Traditional finance is failing millennials. Here’s how investing needs to change

To attract millennials, financial services must offer products that are easy and cost-efficient to access Image: Rich Lock

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Blockchain

The traditional investment landscape, with its stocks, bonds and mutual funds offered by financial services stalwarts, does not align naturally with millennials. This generation grew up in the era of the financial crisis and demands much more than the search for maximum profits. Millennials crave a larger mission and impact from the work they do and the companies they support.

They are the first generation to have digital technology at their fingertips. They are digitally literate. The rise of the sharing economy means that ownership is often seen as a burden rather than an aspiration. This new generation of investors wants to participate rather than own. To attract these investors, the world of financial services must transform its approach to offer products that are easy and cost-efficient to access; reduce or eliminate the need for intermediaries; and give investors the chance to be part of something.

Millennials are generally defined as those born between 1981 and 1996. There are 1.8 billion of them globally, accounting for roughly a quarter of the world. And the spending power of this generation is set to be greater than any previous one, according to World Lab Data.

While the economy has rebounded since last decade’s financial crisis, many recession-fuelled millennial values have stuck. A study by PWC found that 43% of millennials agree that “owning today feels like a burden”.

This is an era where the millennial generation are not only making up a huge proportion of employees in the sharing economy, but are also the biggest consumers of the services of companies such as Airbnb and Uber. The success of these companies lies in their ability to alleviate the burden of ownership, as well as their seamless user experience, which has been vital to their growth.

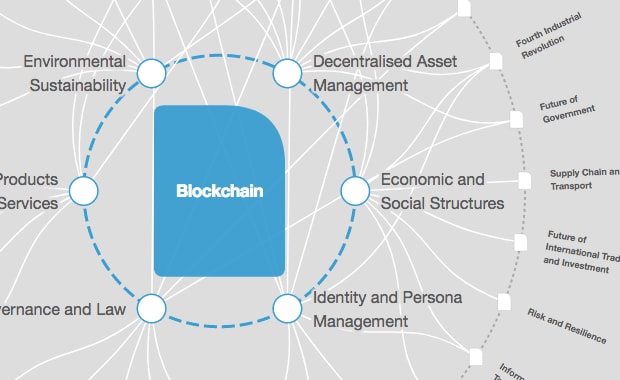

Taking all these trends into account, we believe that tokenization will be particularly well suited to millennial investors. We define tokenization as the process of converting existing assets or future cash-flows into tradable digital securities using blockchain technology.

This is an enabling technology which allows us to do things not possible before. It democratizes access to investment opportunities and allows financial products to be customized and tailored to the new demands of a community-driven society.

Imagine if there was a way to invest in a company that is a service or product that you regularly use, such as a ride-sharing company. But instead of equity dividends paid at the discretion of company management and dependent on intermediaries such as brokers and banks, the company could pay investors automatically, using a smart contract. The business could then issue a token which pays a percentage of all sales in a specific geographic area (such as your neighbourhood) or business line. This would then create an incentivization loop for communities to use these companies’ services or products, and encourage other consumers to do the same.

However, there are some challenges ahead before we see wholesale adoption of tokenization. We saw the beginning of tokenization three years ago with the rise of Initial Coin Offerings (ICOs). Despite a few serious projects and successes, ICOs have been misused by issuers. Most ICOs had very little commercial rationale, lacked transparency and did not have the appropriate disclosures, which led to investor losses.

The challenge now is to transition from a world of mistrust created by the ICO bubble to one which has long-term growth prospects and is catering to the needs and desires of investors. We believe this needs to be driven by a more comprehensive regulatory framework.

However, we are starting to see the tide shifting in a positive direction, as regulators across the globe are responding to the above challenges and are progressively issuing guidelines for token and broader digital security investments.

Regulators seem aligned in the opinion that token investments can fall under existing securities and financial markets regulations. They agree that consumer protection and anti-money laundering laws should also apply to digital assets.

This seems to be the case with the SEC in the USA, FINMA in Switzerland, ESMA in the European Union, and the UK’s Crypto Asset Task Force comprised of the Bank of England, the FCA and the Treasury.

The response from regulators is bringing clarity for market players and paving the way for participation. The new wave of digital tokens will offer investors greater transparency, risk disclosures and protections aligned with securities legislation.

There are also challenges around the evolving technological landscape and market infrastructure, including scalability and compatibility among the existing blockchain protocols as well as appropriate custody and cybersecurity frameworks for this new asset class.

Despite these challenges, we believe that tokenization is set to transform the investing landscape, providing not just millennial investors, but all investors, with a new way to interact with communities and companies that they are aligned with. It will simply take some time to iron out the issues outlined above.

Read PwC's 2015 'The Sharing Economy Report' here.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on BlockchainSee all

Scott Doughman

December 5, 2023

Shawn Dej and Sandra Waliczek

October 19, 2023

Scott Doughman

September 22, 2023