This is the role the services sector can play in transforming economies

Productivity growth has underpinned the expansion of the services sector. Image: Pexels/Ksenia Kartasheva

Gaurav Nayyar

Lead Economist in the Equitable Growth, Finance, and Institutions Vice Presidency , World Bank

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

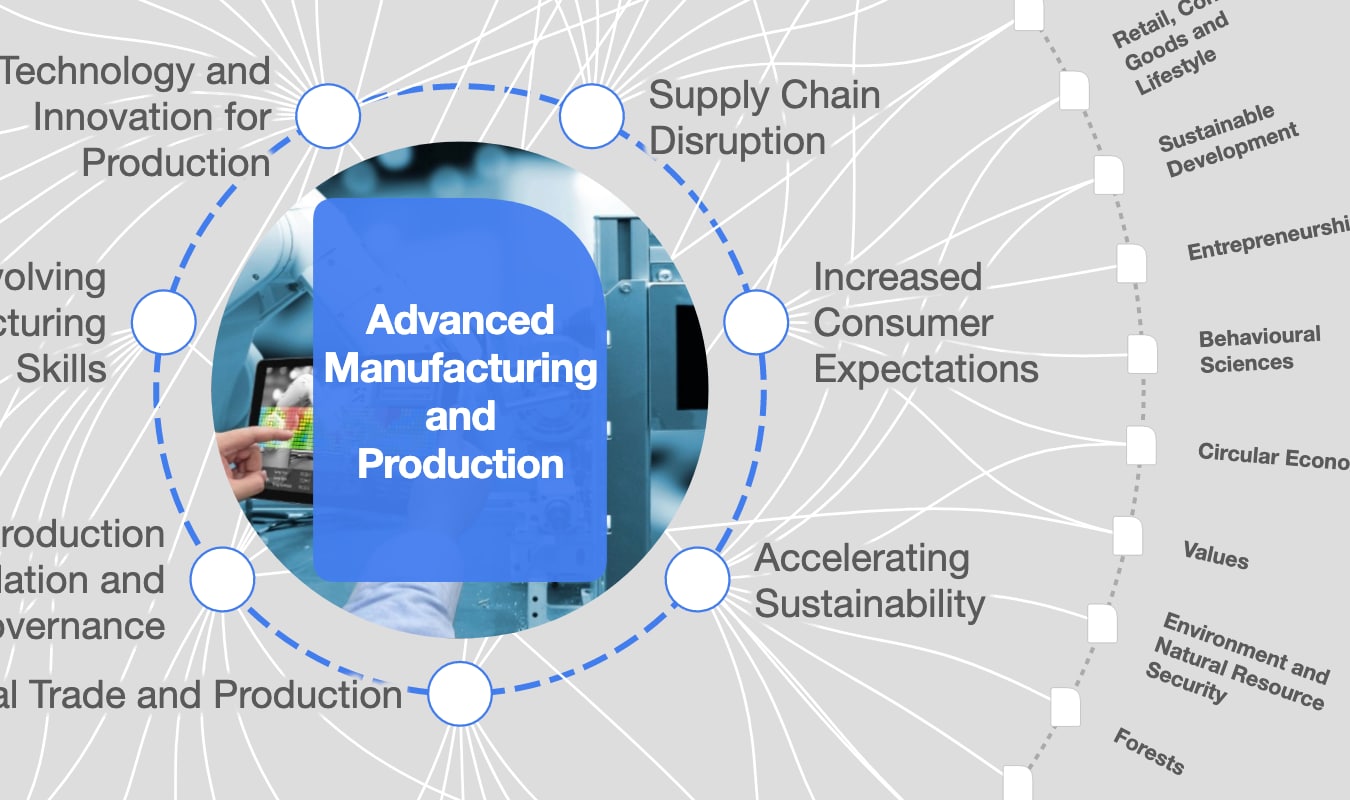

Advanced Manufacturing

- The likelihood of developing economies following a services-led growth model looks increasingly certain, although its benefits may not apply to all countries and individuals equally, three experts say.

- New evidence suggests that productivity growth has underpinned the expansion of the services sector in developing economies, such as India.

- And the future benefits of international trade for developing economies are likely to derive from services trade – in particular, intermediate services – rather than goods trade.

- Better data availability could help countries craft policy to make best use of the services sector for economic growth.

Structural transformation in the past three decades has been driven by a fast-growing services sector, which has outpaced the manufacturing sector in many developing economies. The likelihood of developing economies following a services-led growth model looks increasingly certain, although its benefits may not apply to all countries and individuals equally. The Services and Structural Transformation Workshop, organised by the World Bank, brought together leading experts to discuss the implications of services-led growth on labour productivity, deindustrialisation, industry polarisation, growth dynamics, and job creation.

The services sector is an increasingly important growth engine for developing countries

The share of manufacturing in value added and employment in developing economies has stagnated or declined at lower levels of income compared to the experience of developed economies decades ago (Rodrik 2016). This ‘deindustrialisation’ has been accompanied by rising cross-country dispersion in the manufacturing sector’s share of total value added (‘industry polarisation’), suggesting more limited opportunities for developing economies to industrialise (Figure 1).

Kei-Mu Yi presented evidence that early industrialising countries – facing high prices of manufactured goods – redistributed resources from agriculture to manufacturing. In contrast, countries that began to industrialise later – when prices of manufactured goods were lower – faced more limited opportunities to specialise in the manufacturing sector and instead began to redistribute resources predominantly from agriculture directly to services (Sposi et al. 2021). Despite its increasing prominence, the services sector has been under-studied by researchers and underappreciated by policymakers as a means to create jobs, achieve productivity gains, and reduce poverty (Nayyar et al. 2021).

Richard Rogerson highlighted that cross-country productivity gaps in the manufacturing sector did not shrink in the past three decades (Herrendorf et al. 2022; Figure 2). This challenges the view that expanding manufacturing employment is a prerequisite for developing economies to catch up, given earlier evidence of unconditional convergence in labour productivity levels in the sector across countries (Rodrik 2013). In fact, new evidence shared by Michael Peters suggests that productivity growth has underpinned the expansion of the services sector in developing economies, such as India, where most jobs have been created since the 1990s (Fan et al. 2021). Firm-level evidence from 20 low- and middle-income countries also shows that service establishments can achieve high productivity despite being smaller than manufacturing establishments (Hallward-Driemeier et al. 2022).

Figure 2 Manufacturing versus aggregate productivity relative to respective frontier

In the past, the benefits of industrialisation were often associated with trade integration. Richard Baldwin made the case that future benefits of international trade for developing economies will likely derive from services trade – in particular, intermediate services – rather than goods trade (Baldwin 2023). A range of factors, such as geopolitical tensions and the diffusion of industrial automation, can reduce trade in manufactured goods and weaken their link with generating quality jobs. At the same time, the acceleration of digitalisation is lowering barriers to services trade (Baldwin and Forslid 2020). Further, manufacturing inputs are being displaced by services inputs in export value added (Baldwin and Ito 2022). Banu Demir found that the structural shift toward services can also be linked to an observed increase in demand for local business services, owing to improved market access for local manufacturing (e.g. in Turkey; Avdiu et al. 2023).

Even for non-tradable services, such as wholesale and retail, ICT-based technologies, together with the adoption of new management practices, have enabled firms to standardise and scale up delivery across locations. Chang-Tai Hsieh argued that this is reflected in the rising market share and labour productivity of top firms in these sectors. In the US, the entry of top service firms into new local markets has led to substantial unmeasured productivity growth, particularly in small markets (Hsieh and Rossi-Hansberg 2021).

Income gains from services-led growth may not be equally distributed

Income gains from service-led structural transformation are not necessarily equally distributed across countries or within countries. As the value added in exports shifts from the manufacturing sector to the services sector, own-country sourcing of services has declined in developing economies, while developed economies have been able to maintain their relatively high levels of own-country services sourcing (Baldwin and Ito 2022).

How is the World Economic Forum contributing to build resilient supply chains?

Within countries, although productivity growth in non-tradable consumer services like retail trade has been an important driver of rising living standards, such as between 1987 and 2011 in India, the gains have gone disproportionately to high-income households in urban areas (Fan et al. 2021). Further, the type of services jobs matters for development. Bernard Hoekman shared evidence of a positive relationship between the share of workers in high-skilled services and development (measured by nighttime luminosity) but a negative relationship between low-skilled services and development (Baccini et al. 2022). One possible underlying mechanism is foreign direct investment, which is associated with workers shifting toward higher-skilled jobs (Hoekman et al. 2023). Paolo Bastos added that there is also evidence of dynamic benefits resulting from ‘learning-by-working’ in high-skilled services, which accrues to workers even if they are not currently employed in these sectors (Bastos and Artuc 2023).

The rapid growth of the services sector could call for new ‘industrial’ policies

Given the fundamental shift in the patterns of structural change, with workers moving predominantly into services and informal manufacturing rather than into formal manufacturing, Dani Rodrik called for new ‘industrial’ policies for the services sector. Guiding principles could include policies that promote collaboration and customisation, focus on small- and medium-sized firms, and where partnerships between firms and governments are used to revitalise communities (Rodrik 2023). As the prospects for service-led growth brighten, new development strategies could emphasise elements such as human capital development (via training), quality-job creation, and services value-chain engagement (Baldwin 2023, Rodrik 2023). The panel discussion during the workshop, chaired by Aaditya Mattoo, highlighted the significance of better data availability to advance our understanding of how policy can best leverage the services sector for economic growth.

References

Avdiu, B, B Demir, U Kilinc, T Michalski, and G Nayyar (2023), “Manufacturing-led services growth and structural change”, presentation at the Services and Structural Transformation Workshop, World Bank, Washington DC.

Baccini, L, M Fiorini, B Hoekman, and M Sanfilippo (2022), “Services, jobs, and economic development in Africa”, CEPR Discussion Paper 16924.

Baldwin, R (2023), “Service-export-led development and the future of trade”, presentation at the Services and Structural Transformation Workshop, World Bank, Washington DC.

Baldwin, R, and T Ito (2022), “The smile curve: Evolving sources of value added in manufacturing”, Canadian Journal of Economics 54(4): 1842–1880.

Baldwin, R, and R Forslid (2020), “Globotics and development: When manufacturing is jobless and services are tradable”, NBER Working Paper 26731.

Bastos, P, and E Artuc (2023), “Learning by working in high-skills sectors”, presentation at the Services and Structural Transformation Workshop, World Bank, Washington DC.

Fan, T, M Peters and F Zilibotti (2021), “Growing like India: The unequal effects of service-led growth”, NBER Working Paper 28551.

Hallward-Driemeier, M, G Nayyar, and E Davies (2022), “For services firms, small can be beautiful”, VoxEU.org, 12 January.

Herrendorf, B, R Rogerson, and Á Valentinyi (2022), “New evidence on sectoral labor productivity: Implications for industrialization and development”, NBER Working Paper 29834.

Hoekman, B, M Sanfilippo, and M Tambussi (2023), “Foreign direct investment and structural transformation in Africa”, CEPR Discussion Paper 17838.

Hsieh, C, and E Rossi-Hansberg (2022), “The industrial revolution in services”, working paper.

Nayyar, G, M Hallward-Driemeier, and E Davies (2021), At your service?: The promise of services-led development, World Bank.

Rodrik, D (2013), “Unconditional convergence in manufacturing”, Quarterly Journal of Economics 128(1): 165–204.

Rodrik, D (2016), “Premature deindustrialization”, Journal of Economic Growth 21(1): 1–33.

Rodrik, D (2023), “Why service need an industrial policy”, presentation at the Services and Structural Transformation Workshop, World Bank, Washington DC.

Sposi, M, K-M Yi, and J Zhang (2021), “Deindustrialization and industry polarization", NBER Working Paper 29834.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Advanced ManufacturingSee all

Stephanie Wright, Memia Fendri and Kyle Winters

February 13, 2024

Maya Ben Dror and Lena McKnight

January 31, 2024

Dr. Matthew Putman

January 17, 2024

Kyriakos Triantafyllidis and Andreas Hauser

January 16, 2024