These are the key investment opportunities in Africa's energy sector

Africa's energy sector needs are growing rapidly, but the continent has the potential to be a leader in green energy production. Image: Pexels/Mark Stebnicki

Hauke Engel

Partner , McKinsey & CompanyFrançois Jurd de Girancourt

Partner, McKinsey & CompanyOliver Onyekweli

Partner, McKinsey & Company

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

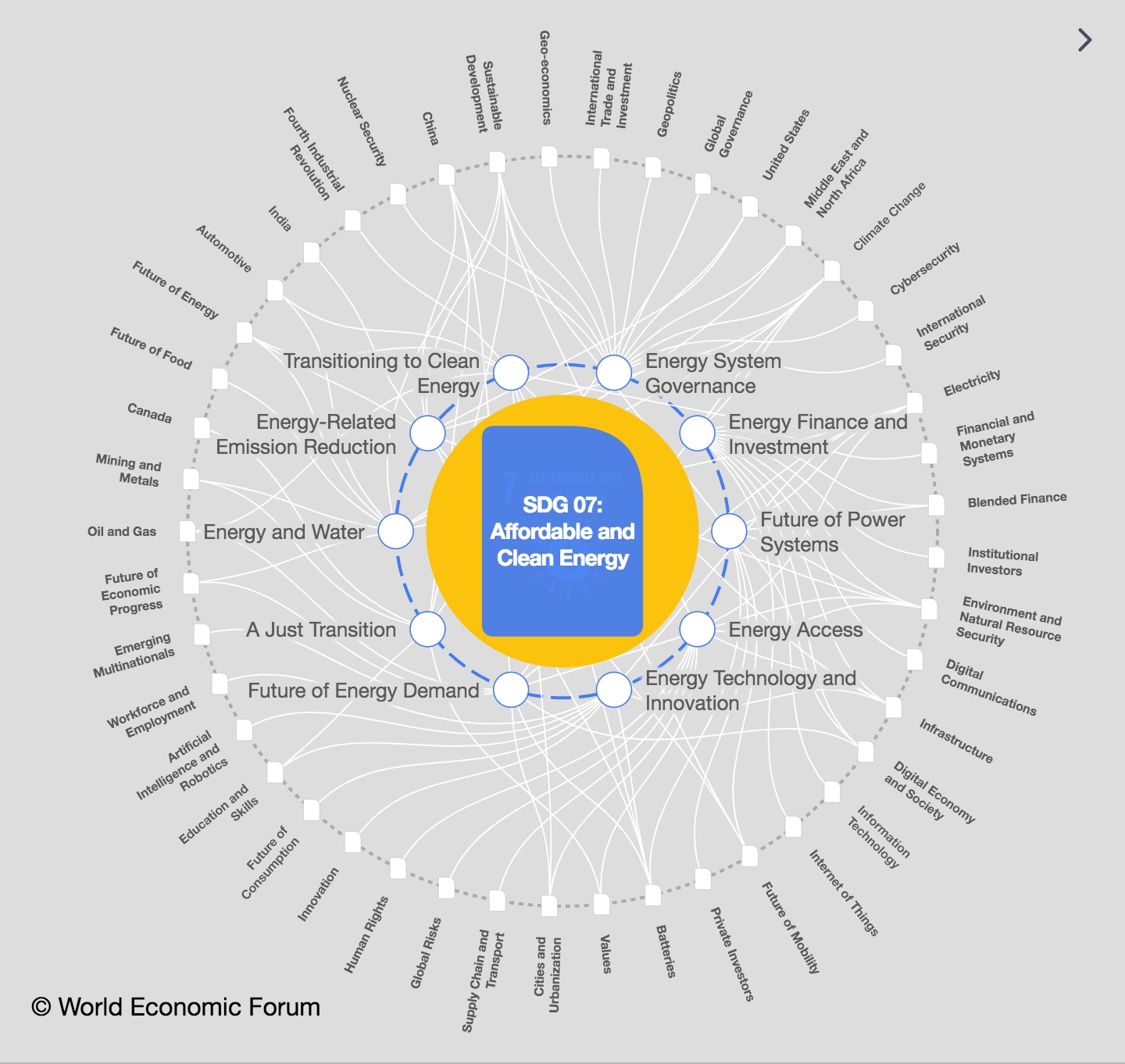

SDG 07: Affordable and Clean Energy

- It is important to consider social and environmental factors when making investment decisions.

- Africa's green energy transition will require significant investment, but it could create millions of jobs and boost economic growth.

- The transition will also help to reduce Africa's carbon footprint and mitigate the effects of climate change.

- Africa's green energy transition is an opportunity to create a more sustainable and prosperous future for the continent.

Africa has the fastest-growing population in the world, and it is set to double by 2050 to reach more than two billion people. Meeting their needs with cost-efficient, sustainable energy sources will be vital to the continent’s socioeconomic development as well as to achieving the goals of the Paris Agreement.

In walking the line between ensuring local growth and addressing the urgent challenge of climate change, the continent has an opportunity to capitalize on its rich renewable-energy resources—notably its wealth of wind, sunshine, and water. A “just transition” of this nature also opens significant prospects for investors.

This article shares our perspective on the scale of the energy capital expenditure opportunity in Africa and the nature and geographic location of the required investments.

How is the World Economic Forum facilitating the transition to clean energy?

Electrification is critical to meet Africa’s energy needs

McKinsey has identified five potential scenarios for the global energy transition, which center around the pace of technological progress and the level of policy support. This article is premised on the Achieved Commitments scenario, which means the capital expenditure path described solves for both meeting the energy needs of the continent and achieving global greenhouse-gas-reduction targets. It is important to note that the Achieved Commitments scenario rests on two critical assumptions: that technological advancement will continue at a rapid pace and that enforceable policy measures that support the transition will be implemented.

Africa’s energy needs could double by 2050 as its population grows over the next three decades. Around 600 million Africans currently lack access to electricity (about half the total population), which is expected to rise to 1.2 billion by 2050. Similarly, while 920 million Africans lack access to clean cooking, this could double to around 1.8 billion people in 30 years. Industrialization will also drive Africa’s energy demand, with the continent’s manufacturing output projected to grow by more than 6 % annually until at least 2025.

The good news is that this growth in energy needs does not translate into a “one to one” growth in energy consumption: consumers can switch to more efficient technologies, that is, products that achieve the same outcome with less energy. For example, in mobility, industrial production, or cooking/heating, electrification can significantly lower energy demand.

Suppose Africa shifts to more efficient and cleaner technologies over the next three decades. In that case, the increase in final energy consumption—the total energy consumed by end-users in homes, industry, and agriculture—can be limited to a 50% increase by 2050. In this scenario, electricity consumption is required to grow by six times between 2019 and 2050 (Exhibit 1).

Changing the mix in Africa’s energy production

To enable the electrification of Africa and reduce the carbon intensity of the energy supply, a change in the mix in energy production capacity is required.

Renewables will become more important in electricity generation, but only progressively: ramping up in 2030 to reach 65% of installed capacity by 2035 and around 95% by 2050 (Exhibit 2). As for renewables, solar and wind will grow much faster than hydropower, with around 70% of installed capacity coming from solar, 20% from wind, and 10% from hydro by 2050.

Gas will likely play an important supporting role over the short to medium term by providing flexible capacity as renewables scale up and battery storage becomes more cost-effective. Demand for gas supply and infrastructure is, therefore, likely to continue to rise in the short term, with African gas demand projected to increase by 3% annually until 2030 and gradually decrease thereafter.

Global gas demand is also expected to increase between now and 2030, and investment in African gas can be expected to help meet this demand. For example, North African countries with relevant capabilities can export gas through pipelines to Europe, and liquefied natural gas (LNG) projects currently being developed, such as the Likong’o-Mchinga LNG project in Tanzania and the Nigeria LNG Train 7 project, can contribute to exports.

Global gas demand is also expected to increase between now and 2030, and investment in African gas can be expected to help meet this demand.

”There are also opportunities in green hydrogen. Produced by using renewably generated electricity to split water molecules into hydrogen and oxygen, green hydrogen is expected to play a key role in the global push to net zero, particularly in decarbonizing hard-to-abate sectors. Richly endowed with wind and solar resources, African countries in the north and southwest of the continent could be highly competitive in supplying green hydrogen for local and global consumption.

In an Achieved Commitments scenario, global hydrogen demand could grow sevenfold by 2050 as hydrogen production costs fall and renewable capacity increases. Furthermore, since the global supply and demand for hydrogen are mismatched, Africa has a significant opportunity to export green hydrogen. The establishment of the Africa Green Hydrogen Alliance in 2022, which seeks to foster collaboration between hydrogen-producing countries, could be a boon for African hydrogen. By 2050, the continent could self-supply its full domestic demand potential of between 10 and 18 megatons of hydrogen, while African hydrogen exports could reach around 40 megatons by 2050.7

McKinsey modelling shows that if the continent’s energy mix evolves in this way, Africa’s energy carbon intensity could decrease substantially. By 2050, energy emission intensity could fall by 45%, driven by the evolution of solar, wind, and green-hydrogen power sources.

Investing in the Africa energy transition

To enable these dramatic shifts, around $2.9 trillion of cumulative capital expenditure would be required between 2022 and 2050, most of which would need to be dedicated to green-energy sources. This would require a significant step up in investment in African renewables and the development of renewable-energy infrastructure (Exhibit 3).

In 2022, annual investments in energy amounted to $70 billion, 58% of which were derived from oil and gas activities and much of the rest from investment in renewables. By 2050, the annual investment required is expected to more than double, reaching $160 billion, and the focus of investments will likely shift, with 43% of capital expenditure spent on hydrogen, 38% on renewables, and 17% on power transmission, distribution, and mini-grids.

Although growth in renewables and green hydrogen is only expected to ramp up from 2030, financial institutions have an opportunity to move early. To earn a seat at the table in the long term and to enable the development of the necessary competencies, financial institutions could consider investing in the African green-energy transition as early as possible. Indeed, some investors are already moving in, and funding is beginning to spur significant green-energy projects on the continent.

For example, at COP27 in November 2022, South Africa launched its Just Energy Transition Investment Plan, announcing a five-year investment strategy for a financial package of $8.5 billion, pledged by the European Union, the United Kingdom, and the United States as part of the Just Energy Transition Partnership between the countries. The project focuses on three priority areas: the electricity sector, new energy vehicles, and green hydrogen. Thanks to the country’s abundant renewable-energy sources, as well as its existing infrastructure—currently used mostly to transport fossil fuels, but which could be repurposed for green-hydrogen exports—green hydrogen could leapfrog grey hydrogen as the most cost-effective form of energy, enabling South Africa to become a major player in the global green-hydrogen market.

Opportunities for investment are also to be found in the development of midstream infrastructure for electricity. Electricity transmission and distribution would require a cumulative investment of around $400 billion by 2050 to increase power generation and electrification, with the largest opportunities concentrated in Egypt, Morocco, Nigeria, and Senegal. By 2030, these countries are expected to increase their transmission and distribution networks by 120,000 kilometers collectively, with some key projects already under construction.

Opportunities for investment are also to be found in the development of midstream infrastructure for electricity.

”For example, in 2022, a new venture was announced that will see the construction of an electricity interconnection between Egypt and Saudi Arabia, representing 1,350 kilometers (400 kilovolts of capacity) of high-voltage line. This is the first large-scale high-voltage direct-current interconnection link between the Middle East and North Africa. Linking the power grids of the two countries will likely support grid resilience and, as electricity is increasingly generated from renewable sources, could also support the countries’ future decarbonization.

Similarly, Vinci Energies, a French construction company, recently signed a three-year $324 million contract to construct electricity transmission and distribution infrastructure in Morocco. The project will involve the construction and maintenance of 500 kilometers of high-voltage power lines and more than 1,000 kilometers of low- and medium-voltage distribution networks, as well as the construction of 11 high-voltage transformer stations. Meanwhile, in Senegal, Omexom, a subsidiary of Vinci Energies, is constructing a 200 kilometer transmission line and 100 distribution substations worth around $230 million as part of the country’s energy plan that includes strengthening and expanding the national grid.

Midstream infrastructure opportunities also exist in the natural gas industry to ensure gas is gathered, transported, stored, and distributed where it is needed. While many West African countries have abundant supplies of natural gas, the pipeline infrastructure beyond Nigeria remains underdeveloped. However, this is also changing. In 2022, Barak Fund Management and TriLinc Global Impact Fund partnered to provide $425 million to Genser Energy Ghana for a variety of gas expansion projects, including the development of a gas conditioning plant, an LNG storage terminal, and the construction of a 100 kilometer natural gas pipeline to Ghana’s second-largest city, Kumasi.

Where to find these energy capital expenditure opportunities

New green investment to develop different energy segments will likely be distributed across the continent, depending primarily on the availability of local natural resources (Exhibit 4).

In 2022, Algeria, Egypt, Mozambique, and Nigeria together produced more than 80% of Africa’s upstream gas, and the continent is also home to several LNG liquefaction facilities, including in Algeria, Angola, Egypt, and Nigeria, with new projects announced in Equatorial Guinea, Mozambique, and South Africa.

Conventional power, like coal, is mostly found in Morocco and South Africa, and coal-fired power plants are expected to be largely decommissioned in the next ten years in an Achieved Commitments scenario. In South Africa, these could potentially be replaced by growth in natural gas capacity. Other countries with natural gas power plants, however, are expected to decrease capacity in the long term, and Egypt, Libya, South Africa, and Sudan are expected to decrease capacity of small oil-powered power plants.

In the renewable-energy segment, while hydro still has plenty of growth runway, solar and wind are expected to represent the most significant growth potential. Hydro represents 45 gigawatts (GW) of capacity in Africa, mainly across sub-Saharan Africa, with installed capacity expected to quadruple by 2050. While solar and wind capacity are both small—with only 15 GW and 12 GW, respectively—both are projected to grow significantly by 2050: solar power by up to 100 times and wind power by up to 35 times.

Green hydrogen remains a nascent technology, but projects are being announced, and it represents a major opportunity in the long term in north and southwest African countries. French energy group Total Eren has already launched a $10.6 billion green-hydrogen and green-ammonia production plant in Morocco.15 The production of the megahybrid facility will be based on wind and solar technology, and with production set to start in 2027, the project could see Morocco rank among the most advanced African countries in the development and production of green hydrogen. Major hydrogen projects are also under way in Namibia and South Africa.

Selecting projects with both sustainability and economic growth in mind

Investors eyeing energy projects in Africa may find they need to navigate a complex landscape of political, economic, and social factors as well as their own environmental, social, and governance rules. To build credible capability in supporting the energy transition, financial institutions can consider defining a nuanced decision framework for evaluating opportunities in Africa’s energy sector.

To build credible capability in supporting the energy transition, financial institutions can consider defining a nuanced decision framework for evaluating opportunities in Africa’s energy sector.

”The first step could be to identify strict no-go areas that do not support the Achieved Commitments scenario and the global transition to green energy—for example, those investments involving fracking or coal.

The second step could involve developing a set of criteria adapted to the specific context of Africa to evaluate energy capital expenditure investments. These criteria should be targeted to meet energy needs and reduce energy production's carbon intensity. As shown in this article, moving from coal to gas, for example, reduces carbon intensity and might be a useful medium-term step to increase electrification; building electricity transmission and distribution infrastructure is critical to distribute wind, solar, and hydroenergy.

For all investments that do not fall into the 100% renewable category, a framework is required to evaluate whether they participate in a “just transition”: Does the company have a transition plan and an emission intensity journey? Will the energy produced be for the benefit of the local economy? Will bundled activities create greener energy opportunities in the longer term? As an example, Sasol in South Africa recently announced that it will progressively shift its feedstock away from coal toward gas, and then toward green hydrogen and sustainable carbon in the longer term.

Following this approach could enable investors to determine which opportunities to support and the best way to do so, whether through investment, credit, or insurance. Given the expected shifts in the African energy mix in the coming decades, short- to medium-term opportunities may include projects that support the development of natural gas production and electricity generation to enable the energy transition alongside renewables. In the longer term, support may be reserved only for renewables and green hydrogen to realize the goals of the Achieved Commitments scenario.

Many of these opportunities will have challenging investment cases, particularly for pioneering projects and pilots, but there is appetite from donors and development partners to help derisk some of these initiatives. Thus, an additional consideration for investors could be to explore partnerships to make the investment case more attractive.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Geographies in DepthSee all

Pooja Chhabria

April 29, 2024

Naoko Tochibayashi and Naoko Kutty

April 25, 2024

Andrea Willige

April 23, 2024

Libby George

April 19, 2024

Apurv Chhavi

April 18, 2024

Efrem Garlando

April 16, 2024