How to scale effective voluntary carbon markets in 6 steps

How to both curb corporate emissions and direct investment towards climate-friendly projects Image: Adina Voicu / Pixabay

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

How to Save the Planet

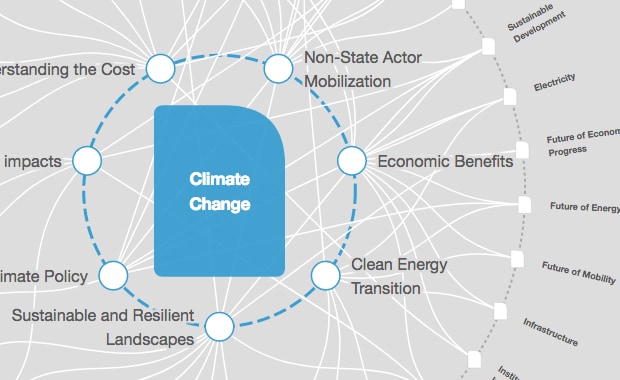

- Carbon markets are a critical tool in corporate emission reduction efforts.

- The voluntary carbon market needs to grow more than 15-fold by 2030 to support the investment required to deliver the 1.5°C pathway.

- The Taskforce for Scaling Voluntary Carbon Markets has released its blueprint for creating large-scale carbon credit trading markets.

- These 20 recommendations support the scale-up of voluntary carbon markets and ensure they are transparent, verifiable and robust.

‘The Paris Agreement Goals are within reach’. This was the positive news rounding out a difficult 2020, as governments' pledges to reduce emissions put the world on a 2.1˚C trajectory. But there is a long road between those pledges and the decisive action needed to manage climate change.

By 2030, the world needs to cut emissions by 50%. Such a transition requires substantial scaling of market and policy mechanisms that incentivise de-carbonization and emission reduction. Effective carbon markets are a vital component of this transition.

Carbon markets can play a big role in curbing emissions

Carbon markets facilitate the trading of carbon credits, usually denominated in USD per tonnes of CO2. They help organizations meet their net-zero commitments while helping to fund projects that can reduce, avoid or remove carbon emissions from the atmosphere. While reducing emissions should be the first priority, companies' use of carbon credits as part of a net-zero transition plan allows action to start now.

As the world pushes for rapid decarbonization, demand for voluntary carbon credits will expand. Voluntary net-zero pledges from corporates doubled within the course of the 12 months to September 2020. It is estimated that voluntary carbon markets need to grow by more than 15-fold by 2030 in order to support the investment required to deliver the 1.5°C pathway.

While carbon markets have come under scrutiny for potential ‘green-washing’, the purchase of high-quality carbon credits is being employed as part of a credible pathway for companies to reach net zero – through annual emissions reductions and compensation of unavoidable emissions as they transition to science-based solutions. To ensure carbon credits are high quality they will have to be VALID – Verifiable, Additional to what would have happened anyway, free from Leakage of emissions elsewhere, Irreversible and are not Double-counted.

Renewables, nature-based solutions and energy-efficiency projects are all critical tools in reducing greenhouse gases and reaching net-zero emissions. But these alone will not be enough to support the global transition away from fossil fuels. We need to boost emerging technologies that can transform our economy – such as low-carbon fuels for heavy transport, low-carbon steel and cement, and better carbon-removal technologies.

Voluntary carbon markets can support new programmes to finance, structure and deploy these critical solutions, so that in the future we can continue economic development in countries across the world, including those that are rapidly industrializing today.

What is the World Economic Forum doing to help companies reduce carbon emissions?

How to scale voluntary carbon markets

The Taskforce on Scaling Voluntary Carbon Markets has devised a blueprint for creating large-scale transparent carbon credit trading markets. Initiated by the UN Special Envoy for Climate Action and Finance, Mark Carney, we have released 20 recommendations for scaling up voluntary carbon markets while ensuring they are transparent, verifiable and robust.

These recommendations (shown below) are mapped under the following high-level vision for voluntary carbon markets:

1. Establish a set of “Core Carbon Principles” (CCPs) and a taxonomy of additional attributes to ensure high integrity and market liquidity.

2. Establish core carbon reference contracts that can be traded on exchanges to concentrate liquidity and unlock its associated benefits.

3. Build strong market infrastructure to ensure resilient, flexible markets that can handle large-scale trade volumes and can do so transparently.

4. Build legitimacy in using carbon credits by aligning on a shared vision for, and understanding of, the role of carbon credits in supporting the achievement of net-zero goals.

5. Improve the integrity of voluntary carbon markets through stronger processes, guidelines and frameworks.

6. Support a clear demand signal to drive the development of liquid markets and scaled-up supply.

Next steps for voluntary carbon markets

There are a range of initiatives working towards scaling carbon markets, both in the voluntary and compliance spaces. We have now launched our final report and continue to work to define the Core Carbon Principles and their governance and legal underpinnings with a view to launching pilots later in 2021.

The commitment to net zero by 2050 has renewed corporate interest in the voluntary carbon market as a tool to support flexible pathways for decarbonization. If managed well, this has huge potential to channel significant funding into additional mitigation, including emission-reducing technologies and nature-based solutions. But there are concerns that without clear and coherent guidance on how engagement in the voluntary carbon market relates to corporate net-zero transitions, the market could undermine the goals of the Paris Agreement and the credibility of those participating in it.

We must get this right urgently. With increasing interest from corporates, and efforts to scale the voluntary carbon market underway, clarity over how it can contribute to the goals of the Paris Agreement is needed quickly to maintain trust and credibility in the market. COP26 provides a milestone for launching robust guidance on the use and claims of carbon credits to ensure that voluntary crediting contributes towards the Paris Agreement temperature goals.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Forum InstitutionalSee all

Kate Whiting

April 26, 2024

Spencer Feingold and Gayle Markovitz

April 19, 2024

Kate Whiting

April 17, 2024

Andrea Willige

March 27, 2024

Shyam Bishen

March 20, 2024