How COVID-19 is taking gaming and esports to the next level

Gaming has been a way for people to socialise while in lockdown Image: REUTERS/Lee Smith

Explore and monitor how COVID-19 is affecting economies, industries and global issues

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

COVID-19

- The COVID-19 lockdowns have boosted user engagement with video games and esports.

- Revenues for many gaming companies and platforms have increased during the pandemic.

- The pandemic is accelerating existing trends within the gaming industry - here's a guide.

The global video game industry is thriving, despite the widespread economic disruption caused by the coronavirus. With the practice of social distancing reducing consumer and business activity to a minimum, gaming offers an engaging distraction for people at home looking for social interaction, and initial data shows huge growth in playing time and sales since the lockdowns began.

The gaming business model

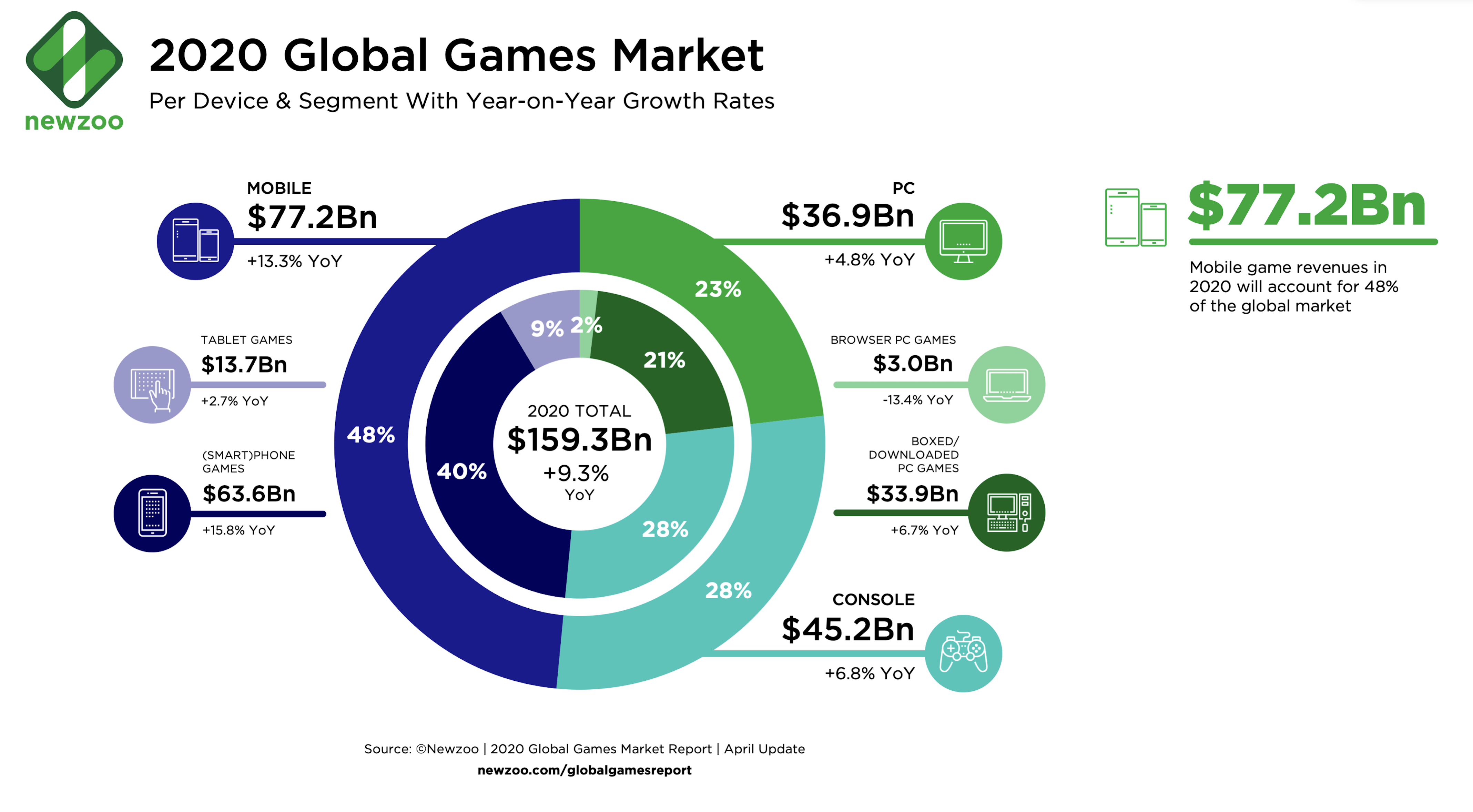

The global video game market is forecast to be worth $159 billion in 2020, around four times box office revenues ($43 billion in 2019) and almost three times music industry revenues ($57 billion in 2019). The biggest market by revenue is Asia-Pacific with almost 50% of the games market by value. North America accounts for a quarter of revenue.

Gaming revenues are almost entirely driven by consumer spending, but the business model has evolved significantly in recent years. Consumers today buy fewer games than previous decades, but spend more time with those games, shifting the business model from single-unit to recurring revenue generated from a base of active users.

As a result, the industry is laser-focused on increasing engagement per user. Aside from making video games as compelling as possible, the strategy for doing so has been the adoption of in-game monetization opportunities. This additional downloadable content (DLC) can include expansion packs, new features, tools and characters, and “loot boxes”, which are effectively a lottery of virtual items.

This business model has come in tandem with improvements to gaming hardware, bandwidth and mobile internet, which have made high-quality games more accessible across devices and platforms. Indeed, close to half (48%) of the industry’s revenue now comes from mobile gaming.

A separate part of gaming is esports, which refers to organized, multiplayer video game competitions. This sector is forecast to grow to just over $1 billion in 2020. Business models in esports closely follow professional sports – though competitions are far more fragmented – with the majority of revenue coming from advertising and broadcasting. Although relatively small in comparison with the overall gaming market, esports is relevant here because it appears connected to the continued growth of gaming.

COVID-19 has boosted engagement with video games, but has complicated hardware and software development

Like many companies, the gaming industry is supporting community initiatives to mitigate the effects of COVID-19. These include charitable pledges worth millions of dollars, the donation of surplus computational power to help researchers better understand the coronavirus, and solidarity response funds to help medical workers, children at risk and employees who have been adversely affected.

Social actions aside, the consequence of COVID-19 on gaming has been a massive enlargement of the audience available to publishers. Gaming is typically an at-home activity, and a steady stream of headlines has shows that it is flourishing during the pandemic.

Asian gaming giants Nintendo and Tencent both saw sales increases during the first quarter. The former sold almost half of its games digitally, a record that helped increase profits by 41%, while Tencent's year-on-year online games revenue increased by 31%. Analysis from GamesIndustry.biz shows that sales across 50 key markets rose by 63%. Even games released during the pandemic are performing well, with titles as varied as Doom Eternal (a first-person shooter) and Animal Crossing (a world-building simulation) both breaking sales records after launching. This is reflective of data from Comcast that shows how new game downloads have increased by 80%, compared to a rise of ‘only’ 50% in total gaming downloads.

Looking at downloads and sales in isolation does not paint a complete picture, since many games are now available for free (and then monetize in-game). But other metrics for engagement tell the same story. Verizon has reported an increase in gaming traffic during peak hours of 75%, compared to increases of 12% increase in digital video traffic and 20% in web traffic. Meanwhile, data from Streamlabs shows that platforms like Twitch, YouTube Gaming, and Facebook Gaming have also experienced a surge in growth, with around a 20% increase in usage hours reported across services.

“Unique to gaming is that it has both interactive and linear consumption models, and the activity of watching gaming video streams and video on-demand has become nearly as big as gaming itself,” says Mike Sepso, co-founder and CEO of Vindex, an esports infrastructure platform. “In the COVID-19 era, all of this activity has increased dramatically because of both the new time available to people and their need for social interaction, which gaming provides.”

This said, gaming is not immune to the coronavirus. Esports, with its reliance on live events, has been one of the first parts of the industry to be affected. Most esports events have been cancelled or postponed, though some are taking place without audiences.

“We have directors, producers, broadcast engineers and professional gamers all working remotely to recreate the excitement and quality of a live event,” says Sepso. “Esports has been able to continue while traditional sport has not because the playing field is virtual and can be replicated online; however, nothing can truly replace the social richness of the live experience.”

The short-term impact on esports is expected to be limited. Although close to 75% of esports revenue comes from advertising and broadcasting, most of these deals were agreed before the outbreak. If restrictions on mass gatherings continue, esports-related income would certainly fall. But considering that esports accounts for less than 1% of the gaming market, this would not represent an existential threat to the wider industry.

Despite this, esports may be growing in prominence as a result of COVID-19. Sports leagues around the world have turned to the sector to find new ways of engaging with fans. Several esports competitions are being shown on live TV, as broadcasters look to fill hours of scheduled sports content that were cancelled in the wake of the pandemic. NASCAR has been one of the most successful sports to augment cancelled events with its iRacing Series, with one event attracting a peak of 1.3 million viewers. Although esports revenues may have declined, the value of the sector more broadly has risen as a result of the low-cost marketing it has benefited from during the crisis.

For the wider gaming industry, coronavirus makes temporary delays in the production of gaming hardware more likely as factories around the world face supply chain interruptions. Furthermore, game developers are preparing for a loss in efficiency as more employees work remotely. Nintendo has issued a warning that a situation of prolonged remote working will impact its processes, and the New York Times reports that developers as large as Sony, Amazon and Square Enix are facing difficulties. Others appear to have adapted quickly, with Epic Games (the makers of Fortnite) still providing regular updates and patches to games.

Long-term transformation

Looking to the long-term, there are several takeaways from the recent spike in gaming that indicate future transformations in the industry.

The greater interest in gaming may accelerate a shift – already underway – towards the delivery of games via mobile and cloud-based platforms. Increasingly, even blockbuster titles are available on mobile devices. Cloud gaming, meanwhile, enables consumers to play streamed games across devices, often without the need for expensive hardware.

The industry clearly now sees potential in this distribution model. Activision Blizzard reported earnings 50% above analyst expectations, largely based on the mobile edition of its popular Call of Duty title. Google recently removed a $130 sign-up fee for its cloud gaming service, Stadia, hoping that the value offered will convince consumers to stay for the long-term. Challenges – particularly to bandwidth – remain, but there is great promise.

The second long-term trend is the widening of monetization avenues through subscription and free-to-play models. Subscriptions provide a reliable path to monetization for smaller, quality games that otherwise lack the marketing or monetization nous to break into the mainstream. Demand for ultra-high-end gaming is likely to remain popular, but services such as Arcade (Apple) and Game Pass (Microsoft) provide gamers with a large library of video games – often without the need for advanced hardware. Meanwhile, free-to-play games allow developers to monetize without needing to convince consumers to make up-front purchases. Instead, they offer in-game upsell opportunities such as upgrades and expansion packs.

Such buffet models may even encourage consumption. Microsoft has reported that subscription gamers increase play time by up to 40%. With evidence showing that cheaper entertainment tends to prosper during recessions, these low-cost, high-value offerings are a serious way for the gaming industry to expand.

Thirdly, we should expect to see the gaming industry increase its partnerships with other entertainment sectors. Some video games become so popular that they spill over into cultural discourse. The most obvious recent example is Fortnite, which has made its mark on music, sports and television. The game has hosted live concerts, premiered new albums by major artists, and featured content from movie directors. During the pandemic, Fortnite hosted a live rap concert that attracted almost 30 million live viewers.

Other exceptionally popular games, such as Roblox and Grand Theft Auto, have adopted similar strategies in the past. The pulling power of the 120 million active users and 1.5 billion hours of playtime they generate each month are hard for other entertainment sectors to ignore. Going forward, there will be more partnerships with the wider entertainment industry, as media companies seek to take advantage of the momentum gaming has produced. Reports have surfaced in the past weeks that Sony is building an immersive media team to work at the intersection of music and gaming. These in turn create opportunities for supporting industries, such as technology companies that supply the infrastructure for such experiences.

Finally, the pandemic may lead to the normalization of esports. Analysts have described esports as being “popularized and legitimized in an unpredictable and profound way”, thanks to the unprecedented (and accidental) adoption of esports by broadcasters, leagues and athletes seeking to engage fans. “Among younger demographic groups, a prolonged shutdown for traditional sports leagues may drive more fans to esports on a regular basis – which globally would represent tens of millions of new consumers for the industry”, says Sepso.

At the very least, the pandemic has reminded media companies and brands that there remains an addressable market of highly engaged consumers. Recent developments will likely inch esports towards the mainstream. The earliest proof point is the state of Nevada, which legalized betting on competitive gaming just two weeks into confinement measures in the US.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on COVID-19See all

Charlotte Edmond

January 8, 2024

Charlotte Edmond

October 11, 2023

Douglas Broom

August 8, 2023

Simon Nicholas Williams

May 9, 2023

Philip Clarke, Jack Pollard and Mara Violato

April 17, 2023