Long-term investing: how can we plug the gap?

Roads to ruin ... the world needs an estimated $60 trillion to spend on basic infrastructure such as roads and power plants Image: REUTERS/Krishnendu Halder

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

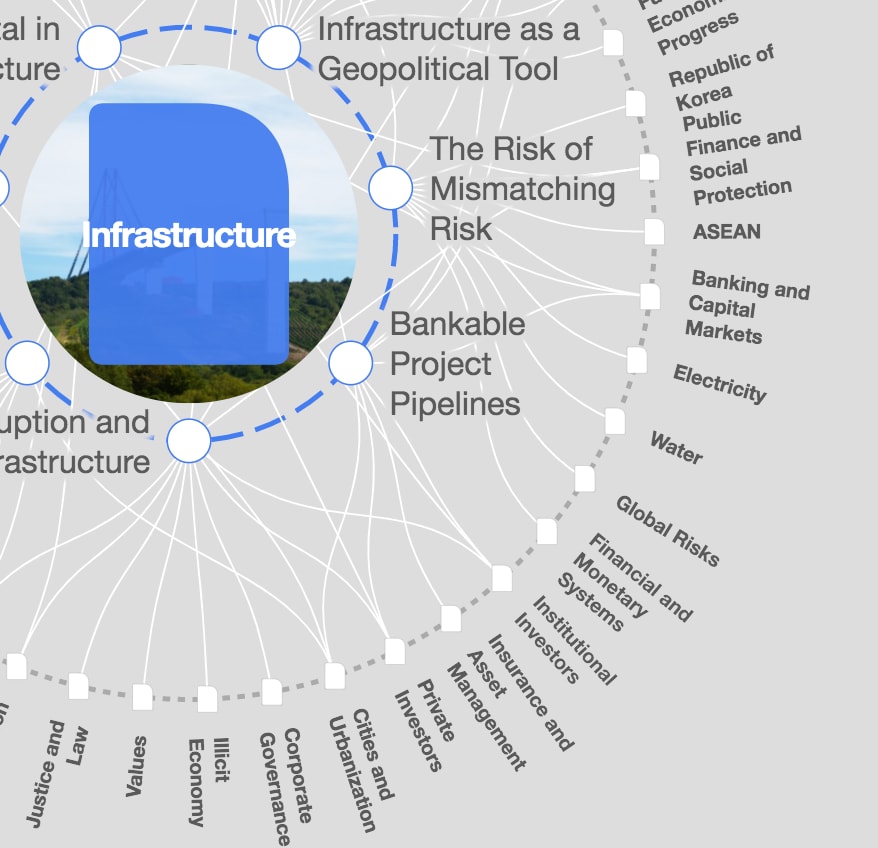

Infrastructure

Investing for the long term is vital for economic growth and social well-being. Whether it’s building new infrastructure or maintaining what already exists, funding is vital to maximize the economic benefits that flow from it.

But seven years after the global financial crisis, the world is still facing sluggish economic growth and constrained government budgets. As a result, there is an overall lack of long-term investment, which has serious implications for global growth.

The challenge is to find ways of funding the basic systems and services that countries need to function in a difficult financial climate.

How big is the problem?

Put simply, huge. Over the next 15 years we will need to spend an estimated $60 trillion on basic infrastructure like roads, power supplies and other key services to keep economies and societies functioning well – $15 trillion of that is currently unfunded.

There is also a massive gap in other types of long-term investment. Public pension shortfalls in the US alone are estimated to be between $1 and $2 trillion; that’s 10% of the country's annual GDP.

The United Nations Sustainable Development Goals aim to end poverty, promote access to education and health, and protect the environment. But how much will governments need to spend to achieve the goals? The UN Conference on Trade and Development has estimated that it could cost as much as $4.5 trillion a year in state spending and investment.

What happened to all the money?

In the past we relied on public finance for major infrastructure projects, but tighter government budgets in the wake of the global financial crisis have had a substantial impact on how much money is available.

Development finance, which has helped developing countries fund major projects, has also been cut back.

Long-term investors such as pension funds, insurance companies and sovereign wealth funds have struggled to find infrastructure investments that offer returns high enough to match their future liabilities, so cash flow from those sources has slowed too.

Who can fund the shortfall?

There is a potential solution to the funding shortfall if long-term investors can be persuaded to put some of the estimated $60 trillion they control into these projects.

Currently the obstacles to institutional investors are significant – short-term political cycles, currency variations and a lack of viable financing structures are just a few of them.

Some governments, including the UK, France, Italy and Australia, have a long-established record of attracting private sector finance for infrastructure. But public-private partnerships can sometimes lead to problems as tenders often go to the lowest bidder, which can involve corners being cut in the long term.

What’s the World Economic Forum doing about it?

The Forum's Regional Acceleration Projects are designed to help government and regions streamline and accelerate project pipelines. Meetings between all parties help highlight problems and solutions.

It also looks at ways that risk can be mitigated for investors and investment standards applied to individual projects.

Finally, it brings together experts in public-private finance and major infrastructure projects to share knowledge on this difficult area with the aim of developing new policy frameworks for the future.

Click here for more information on the Forum's Global Challenge on International Trade and Investment.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Trade and InvestmentSee all

Michael Eisenberg and Zlatan Plakalo

May 6, 2024

Nils Aldag and Christopher Frey

May 1, 2024

Maria Mexi and Mekhla Jha

April 30, 2024

Chido Munyati

April 28, 2024

Matthew Stephenson

April 23, 2024

Libby George

April 19, 2024