My 3-step plan to keep Ireland’s recovery going

Looking to the future: "The progress we have made is welcome, but it is not enough." Image: REUTERS/Victor Fraile

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Future of Work

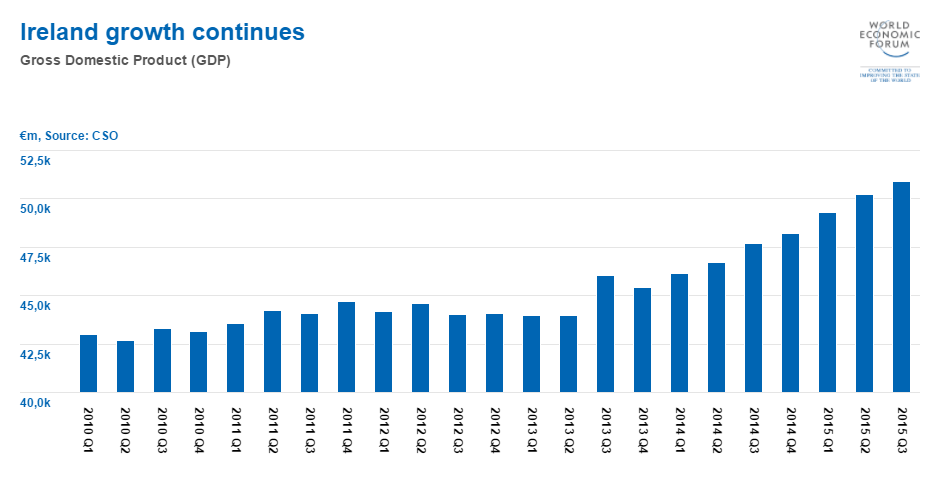

Ireland is now the fastest growing economy in Europe. Thanks to the hard work and resilience of the Irish people and Irish businesses, we have come a long way since 2010. That was when a banking and economic collapse locked our state and financial system out of the international markets, and forced the previous Government to seek external financial assistance from the IMF and our European partners.

Since a new government was formed under my leadership in 2011, we have followed a clear plan: fix our banks and the public finances quickly and get our country working again. That plan involved huge sacrifices by the people, but has clearly worked.

Since the end of the bail-out in 2013, our economy (in real GDP) grew by 5.2% in 2014 and is likely to have grown by a further 6.2% in 2015. Unemployment has fallen from a peak of over 15% to below 9%. Government borrowing has fallen from 11% of GDP in 2011 to less than 2% last year.

From property bubble to export-led growth

Unlike the unsustainable credit-fuelled construction boom and property bubble of the last decade, the recovery of the Irish economy is now driven by exports, business investment and high productivity, and is diversified across a range of sectors.

The progress we have made is welcome, but it is not enough. Unemployment remains too high. Too many families still struggle weekly to make ends meet. Our public finances still need to be fully repaired, and public services and infrastructure need more investment.

My message at home and abroad will be clear. My Government, if re-elected, will continue to implement our long term economic plan to keep the Irish recovery going. It is based on three simple steps.

Three simple steps: jobs, welfare reform, housing

The first step in the plan is to continue to create even more job opportunities. We have strategies across a range of sectors (tourism, agriculture, financial services, retail etc.) that aim to add an additional 200,000 jobs by 2020, to bring employment levels back above their pre-recession peak. At that point, everybody who wants a job will be able to get one. To achieve this, we will protect and enhance our 12.5% rate of corporation tax regime, invest more in skills and infrastructure and cut taxes on smaller, Irish-owned businesses. Our commitment to our status as the only English-speaking country in the eurozone is beyond doubt.

The second step in the plan is to continue cutting personal income tax rates, reforming our welfare system and improving affordable access to childcare and medical care for working parents in order to “make work pay”. We will make sure that those who want to work feel it’s really worth it, and make it even more attractive for highly skilled people to live and work in Ireland. Our target is to reduce unemployment to 6%, bring home 70,000 Irish emigrants forced to leave because of the recession, and reduce the numbers of people living in jobless households by 200,000.

With the boost to the public finances from increasing numbers back at work, the third step in the plan is to continue to fund sensible improvements in key public services and housing, while never going back to the reckless spending increases that helped to derail the economy a decade ago.

Selling stakes in bailed out banks

While providing for a package of supports for families and the elderly, and targeted increases in the numbers of doctors, nurses, teachers and Gardai, our new Expenditure Rule will cap the growth of government spending below the underlying growth capacity of the economy. This will eliminate new government borrowing by 2017, and keep the public finances in surplus thereafter. We will, over time, sell our stakes in the bailed banks to bring Government debt levels down below the EU average.

Our plan can make Ireland the best small country in the world in which to start a business, live, work, raise a family and grow old with dignity. In an uncertain world, it will reinforce Ireland’s position as a pro-jobs and pro-investment haven of stability, opportunity and growth. We are moving in the right direction. My promise to our people at home will be to keep it that way.

Author: Enda Kenny has been the Taoiseach of Ireland since 2011. He is participating in the World Economic Forum’s Annual Meeting in Davos

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Jobs and the Future of WorkSee all

Roman Vakulchuk

April 24, 2024

Eli Joseph

April 19, 2024

Kate Whiting

April 17, 2024

Juliana Guaqueta Ospina

April 11, 2024

Victoria Masterson

April 9, 2024