COVID-19 is challenging the way we think of chemical industry trends. This is how

Long-term trends forecasting in the chemical industry now must take place in parallel to preparing for global risks. Image: Getty Images

Fernando J. Gómez

Head, Resource Systems and Resilience; Member of the Executive Committee, World Economic Forum

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Chemical and Advanced Materials

• Short-term management has been key to managing chemical supply during the pandemic, but long-term trends are equally important.

• Trend analysis is becoming less reliable because of the increasing frequency of global shocks.

• The chemical industry must embrace a broader view of resilience.

COVID-19 has shattered many established beliefs, shaken up value chains, prompted governments into action and upended many consumer behaviours. In the first months of the crisis, businesses and governments logically focused on protecting people and identifying the steps to recover from a deep health, economic and social shock.

Through all this and in an effort to maintain the availability of goods across the economy, the chemical (and other manufacturing industries) dedicated much attention to understanding the pandemic’s impact on stocks (e.g. managing volumes or production location to match shifting demand) and flows (e.g. changing supply routes to guarantee supply of consumer goods or intermediates).

An immediate- or short-term focus has proven invaluable to managing stocks and flows with high flexibility, increasing the resilience of the goods economy. Nevertheless, it is just as important not to lose sight of deeper trends. These dynamic processes shape business sectors and influence mid- to long-term business strategies. Are they impacted too, and in what way? Are these changes temporary or will they alter even the structures that have supported the activities of the chemical industry for decades? And if so, can trends still provide the certainty for long-term planning or investments they used to?

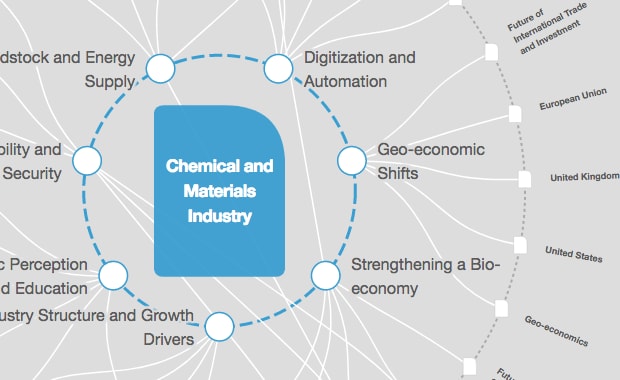

The World Economic Forum’s Chemical and Advanced Materials Industry Action Group (IAG), supported by the Forum and in collaboration with Accenture, has identified opportunities to increase sectorial and societal resilience through collaborative action. As part of this work, we highlight how more profound changes to the industry trends landscape are evolving, and why this is prompting a re-evaluation of established management practices.

Trends. How have they changed?

The chemical and advanced materials industry has been shaped by long-term, stable trends, like its pattern of feedstocks, the evolutionary perfection of technologies, the incremental capacity investments that shift the industry’s centre of gravity to new regions and balance economic cycles. The industry makes strategic decisions and commitments for decades rather than years, and includes detailed assessment of relevant trends (e.g. when planning asset investments; implementing seminal regulation like REACH, or packaging waste; or making a shift to circular business). Any changes to the underlying sector trends have a profound impact on how successful these bets can be.

While most of these trends have been visible for years, the accelerated speed of adoption for many, and the scale these are reaching in a very short period following COVID-19, is noteworthy. Here are a selection of the most visible recent changes; some that will inevitably challenge chemical company strategists to adjust their roadmaps and strategic plans.

1. An intensified shift to sustainable consumption

Consumer preferences have shifted rapidly towards more environmentally friendly, sustainable and ethical purchases, and dramatically accelerated FMCG (fast-moving consumer goods) manufacturer responses. These require very significant chemical industry contributions. Recent research shows that COVID-19 prompted 61% of consumers to change shopping habits immediately, and nearly 90% of those consumers say they will adhere to the changes post-crisis. Consumer industries are adapting to these preferences by pledging to increase the percentage of recycled and bio-based content in their supply chains. Policy-makers are addressing these consumer expectations by setting more ambitious sustainability agendas. For example, the European Commission plans to raise the CO2 emission reduction target from 40% to 55% by 2030, focusing Europe’s economic recovery from COVID-19 towards a resource-efficient economy. New regulations and incentives are being introduced to achieve this target.

2. A further deceleration of globalization is taking place

The shift towards more regional and local value chains has been triggered by the concerns of industrial customers and politicians becoming more wary of non-transparent and unwieldy supply chains for critical goods. More national industrial policies and investment incentives for domestic production have forced companies to reconsider their investment plans in response.

3. Structural change in key customer industries

The transformation of key industries (e.g. automotive) supplied by the chemicals sector has accelerated dramatically, further motivated by targeted government incentives. In 2020, sales of cars with conventional diesel and petrol-fuelled engines saw the sharpest drop in history, while tax breaks and COVID-19-related discounts fuelled sales of electric vehicles. China subsidized the purchase of electric vehicles, and the EU backed e-mobility with incentives worth $91 billion (amounting to 2.5x the EU's existing electric vehicle market). Accordingly, the sales of battery-powered cars tripled in less than 12 months. Manufacturers acknowledge the tipping point towards e-mobility has arrived much more rapidly than initially planned, and are fast-forwarding the overhaul of their ranges towards alternatively powered models. In terms of the necessary supply chain, these shifts have upended the product portfolios of many chemical manufacturers in a quarter of the previously assumed time horizon.

4. The restructuring of business portfolios has only temporarily been put on hold

The year 2021 will likely witness a surge in mergers and acquisitions in upcoming months, as COVID-19 demonstrated the value of a well-balanced portfolio (whether well-balanced means “focused” or “diversified” will remain a subject of debate for some time). Valuation multiples in sought-after chemicals sub-segments like pharmaceuticals, nutrition, or paints and coatings have remained high through the “pandemic pause”, and deal activity is already picking up in Q1 2021.

5. The forced adoption of remote working models

More flexible and digital work schemes have become a new norm, and led to an openness towards automation across many functions, including manufacturing and R&D. Though remote working at scale was not deemed possible in the chemical industry, it has become the norm for almost all office employees. Research shows that 73% of all employees enjoy working from home, and 35% plan to work from home at least once a week in the future, enabled by cloud, digital tools and automation.[1] Lean staffing, remote monitoring, plus new shift models that allow distancing have also proven effective in plants and labs and are rapidly spreading.

Research at process industry companies revealed that COVID-19 has triggered a step-change for investment in industrial autonomy, and 64% of companies expect to deploy autonomous primary operations by 2030. Industry leaders are also pushing hard on digital research to be applied to further sources of innovation. As a consequence, the capability profiles of the future workforce in the chemical and advanced materials industry are changing much more rapidly than considered possible, and this creates an urgency to update both university and company-level education programmes to help navigate these trend changes.

Trends. Do they matter the same?

Looking at these post-COVID-19 trends, one is tempted to apply these “new patterns” in revising long-term strategies and plans. But this may be missing a crucial point: the world is becoming a more unstable and uncertain place, with the frequency of shocks and the magnitude of their impact in an apparent increase.

COVID-19 has also pushed established management practices to the limits, especially in strategy development, investment risk assessment, in scenario planning, or in following the rapid changes of customers and end consumers. Realizing how prevalent large shocks really are and seeing their impact on established beliefs makes us question the validity of trend analysis or forecasting a new trend (e.g. emerging from supply side or consumer research). We will have to consider global risks as a likely influence factor in parallel to trends-based planning, and understand how they will jointly shape the future of the sector and of the societies in which the industry operates.

Organizations must think of resilience more broadly than before. More prevalent shocks and less stable trends will let managers and investors alike look for:

- Scenario analyses that integrate trends and risks into multiple time horizons to enable more flexible planning and strategizing.

- Dynamic rolling plans in short (best: weekly) intervals, coupled with powerful analytics to make sense of the short-term data, instead of deviation analysis vs. annual or quarterly plans.

- More comprehensive assessments of redundancies (assets, shifts, processes, partnerships) instead of discrete optimization.

- Agility through distributed decision-making at a local level instead of centralized, global authority.

The path to resilience

COVID-19 also demonstrated that the weakest link in a chain defines the resilience of the overall structure. Responses to shock events therefore require a broader, multilateral perspective: Cross-company, value chain and private-public collaborations help build resilience beyond the preparedness of a single organization. Approaches include:

- More balanced relationships with suppliers and ecosystem partners that provide some level of security and stability for investments into capacity that are required for resilient value chains, instead of transactional spot contracts.

- Safeguarding the livelihood of small and medium-sized firms (SMEs) that are vital to many value chains and essential to the local communities, because the pandemic has demonstrated that SMEs struggle more and for longer than large firms.

- Building local networks with suppliers, customers and communities for early sensing of the triggers that require industry action.

- Multistakeholder and cross-sector collaboration platforms supported by impartial facilitation to uncover the multiple facets of shared risk management and help to recover together.

Trends were once the basis for strategic planning in the chemical and advanced material industry, as they could be expected to slowly unfold over long periods of time, allowing for careful decisions based on rigorous analysis of the future (scenarios). This has brought the industry stability and successful evolutionary development. COVID-19 has reshaped this landscape by squeezing the timeline in which trends materialize from decades to a few years, and by disrupting the relative dynamics of trends, increasing the relevance of some trends while pushing others into obsolescence.

What is the World Economic Forum doing to manage emerging risks from COVID-19?

Future shocks will lead to yet more changes to those trends, so the certainty of trend and scenario analysis for strategic, financial and operative management may be disappearing. Enhancing the resilience of societies requires new management practices such as more agile monitoring, planning and decision processes, more distributed responsibilities, more engagement with local and regional stakeholders, and more multistakeholder collaborations. But even more importantly, it requires a change in management mindsets and paradigms.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Industries in DepthSee all

Abhay Pareek and Drishti Kumar

April 23, 2024

Charlotte Edmond

April 11, 2024

Victoria Masterson

April 5, 2024

Douglas Broom

April 3, 2024

Naoko Tochibayashi and Naoko Kutty

March 28, 2024