How failing banks paved Hitler's path to power

How did failing banks contribute to the rise of the Nazis? Image: REUTERS/Kai Pfaffenbach

José-Luis Peydró

ICREA Professor of Economics at UPF, Barcelona GSE; Research Professor and Research Associate, , CREI; and CEPR Research Fellow

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

European Union

Polarised politics in the wake of financial crises echo throughout modern history, but evidence of a causal link between economic downturns and populism is limited. This column shows that financial crisis-induced misery boosted far right-wing voting in interwar Germany. In towns and cities where many firms were exposed to failing banks, Nazi votes surged. In particular, places exposed to the one bank led by a Jewish chairman registered particularly strong increases of support – scapegoating Jews was easier with seemingly damning evidence of their negative influence.

Can financial crises fan the flames of fanaticism? The Great Recession of 2007-08 not only wrought havoc on employment and output, but its aftermath has seen the rise of populism across the Western world, from Sweden to Spain and from Germany to the US. Many cross-country studies claim that there is a direct link from financial crisis to right-wing populist movements (Mian et al. 2014, Algan et al. 2017, Eichengreen 2018). The Financial Times led its ‘10 years after’ editorial on the crisis of 2008 with the headline “populism is the true legacy of the financial crisis”. And yet, cross-country evidence is often inconclusive, and hard evidence of a causal link running from financial shocks to political catastrophe has been difficult to come by.

In a new study, we provide such evidence for the canonical case of Germany during the 1930s (Doerr et al. 2019). The country saw one of the worst depressions on record, with output contracting by more than a quarter, and sky-rocketing unemployment. Germany’s slump was aggravated by a severe banking crisis in the summer of 1931, which helped turn an ordinary recession into the Great Depression (Figure 1). The crisis was triggered by the collapse of Danatbank, one of Germany’s four big universal banks. Following a Central European banking crisis that had begun in Austria in May, German banks experienced deposit withdrawals. Danatbank itself faced unsustainable losses when one of its borrowers, a large textile firm, defaulted due to fraud and bad luck. The ensuing bank run led to a suspension of bank deposits, the failure of another bank, Dresdner, and a three-week bank holiday with Germany’s de facto exit from the gold standard. Both external and domestic factors, combined with political inactivity because of repayments (due to political conflict between Germany and France over reparations), turned Danatbank’s troubles into a full-blown financial crisis (Ferguson and Temin 2003, Born 1967, Schnabel 2004).

Figure 1 Industrial production in Germany, 1930-34

In our paper, we show that the German banking crisis was crucial to boosting the Nazi movement’s electoral fortunes. It aggravated the German economy’s downturn, leading to more radical voting because of declining incomes. In addition, it also increased the Nazis’ popularity directly. The bank at the centre of the crisis, Danatbank, was led by prominent Jewish banker Jakob Goldschmidt. The Nazi party’s central long-standing claim that “the Jews are [Germany’s] misfortune” was thus seemingly borne out by indisputable fact. We argue that these non-economic effects of the banking crisis were crucial to explaining political radicalisation.

Based on newly collected data detailing firm-bank connections for the universe of German joint-stock companies, we present new evidence on the real effects of the German banking crisis and document the crisis’ consequences for Nazi support and anti-Semitic actions. To identify the effect of bank failures on the real economy and voting, we collect data on firm-bank pair relationships on more than 5,600 listed German firms. German firms typically had a strong relationship with a single bank, often the one that had brought them to market. The ‘Hausbank’ (house bank) would offer payment services, provide credit and capital market services, and send a delegate to the supervisory board of the connected firm (Fohlin 2007). For identification, we use cross-sectional variation across Germany in pre-crisis firm and city exposure to Danatbank and Dresdner Bank, the two banks that failed during the crisis (Figure 2). German banks lent nationwide in the 1930s (in contrast to US banks), and bank connections were in general sticky. We find no evidence that firms linked to the Danatbank were ex-ante riskier than client firms of other banks – nor were they different in size, age, or leverage when compared to borrowers of other large banks.

Figure 2 Exposure to failing banks, Germany 1931

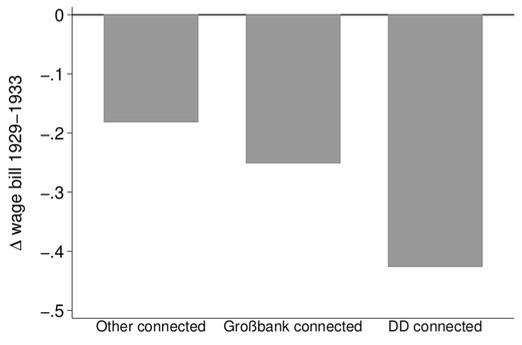

We first show that firms connected to Danatbank or Dresdner Bank saw sharper declines in their liabilities and wage bills, compared to unconnected firms (Figure 3). They cut their wage bill by around 20% more than unconnected firms. The shock to firms connected to failing banks had aggregate consequences – where firms were pushed to cut expenses because their main bank had collapsed, economic activity contracted markedly more rapidly. Cities with a higher share of firms connected to failing banks saw a stronger decline in incomes (Figure 4, panel A).

Figure 3 Bank exposure and firm wage bill growth 1929-1934

Figure 4 City income and NSDAP votes

a) City income

b) NSDAP votes

Greater economic collapse was one important mechanism that links the banking crisis to Nazi voting. While unemployment did not affect Nazi votes, income declines driven by exposure to Danatbank and Dresdner Bank (DD) strongly increased support for the Nazi party (NSDAP) – a one standard deviation decline in income caused by DD was associated with a 4.3% rise in Nazi support (while the average change in NSDAP vote share from 1930 to 1933 was 22%). In contrast, a one standard deviation change in income (not predicted by DD exposure) increased Nazi votes by only 1.1%.

However, exposure to failing banks also mattered through non-economic channels. After controlling for changes in economic fundamentals, higher DD exposure by local firms directly increased Nazi voting above and beyond its direct effect through falling incomes. While the Nazis’ message was similar across Germany, it had greater success in cities affected by DD failures. With the financial crisis, the Nazis had seemingly incontrovertible proof for their misguided theories of Jewish domination and destruction. As in many other countries, Jews were vastly overrepresented in 1930s German high finance (Mosse 1987). Nazi propaganda consistently blamed the Jewish population for Germany’s economic ills – one infamous cartoon in Der Stürmer, a Nazi weekly, showed a gigantic, obese Jewish banker hanging a starving German businessman (Figure 5). Goebbels, later Minister for Propaganda, instructed party propagandists to emphasise that the banking crisis validated the party’s anti-Semitic line.

Figure 5 1931 Nazi cartoon showing a Jewish banker hanging the German businessman

In line with anti-Jewish sentiment being a key factor behind electoral gains, effects of DD exposure on Nazi voting were greatest in towns with an earlier history of anti-Semitism (as proxied by medieval pogroms, or by voting for anti-Semitic parties 1890-1914). In those cities, income declines induced by Danatbank’s collapse led to an even stronger increase in NSDAP support than income itself. In addition, the banking crisis’ direct effect – over and above economic fundamentals – on Nazi voting was also markedly greater. In cities without a prior history of anti-Semitism, the non-economic mechanism played no role. In other words, where hatred of Jews had no deep historical roots, there was no effect of the banking collapse on Nazi voting except through direct economic effects. This conclusion is reinforced when we distinguish between Dresdner- and Danat-connected firms. Economic effects of association with Dresdner Bank or Danatbank are large, negative, and statistically indistinguishable. However, for Nazi support, the effect of Dresdner Bank alone is statistically and economically zero. Only cities where Jewish-led Danatbank was important show significant evidence of voting for the Nazis.

Did relations between Jews and non-Jews actually worsen differentially in towns and cities affected by the Danat collapse? To find out, we collect monthly data on Jewish mixed marriages, an indicator of the quality of inter-ethnic relations. We find that they declined more sharply right after the banking crisis in cities where firms were heavily exposed to failing banks. The financial crisis also had serious after-effects. Anti-Semitism heightened by the banking crisis led to more vociferous forms of hate even after 1933. Cities more exposed to the collapsing banks witnessed higher deportation rates of Jewish citizens to concentration camps, and more attacks on synagogues, Jews, and their property during the 1938 pogroms (“Reichskristallnacht”).

The Weimar Republic – Germany’s first experiment with democracy – did not only fail because an ageing and increasingly senile President signed over power to Adolf Hitler (Evans 2004). To be able to make a credible bid for power, millions and millions of voters had to support the Nazi party’s agenda. While few scholars believe that the Nazis’ meteoric rise to power would have been possible without the Great Depression, strong links between economics and radical voting during Germany’s slump has so far proven elusive (Falter 1991, Evans 2004, King et al. 2008). Our research establishes such a link, showing how misery spelled radicalised voting.

A rich and growing literature has shown that financial crises have real economic effects. Firms connected to banks in trouble perform worse, and the more so if they need external financing (Ivashina and Scharfstein 2008, Campello et al. 2010). Local economies exposed to firm-specific financial shocks suffer economically (Huber 2018). What has been missing in the literature on ‘real effects’ of financial crises is a clear link between financial shock and political catastrophe. Our new study documents such a link for one key historical episode – a financial shock increased support for a radical agenda that successfully blamed a minority for the general population's misery.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Geographies in DepthSee all

Sarah Rickwood, Sue Bailey and Daniel Mora-Brito

August 13, 2024

Mthuli Ncube

August 13, 2024

John Letzing

August 12, 2024

Mohamed Elshabik

August 9, 2024

Camilo Tellez-Merchan and Gisela Davico

August 7, 2024

Pamposh Raina

August 6, 2024