Why investment in clean cooking is falling short

Around 2 billion people could still be without clean cooking options in 2030. Image: REUTERS/Andrew Biraj

Paul Lant

Professor, School of Chemical Engineering and Co-Founder, Energy & Poverty Research Group, The University of QueenslandListen to the article

- The global community has committed to ensuring everyone has access to clean cooking options by 2030, but the financial investment needed to make that happen has fallen short.

- Estimates as to the amount needed to meet the commitment range from $8 billion to $158 billion a year.

- In 2020, investment in clean cooking companies stood at just $61 million.

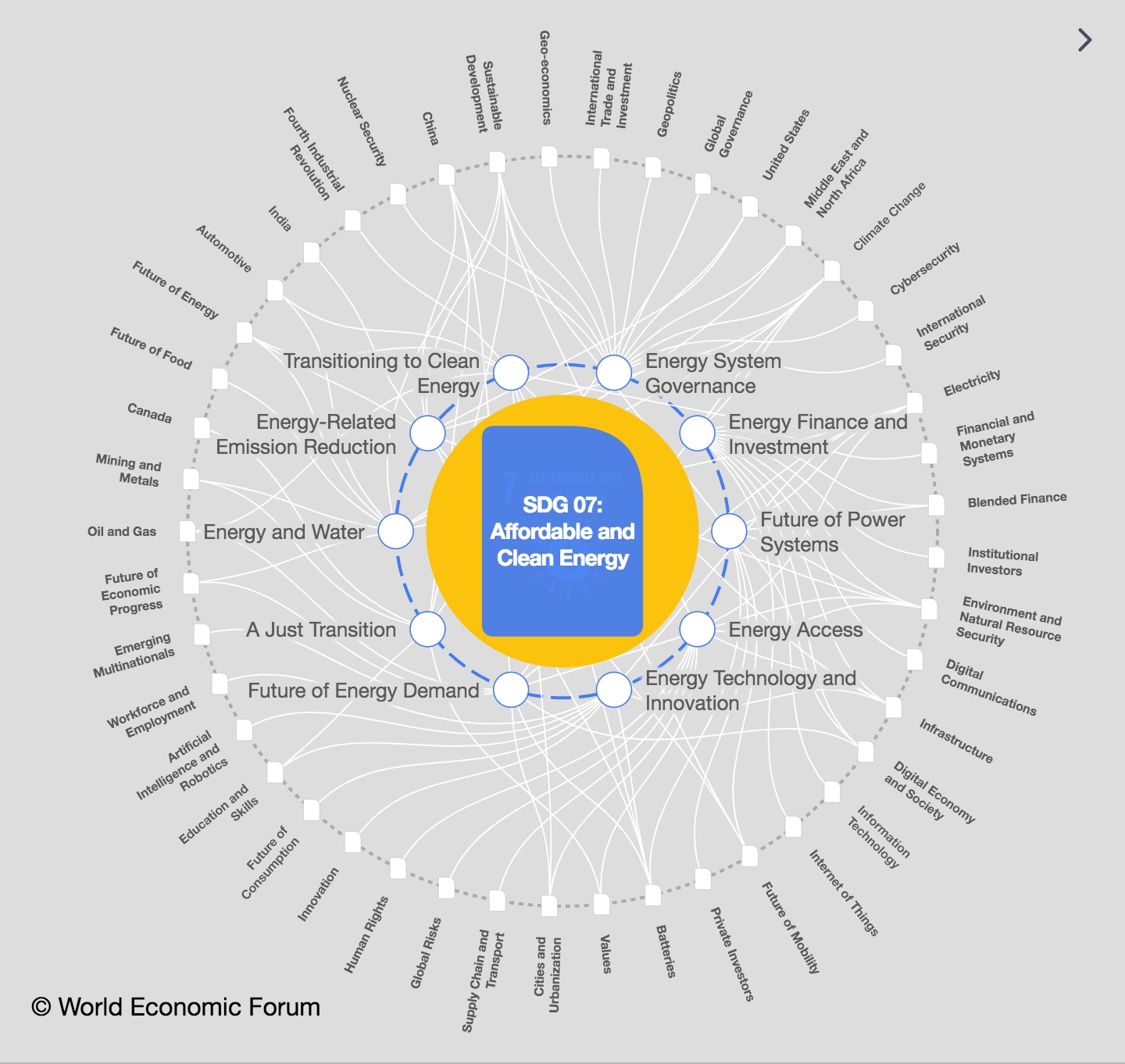

In 2021, 2.3 billion people relied on traditional biomass, animal dung, coal or kerosene as their primary cooking fuel. In a business-as-usual scenario, around 2 billion people will remain without clean cooking options in 2030, meaning the global community will fall short of its commitment, captured in Sustainable Development Goal 7, to provide access to affordable, reliable, sustainable and modern energy for all.

The impact of this lack of access is conservatively costed at $2.4 trillion per annum through to 2030, comprised principally of negative health, gender and climate externalities. By contrast, the potential co-benefits of increased access span multiple SDGs.

While of itself insufficient, significant investment is needed to address cooking poverty globally. Estimates range from annual investment of $8 billion to achieve SDG7’s clean cooking targets, to as high as $158 billion a year to support a full transition to modern energy cooking services by 2030. The scale of the challenge means that large volumes of public and private finance are required.

Investment shortfalls

And yet, actual finance flows fall conspicuously short of these projections. For example, in 2020, investment in clean cooking companies stood at just $61 million. In 20 countries across Sub-Saharan Africa and Asia, which together are home to more than 80% of people without access, finance commitments for clean cooking, from public and private, international and local sources, averaged approximately $130 million per annum between 2015 and 2019. Exacerbating the shortfall, much planned funding faces structural barriers to its deployment. Between 2002 and 2018, approximately half of the energy projects in these 20 countries that had funding committed were delayed.

While investment in clean cooking companies increased at a compound annual growth rate of 20% from 2014 to 2020, at that rate it would be 2036 before investment in the sector exceeds $1 billion.

The sector is characterized by few investors, a limited number of companies that have not achieved significant traction, and few successful investment exits. Very few businesses have reached sales volumes that enable economies of scale, and corporate funding is highly concentrated. Of the estimated 450-500 fully dedicated manufacturers and distributors in the cookstove operations chain globally in 2020, around 10% were responsible for over 40% of stove sales. The same year, six companies accounted for 82% of revenue, while seven late-growth stage companies raised more than 90% of total investment. Financiers consider only 10-20 companies investible and scalable.

A high-risk capital gap

The data reveal a large shortfall of finance for clean cooking companies in the initial stages of the business innovation cycle. A relatively high number of investment opportunities exist at this stage, where risks associated with new ventures are highest and funders that seek a return are reluctant to invest. In 2019-2020 combined, almost nine out of every ten dollars going into clean cooking companies sought some return on investment. Most financiers are interested in enterprises in their early or late growth stages, followed by mature and then seed companies. Risk aversion has driven investors towards familiar investees rather than high-potential new ventures.

These dynamics create a high-risk capital gap that has not been filled with funding for technology development, business model improvement and proof of concept. Accelerating energy innovation through these activities hinges critically on public investment and institutions for research, development and demonstration (RD&D). However, there is a dearth of public RD&D funding for clean cooking, underscored by the diminishing role of grants in funding enterprises. Combined with evidence suggesting the sector’s traditional reliance on grant funds does not reduce the risk of debt or equity financing for private financiers, this speaks to a failure of early-stage funding to target key risks to business and sector growth.

Lessons from PV technology

Contrast this with the impact of decades-long public funding for solar photovoltaic (PV) technology development on PV deployment. The cost of PV modules has declined 99% since 1980. RD&D and improvements in cell efficiency are the major contributing factors, accounting for almost a quarter of the decline between 1980 and 2012. The cost of electricity from utility-scale PV fell 85% percent in the decade to 2020 and it is now the lowest cost source of electricity generation in history.

If fledgling clean cooking companies do not secure finance to develop their business models to viability, they will not contribute to a pipeline of potential investees. These are precisely the issues cited by financiers as the greatest barriers to scale. Public funders play a critical role in supporting the RD&D and innovation necessary to nurture promising ideas through to bankability.

They are also uniquely placed to promote financing solutions that foster self-sustaining private finance markets, especially through well-structured blended finance. This is in the broader context of calls to reform the delivery of development finance to bolster poor countries’ climate resilience and support their low-carbon development.

Catalysing private investment

Understanding the intersection of innovation, investment and company growth enables investors to see the investible clean cooking landscape “whole” and pinpoint funding gaps. This can help promote singularity of purpose among the funder group and, ideally, greater risk tolerance and agility on the part of public funders.

Combined with improved data capture and knowledge sharing to better enable funders to define markets, develop investment strategies, conduct due diligence and close investments, such an understanding could help mitigate financing risks and assist policy-makers to target their climate finance for greatest impact, especially to catalyse much needed private investment in clean cooking.

Read the full article here.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

SDG 07: Affordable and Clean Energy

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.