'Phygital': a banking strategy for the new isolation economy

A hybrid, best-of-both-worlds approach to banking Image: Willfried Wende on Pixabay

Markos Zachariadis

Professor; Chair in Financial Technology and Information Systems, University of Manchester

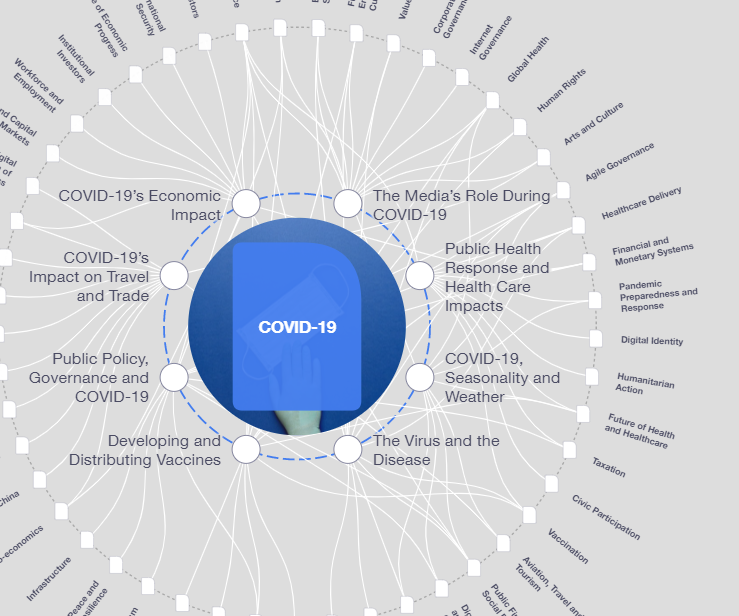

Explore and monitor how COVID-19 is affecting economies, industries and global issues

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

COVID-19

- The pandemic is ushering in a new, digital-oriented way of life for many people.

- Banks should not be tempted to ditch their physical presence altogether, however.

- A hybrid of offline and online engagement is the best way forward.

Society is now said to be entering a new phase; the 'isolation economy'. This is being driven by the COVID-19 pandemic, and is superseding the previous 'social' and 'sharing' economies.

Under lockdown restrictions, digital became the primary channel for retailers, doctors, governments, property, auto sales and banks. Now, as lockdowns are relaxed, the consensus is that many consumers will take a long time to return to regular physical engagements – and some may not come back.

So, is there a future for ‘brick-and-mortar’ banks? Can one marry the online and offline worlds to create a truly cohesive physical/digital hybrid - 'phygital' - experience?

The pandemic has accelerated most banks’ digitalization initiatives. If the 2008 recession caused a boost in financial technology innovation, appetite for experimentation, and a wave of fintech start-ups, then this time round it is more about delivering real change.

Here banks can learn from the digitalization of other industries such as manufacturing, retail and consumer packaged goods, and utilities. Across these, we see an increasing focus on technology innovations related to voice as a channel, AI-powered chatbots, augmented reality, social virtual reality, hyper-personalisation, gamification, secure video interactions, digital ecosystem plays and others.

Yet the physical branch network remains particularly challenging to shift online.

Not only does a bank branch hold cultural, historical and prestige value for communities - it also is the final bastion for key segments of the population that cling to cash. Typically these are small businesses, the mainstay of local economies.

In order to retain this prestige and their important link with communities, the model of branch banking will have to be turned completely on its head in the post-COVID-19 era.

We believe that banks must break out of the traditional branch model and focus on how to deliver specific, high value, physical interactions and experiences that can complement a digital banking core. In true complementary fashion, digital technologies should also be used to augment physical experiences and make services faster, more secure, and more convenient. This is the essence of a true phygital strategy.

In the new normal, consumers will carefully pick and choose how to spend their time interacting. Bank branches, already a low-priority destination for most, will likely struggle to grab a share of this time.

This means a smaller network of branches providing a wider variety of services and experiences, potentially even beyond finance. This will include banking kiosks that are co-located within other businesses or physical destinations. These embedded experiences should be orchestrated in a way in which technology also matters and makes a difference.

There are many banks that have begun experimenting with new style branches – modelling them on coffee shops or technology retailers, for example. Of particular note is Barclays’ 25 Eagle Labs, which converted a series of closed branches in the UK into entrepreneurial shared-work, mentoring, networking and maker spaces. Of course, they also provide SME banking advice.

More of this experimentation should be encouraged. Bank branches need to offer real value to customers by showcasing the best of what a bank has to offer in terms of education, trust, advice and networking.

But they also must be places where people will choose to spend their time. These could be department stores, car showrooms, real estate agents, museums, or even places of local interest such as monuments or tourist destinations.

Such ‘platform thinking’ or ‘cluster layout’ is not completely new and can be traced back to the era of shopping centres and malls between 1950s and 1980s. This time, however, technology can reinforce interconnections between products and services and make a difference for consumers by giving them more choice and transparency, and by helping them to make better-informed decisions.

Indeed, this can also enable closer links with corporate clients. As many countries face an unprecedented recessionary environment, consumer spending is going to be tight. Many businesses would welcome their own miniature bank advisor in their store, helping customers understand and responsibly access their finance options.

If integrated correctly with the consumer’s online interactions – both with the bank and the business – there could be many opportunities in analysing and sharing data on buyer behaviour and finance capability.

This move to phygital will, of course, impact on the workforce. The skills and roles required for retail banking professionals will have to be re-assessed. Branch colleagues will need to be better trained, have more soft skills, and a wide knowledge base supported through effective technology.

But it will be worth it. It will be much more important to get ever-more limited physical interactions right. Banks must think twice before going fully virtual. A phygital strategy and combination of the two could give them the edge in this new normal.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on COVID-19See all

Charlotte Edmond

January 8, 2024

Charlotte Edmond

October 11, 2023

Douglas Broom

August 8, 2023

Simon Nicholas Williams

May 9, 2023

Philip Clarke, Jack Pollard and Mara Violato

April 17, 2023