The world’s changing trade patterns

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

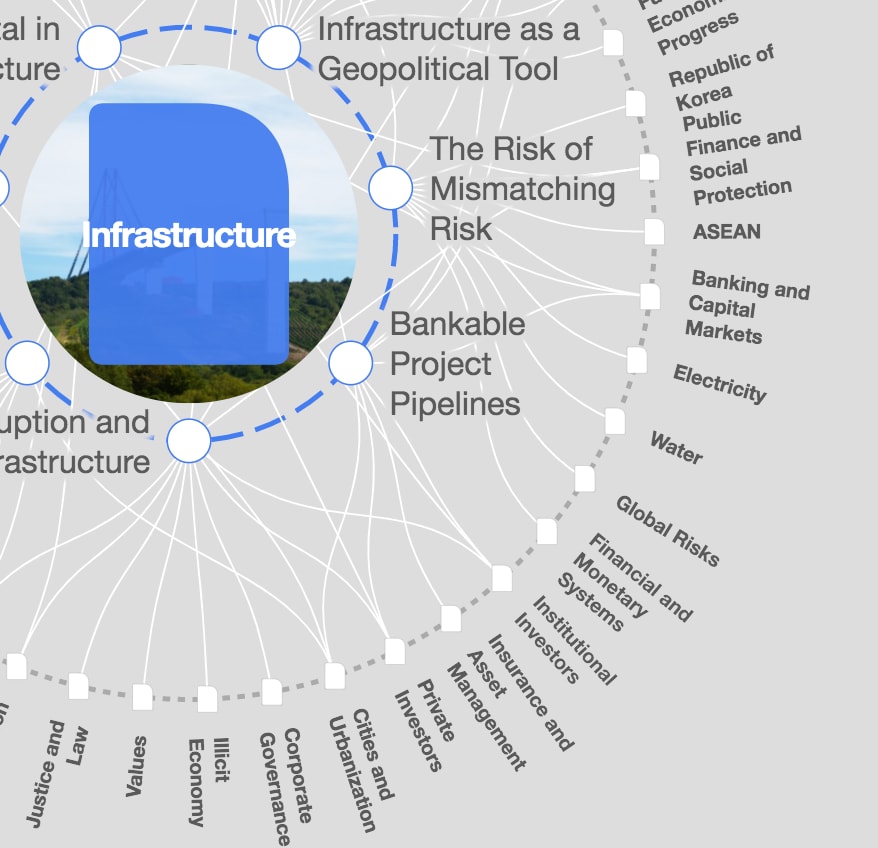

Infrastructure

Global trade has not accelerated to levels reached prior to the global financial crisis of 2008, but global trade is in the midst of a massive (albeit gradual) shift. Speaking at “View from the Bridge: Transformations in Global Trade”, a high-level briefing organised by The Economist events and sponsored by GE in South Korea, EIU economist Simon Baptist sketched out some of the macro factors that will shape the future the global trade—and with it the shipping sector.

Of particular importance to the changing landscape was the increasing role of Asia in global trade. “China’s rise has dominated global manufacturing,” Mr Baptist noted—a trend he said would continue, noting that, while Chinese wages are rising, so is productivity. According to EIU projections, China will remain the world’s top exporter in 2030 while the US will fall from second to third place. Most notably, India will have risen from 13th place in 2014 to 2nd place by 2030; by 2050, India could be the world’s largest exporter.

These trends signal a major shift in global trade for the longer term. In the short term, however, shippers will have had to deal with dipping global trade growth. “For about 30 years, up to the economic crisis in 2008, we saw very strong global trade growth; trade grew three times GDP growth, per year,” noted Tim Smith, chief executive of Maersk Line for Northeast Asia, noting that while trade was still growing faster than GDP in—3.1% vs 2.6% in 2013, according to WTO—“ … the days when we could rely on a three-times multiplier are long gone”.

This is not necessarily bad news for shipping, which is now facing a more diversified geography of trade. On the supply side, for example, companies have both offshored production and near-shored it to get closer to markets. “Take the auto sector: Companies like Nissan have plants in India, Brazil and Mexico and they all supply each other,” said Mr Smith. “It is no longer Japan supplying the world from Japan.”

Demand has diversified as well. China’s rising middle class, for instance, is now consuming finished imports—such demand is also easing shippers’ back-haulage problems from Chinese ports. As a result, says Kim Sung-gwi, president of the Korean Maritime Institute, South Korean firms are increasingly shipping to Southeast Asia. Other changes, such as Japan’s turn away from nuclear—which has sparked demand for LNG—have been less gradual and more crisis-driven, Mr Kim noted.

With WTO global trade talks largely stalled, countries are turning to bilateral and regional free trade agreements to reinvigorate trade: South Korea, for example, has FTAs with the EU, the US and (as of this month) China. Trans-oceanic FTAs, such as the US-sponsored Trans-Pacific Partnership (TPP) and China’s competing Free Trade Area of the Asia-Pacific (FEAAP) are the next logical step.

Mr Smith praised the pragmatism of FTAs, but noted that tariffs are not the only barriers to efficient trade. “In logistics, if you look at how many touch points there are—how many times someone needs to give approval to move things—it is staggering,” he said. “It is a very large unseen cost, and organisations like APEC [Asia Pacific Economic Cooperation] are trying to systematically remove these barriers.”

As supply chains mutate and new markets in regions such as Southeast Asia and Africa come online with smaller ports, demand for gigantic container ships may fall. This could affect South Korea’s top-tier yards, which lead the market in mega-ships. According to the shippers present at the conference, however, the “Big Three” (Hyundai Heavy, Samsung Heavy and Daewoo Shipbuilding and Marine Engineering) should retain their lead. “We built 14 container ships in Korea and every ship was delivered at 3.00 pm on the designated day,” said Esben Poulsson, vice chairman of the International Chamber of Shipping and chairman of Singapore-based shipping firm Avra Asia Pte; Chinese yards cannot match that efficiency, he said. “Korean shipbuilders have the best combination of scale, execution and innovation,” added GE Chairman and CEO Jeff Immelt.

In the post-2008 slump, major South Korean yards have pioneered high-value products, KMI’s Mr Kim noted, such as LNG carriers and offshore platforms as well as new geographies like Arctic exploration. But while the big boys look safe, South Korea’s second-tier shipbuilders are nevertheless highly exposed to China’s surge, said Ko Jae-ho, president of Daewoo Shipbuilding and Marine Engineering.

As for shippers, overcapacity casts a shadow on those who over-ordered in the 2003-2007 boom years and that have ordered an additional 8-9% of shipping for anticipated upturns in 2015-2016, said Mr Smith. This has partly been driven by finance. With traditional shipping banks negatively affected by the 2008 crisis, private equity firms (PE) entered the sector, but not all their investments worked out and PE is “falling out of love with the industry”, said Mr Poulsson. Fortunately, financiers with longer-term horizons—state-run policy banks and sovereign wealth funds—are taking up the slack, said Kim Yong-ah, a senior partner at McKinsey and Co.

China’s ambition in the shipbuilding segment is another driver of overcapacity. The country had 1,647 yards as of 2014—nearly double 2001 levels. In a context of oversupply, maintaining such a high number of yards is going to be difficult, and many Chinese yards are expected to close or consolidate. Maersk’s Mr Smith and Busan Port Authority President Lim Ki-tack noted that competitors would, ideally, discuss overcapacity and competitiveness issues—but need to be careful not to trespass into anti-trust or price-fixing territory. Other factors, like environmental regulations, may slow speculative shipbuilding. “A raft of new technologies and environmental changes are coming, and it is very risky to build a ship that may be subject to new regulations,” said Mr Smith.

The days where trade grew three times faster than GDP may be over, but the transformation of the trade routes—and with it the shipping sector—is far from finished.

Published in collaboration with GE LookAhead

Author: Andrew Salmon is a writer for GE LookAhead,

Image: A seagull flies over the dock of C.C shipyard Co.Ltd, which refurbished South Korean ferry Sewol. REUTERS/Kim Kyung-Hoon

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Trade and InvestmentSee all

Nils Aldag and Christopher Frey

May 1, 2024

Maria Mexi and Mekhla Jha

April 30, 2024

Chido Munyati

April 28, 2024

Matthew Stephenson

April 23, 2024

Libby George

April 19, 2024

Johnny Wood

April 17, 2024