How does use of the US dollar and Euro compare?

In October 2020, Euro transaction value slid briefly ahead of the US dollar. Image: Unsplash/ Ibrahim Boran

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

United States

- Growth in the Eurozone is predicted to hit 4.4% this year, compared to 3.5% for US GDP, according to Goldman Sachs.

- But how does use of the two currencies compare?

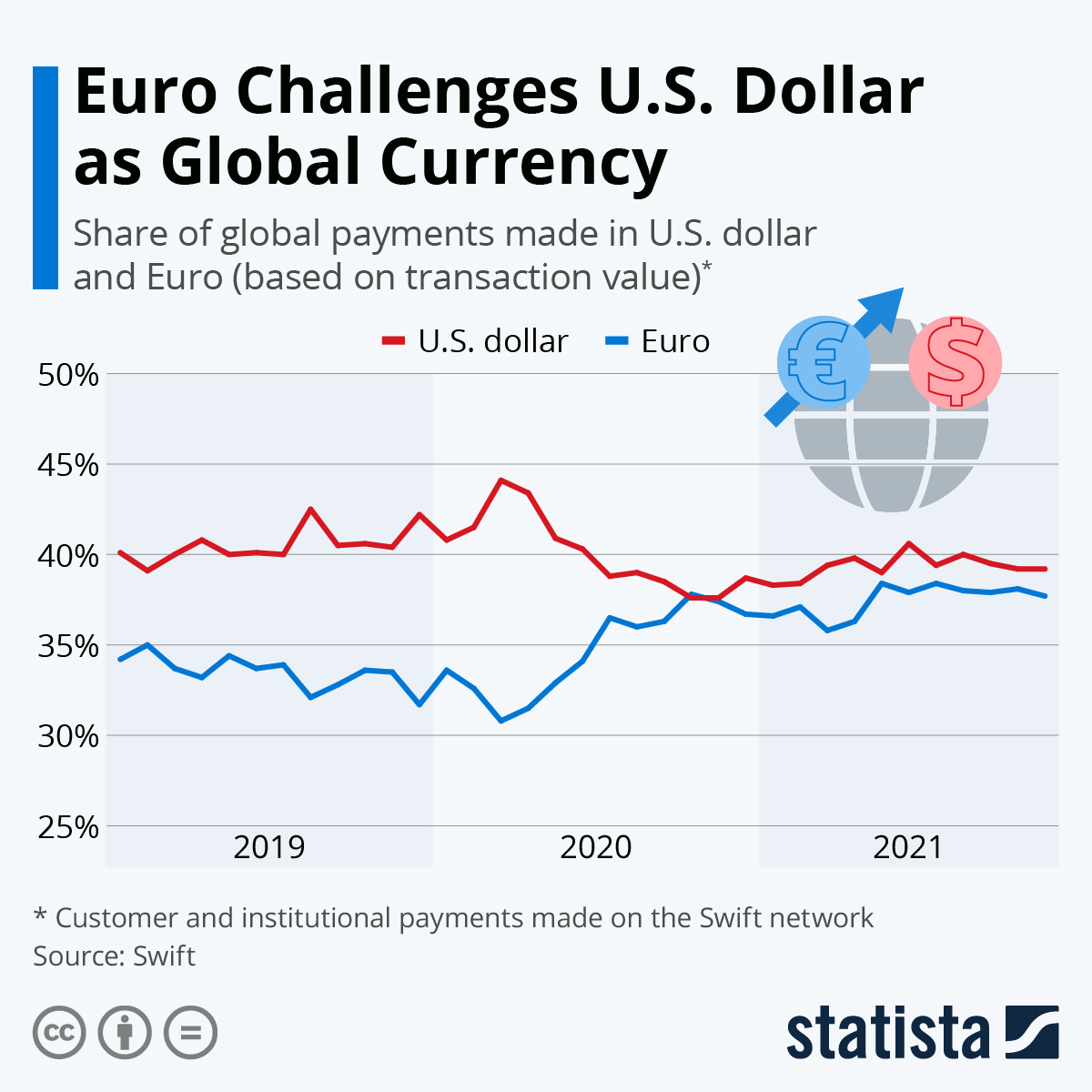

- The value of global payment transactions in Euro has been inching up to that of the U.S. dollar, data from the Swift international payment network shows.

Goldman Sachs last week predicted that the Eurozone would grow at a faster pace than the U.S. in 2022, projecting a growth rate of 4.4 percent for European Union currency area and only 3.5 percent for U.S. GDP. The latest World Bank forecast, also from January, still sees the U.S. ahead, if only by a paper-thin margin of 0.1 percent, while the new IMF outlook is yet to be released.

While the jury is still out on who will trump who for economic growth this year, there are other indicators that already show the Eurozone’s growing economic prowess and international importance. The value of global payment transactions in Euro has been inching up to that of the U.S. dollar, data from the Swift international payment network shows, hinting at increased activity around the currency. In October 2020, Euro transaction value even slid ahead of the U.S. dollar, and while that didn’t last long, the gap between the two currencies on the world stage has become considerable smaller since the start of the coronavirus pandemic. Potential reasons for this include the EU’s coordinated efforts to prop up its economy in the current crisis and its continued zero-interest fiscal policy. Faith in the U.S. economy and its growth is meanwhile shaky, according to CNBC, as uncertainty around President Joe Biden’s “Build Back Better” economic package continues.

Looking strictly at payments between two actors from different currency zones – thereby excluding international payments between different Eurozone countries – the U.S. dollar still retains more of an edge as a global trade currency. The gap to the Euro stood at around three percentage points of transaction value in November 2021. Yet, economists have shown surprise at the Euro’s general international success as a strong second player since the U.S. dollar was long seen as the singular international trade currency.

What's the World Economic Forum doing about tax?

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Financial and Monetary SystemsSee all

Lucy Hoffman

April 24, 2024

Michelle Meineke

April 24, 2024

Annamaria Lusardi and Andrea Sticha

April 24, 2024

Emma Charlton

April 24, 2024

Piyachart "Arm" Isarabhakdee

April 23, 2024

Kate Whiting

April 23, 2024