Crypto crash: How the algorithmic stablecoin UST failed and what we can learn from it

A stablecoin is a digital asset that aims to maintain the same value as a stable asset, or basket of assets. Image: Reuters/Dado Ruvic

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Davos Agenda

Listen to the article

- The recent stock market and crypto crash was partially in response to a tightening of monetary policy by the US Federal Reserve.

- The crash saw algorithmic stablecoin TerraUSD (UST) and its sister coin luna fail and saw their prices plunge.

- However, crypto is here to stay and creating inclusive regulations will make the system more agile, efficient and resilient.

The global economic engine is sputtering as it tries to move forward under a heavy burden – a war in Ukraine, mass supply chain disruption, questions about food security, a global pandemic still with grave consequences and the highest inflation in 40 years.

As the smoke clears from the recent stock market and cryptocurrency whirlwind, it’s important to digest and clarify what happened. Crypto has mass appeal now, but it’s only been around since 2009 and people are still learning the ropes.

What is happening in the US? Financial markets are trying to process a tightening of monetary policy by the Federal Reserve to slow the growing threat of inflation. We are seeing the impact on the stock market and crypto pricing. We also know that some crypto assets have grown more correlated with broader market trends.

Bitcoin, the most commonly known cryptocurrency, dropped in value in the week of May 8, just as Tesla, Apple, and Microsoft did. There have been three other “downward” market cycles – in 2011, 2013 and 2017 – and we could be in another one.

But, recently the term ‘crypto’ has been inaccurately used in broad sweeping language.

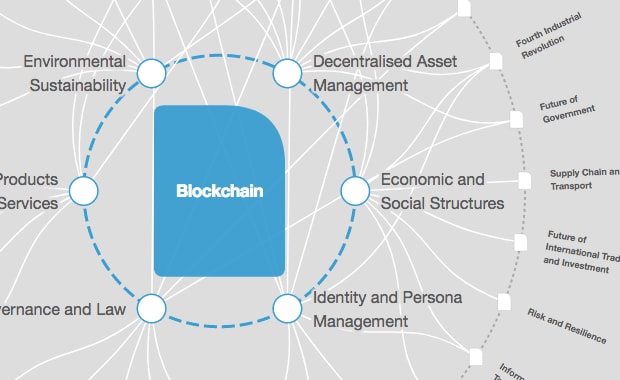

What is a stablecoin?

The term 'stablecoin' has now gone mainstream, and it was probably the first time many had heard of it. A stablecoin is a digital asset that aims to maintain the same value as a stable asset, or basket of assets. The US dollar has been the most common asset to date.

The idea behind stablecoins is to combine the technical capabilities of digital assets, while providing an alternative to the price volatility that has historically been characteristic of major cryptocurrencies like bitcoin and ethereum.

That means you can take advantage of the benefits of blockchain technology – traceability, the ability to engage in smart contracts, etc – while maintaining a stable price.

But, not all stablecoins are equal – Coinmarketcap lists more than 70 – so it’s important to understand the nuances of each type of stablecoin.

For those who want to dive a bit deeper, here are four categories of stablecoin:

Fiat-backed: Stablecoin issuers hold 1:1 reserves of fiat currency. The total value matches how much they have backed by fiat.

Crypto-backed: These stablecoins are backed by other cryptos via smart contracts rather than a service provider. They are “over-collateralized” meaning the value of the crypto backing exceeds the value of stablecoins issued, in order to account for price fluctuations.

Commodity-backed: Similar to fiat-backed stablecoins, stablecoin issuers hold equivalent values of commodities like precious metals, oil and real estate. The coins may or may not be redeemable for the physical asset.

Algorithmic: These stablecoins are not backed. Instead, they aim to maintain a stable value through algorithms and smart contracts that manage the expansion and contraction of token supply.

What is UST and how does it work?

At a high level, TerraUSD (UST) is a decentralized algorithmic stablecoin that aims to maintain the value of 1 UST=$1 through a “mint/burn” mechanism.

Maintaining dollar-peg stability means algorithmically regulating supply and demand of the coin – a computer programme balances the price. To go back to some economics 101: When demand exceeds supply, the price goes up (in this case, UST>$1). When the opposite occurs, the price goes down.

So, the task at hand is to regulate the supply so that the price of the stablecoin remains at $1. This is done through a two-coin system. As discussed, UST is the stablecoin. Terra’s native cryptocurrency, luna, backs UST.

Minting $1 of UST requires burning $1 worth of luna, and vice versa. Say the demand for UST is too high. The price will go above $1, perhaps to $1.01. To bring the value back down, $1 of luna can be exchanged for $1 of USD.

This “mints” $1 of UST, increasing the supply and ultimately lowering the price. At the same time, it “burns” $1 of luna. When the demand is too low, users can “mint” luna to reduce the supply of UST and increase its value back to $1.

With market volatility and an overall downward trend, the balancing act for this particular stablecoin failed. The reflexivity of the system meant that when demand for UST falls, sell pressure on luna increases. This can and did, result in a downward spiral that saw the price for both plunge to near zero.

Crypto is here to stay and needs regulating

What we do know about the future is that policymakers have their eyes on crypto’s up and down movements – and it’s a good thing.

Creating inclusive regulations means policymakers are taking a long-term view and not reacting to short-term market fluctuations. Crypto is here to stay.

How is the World Economic Forum promoting the responsible use of blockchain?

Whenever the hype bubble bursts, the speculator's exit and leave the real users and builders of the technology to make the system more agile, efficient and resilient.

Looking ahead, financial tools should be more accessible, transparent and efficient. They should take advantage of new opportunities from innovation.

Over the long term, crypto remains well-positioned to provide these benefits and address challenges in legacy financial systems.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Forum InstitutionalSee all

Spencer Feingold and Gayle Markovitz

April 19, 2024

Kate Whiting

April 17, 2024

Andrea Willige

March 27, 2024

Shyam Bishen

March 20, 2024

Simon Torkington

March 15, 2024