the perennial demands of fast-moving innovation against the slower pace of regulation. Good regulation is needed but stifling innovation would be costly.

Fintech beyond financial services

Finally, a message to policymakers and entrepreneurs: consider the potential of fintech beyond the narrow confines of financial services. This untapped resource can help create jobs and increase the productivity of both workers and firms. Ultimately, fintech could be the critical stepping stone towards a digital economy for Africa—a continent where most countries are still overly dependent on a few dominant sectors. Fintech—if exploited well—could yet prove key to this structural transformation.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Economic GrowthSee all

Piyachart "Arm" Isarabhakdee

April 23, 2024

Pooja Chhabria and Kate Whiting

April 23, 2024

Pedro Conceição

April 22, 2024

Joe Myers

April 19, 2024

Joe Myers

April 12, 2024

Joe Myers

April 5, 2024