How biodiversity loss could cause bankruptcy in some countries

Biodiversity loss has the potential to impact economics, according to a new report. Image: Unsplash/Towfiqu barbhuiya

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Biodiversity Finance

Listen to the article

- Economists at the University of Cambridge have developed what they say are the world’s first biodiversity-adjusted sovereign credit ratings.

- Their research finds that many countries are at risk of effectively going bankrupt if their credit ratings deteriorate due to ecological factors like biodiversity loss.

- Sovereign credit ratings usually only weigh up geopolitical risk, but their findings suggest this will soon change because of the rapid deterioration of ecosystems.

The growing threat to the biodiversity of the planet, upon which life on earth depends, is well documented. It is declining faster than at any other time in recorded history, and this has serious implications for human health and prosperity.

Around a million animal and plant species are facing extinction according to the UN. It says human activity has altered almost two-thirds of the earth’s surface area. This is putting enormous pressure on nature and increasing the risk of zoonotic diseases such as COVID-19, as humans come into greater contact with wildlife.

Research by the Royal Society Scientific Journal also indicates that climate change is expected to become one of the largest drivers of biodiversity loss by the second half of this century. Rising temperatures and changing rainfall patterns could match or even surpass the effects of deforestation and agriculture.

However, biodiversity loss has the potential to impact economics, according to a new report from the University of Cambridge. A team of economists has drawn up what it says is the world’s first biodiversity-adjusted sovereign credit ratings. These show how ecological destruction can prompt credit rating downgrades and make borrowing costs spiral. The report says degradation of nature-provided “ecosystem services” - such as bees pollinating crops and plants that regenerate soil and prevent flooding - can create huge economic costs.

A new era for the sovereign credit rating system?

A sovereign rating is an independent assessment of a country’s or sovereign entity’s creditworthiness. It enables investors to check the level of risk associated with investing in debt (government bonds) of the nation in question.

While the agencies behind these ratings are prepared to assess risks such as potential geo-political events, they are less focused on the financial fallout from environmental degradation, according to the authors of the new report. They argue that to manage risk effectively and maintain market stability, biodiversity loss must be factored into calculations.

“As nature-loss reduces economic performance, it will become harder for countries to service their debt, straining government budgets and forcing them to raise taxes, cut spending, or increase inflation. This will have grim consequences for ordinary people” says lead author Dr. Matthew Agarwala, from Cambridge University’s Bennett Institute for Public Policy.

How does the World Economic Forum encourage biological diversity?

Many countries could face a credit crunch amidst biodiversity loss

The report builds on a study published by the World Bank last year, looking at the credit ratings of 26 nations across different scenarios: “a halt to biodiversity loss”, as well as what it calls a “business as usual” scenario, where ecosystems degrade at current rates. This includes the global loss of 46 million hectares of wilderness by 2030.

The researchers also studied a “tipping point” scenario, where ecosystems suffer a partial collapse. This was measured by a 90% reduction across marine fishing, wild pollination and supplies of timber from tropical regions.

“If parts of the world see a ‘partial ecosystems collapse’ of fisheries, tropical timber production and wild pollination... then more than half of the 26 nations studied would face downgrades.

Across the 26 countries these downgrades would increase the annual interest payment on debt by up to $53 billion a year, leaving many developing nations at significant risk of sovereign debt default – in effect, bankruptcy”, the researchers say.

Almost half of the 26 countries studied would increase their risk of bankruptcy by more than 10% under the scenario.

Saving nature could save money

The researchers say that by better protecting their natural assets, countries could see their creditworthiness improve. “Biodiversity-related risks are a material risk to economic activity and public finances. Protecting the natural habitat is not just important for nature’s sake but also crucial for safeguarding macroeconomic stability,” says Co-author Professor Ulrich Volz.

The research team says it was the first to produce “climate-smart” sovereign credit ratings, which predict climate change-related downgrades as soon as 2030. They conclude that due to the potential size of the growing economic risks, the inclusion of biodiversity into ratings is inevitable.

The World Economic Forum’s Nature Action Agenda aims to promote systematic solutions and transitions that will create a ‘nature-positive’ economy through public-private collaboration. Partners such as Unilever, Walmart and Gucci have already made ambitious commitments to address biodiversity loss in their business activities.

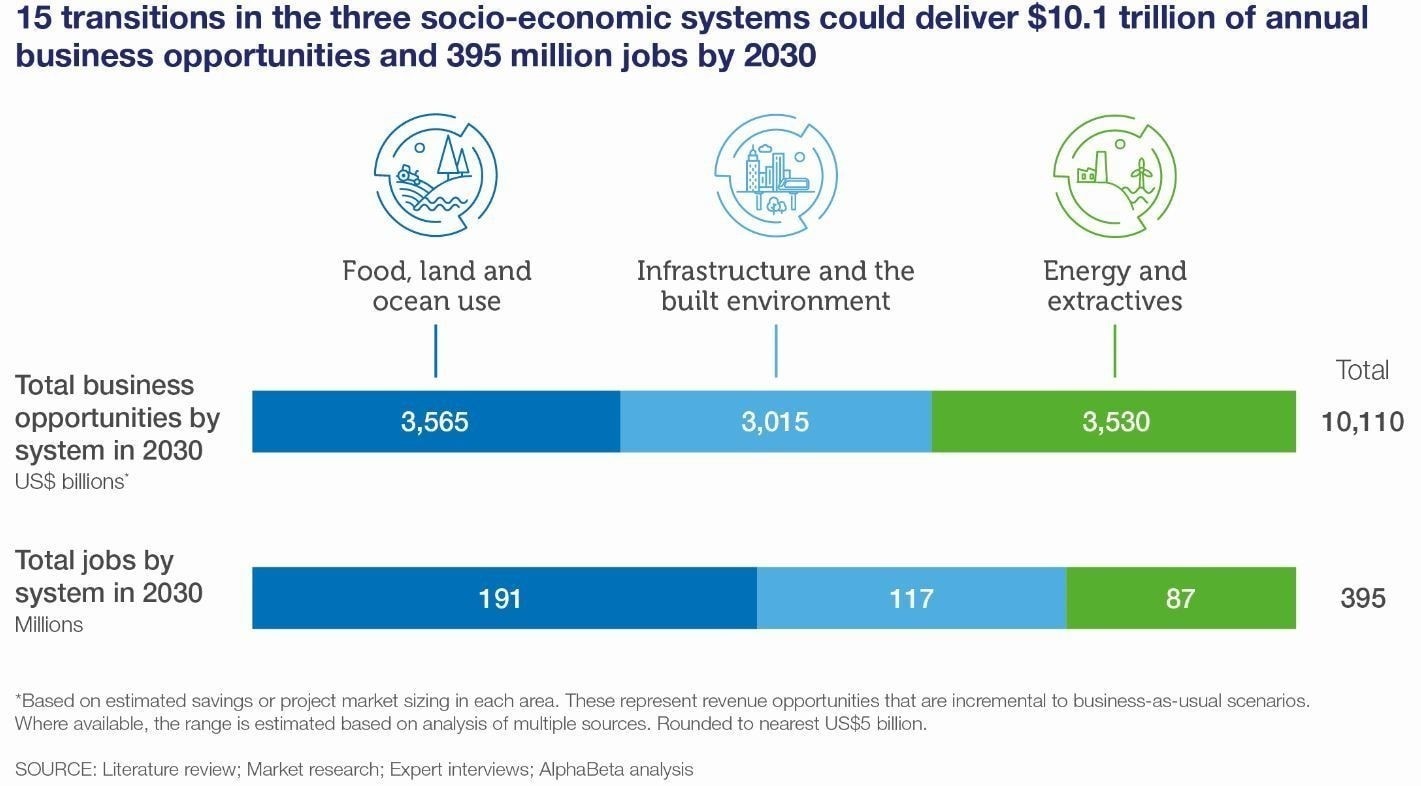

The business value of protecting the natural environment better is clear. The Forum’s The Future of Nature Business 2020 report has estimated that transitioning towards nature-positive economic models in key sectors could generate almost 400 million jobs and more than $10 trillion in annual business value by 2030.

What is the World Economic Forum doing about nature?

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Nature and BiodiversitySee all

Dan Lambe

April 24, 2024

Roman Vakulchuk

April 24, 2024

Charlotte Kaiser

April 23, 2024

Jennifer Holmgren

April 23, 2024

Agustin Rosello, Anali Bustos, Fernando Morales de Rueda, Jennifer Hong and Paula Sarigumba

April 23, 2024

Carlos Correa

April 22, 2024