Securing critical minerals for energy transition requires collective action

The energy transition requires rapid acceleration of critical minerals supply. Image: Getty Images/Vetta.

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Mining and Metals

This article was originally published in November 2023 and has been updated.

- Minerals and rare earth elements are essential in the production of clean energy technologies.

- There is a supply and demand gap for the critical minerals necessary for the energy transition.

- The Securing Minerals for the Energy Transition initiative has identified the risks and implications of this gap and how to manage it.

The widespread and rapid increase in adoption of low-carbon technologies required for the energy transition will not be possible without a ramp-up of critical minerals supply at a pace never seen in history.

Minerals such as lithium, cobalt, copper, nickel, and rare earth metals are essential inputs in the production of electric vehicles (EVs), renewable energy, power grids, and other clean-energy technologies.

Recent UN data reveals rising resource extraction, which has soared by almost 400% since 1970, and is projected to increase by 60% by 2060, according to The Guardian.

The uptake of low-carbon technologies would need to skyrocket further to meet climate goals, especially given that clean energy solutions are often much more materials-intensive compared to their conventional counterparts during the construction phase.

Taking offshore wind as an example, this is six times more materials-intensive than a gas-based installation on a megawatt basis, McKinsey finds.

The widespread and rapid increase in the adoption of low-carbon technologies required for the energy transition will therefore not be possible without a ramp-up of critical minerals supply at a pace never seen in history.

For instance, if the world aims to achieve net-zero by 2050, around 60% of the cars sold globally in 2030 must be battery electric vehicles (BEVs). The International Energy Agency (IEA), as per its “Net Zero by 2050” scenario, estimates to achieve net-zero globally, it would require six times more mineral inputs already in 2040 than today.

Such rapidly escalating demand stands in stark contrast to the length of time it will likely take to expand supply under current circumstances. Not only can the permitting, exploration and asset development phase extend over one or two decades—prior to starting production—but not enough money is being invested today to meet future demand.

Though with policies such as the Inflation Reduction Act (IRA), there has been a change in the subsidy and investment landscape, with increased incentives for the inputs to produce energy transition technologies and thus reducing supply constraints for critical minerals.

Considering the mining project supply pipeline and the time it takes to bring these new projects to market, many of the required minerals are expected to reach a supply-demand imbalance by 2030, even in a high-supply scenario.

McKinsey estimates that, based on the current supply and technology outlook, an inability to close the supply-demand gap in critical minerals would lead to the release of an additional 400 to 600 MtCO₂e greenhouse gas emissions in 2030 alone. The result is a looming supply-demand gap that is already leading to a race for resources among many countries.

In the coming decades, it will be crucial to secure a reliable supply of critical minerals to power the energy transition. Energy systems—vital to our economies and lives—should be sustainable, secure, and equitable. Delivering on this “energy triangle” is a meaningful challenge in itself. Further, the race against the climate clock to accelerate energy transition to a pace aligned with a net-zero pathway adds significant urgency—and this needs to be accompanied by a sprint to secure the minerals needed for the switch.

What's the World Economic Forum doing about the transition to clean energy?

Addressing the critical minerals supply-demand gap

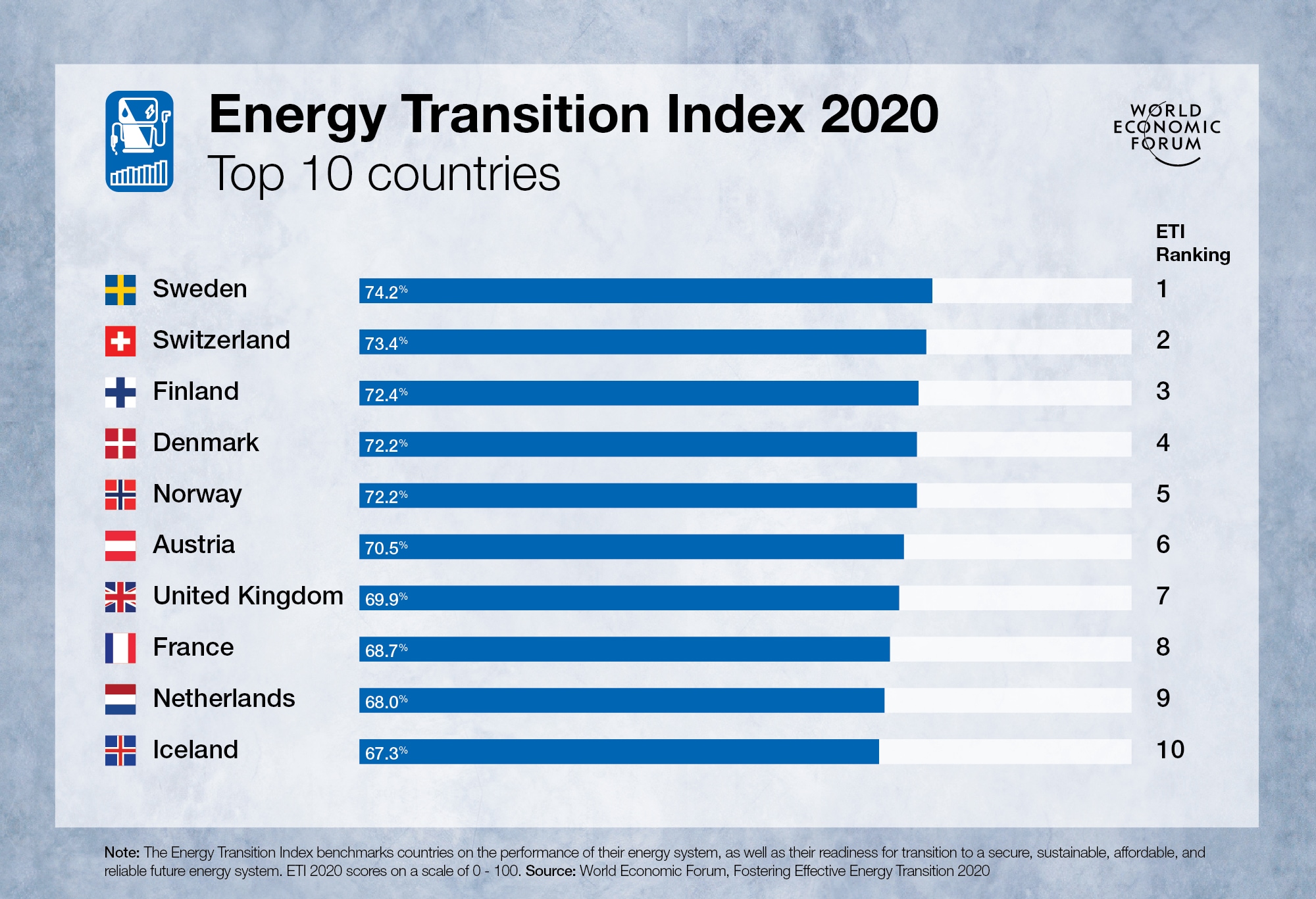

The supply-demand gap in critical minerals threatens energy security and sustainability and could create a variety of global risks. The Securing Minerals for the Energy Transition (SMET) initiative of the World Economic Forum, in collaboration with McKinsey, has identified the risks that may arise from an inability to close the supply-demand gap, as well as from efforts designed to close the gap (Figure 1).

These risks can be classified into five categories: political, economic, social, technological, and environmental. Moreover, they can be assessed on their likelihood of occurrence and their impact on primary and secondary stakeholders within the minerals’ ecosystem. Among the most important risks we have identified are:

- Rising new technology prices (economic risk). Raw-materials prices could increase substantially due to input shortages, ultimately driving up the price of the clean-energy technologies and solutions we all need.

- Delays to the energy transition and progress on addressing climate change (environmental risk). Energy-transition goals could be delayed due to lack of sufficient technologies to ensure the transition. Essentially, supply shortages leading to delayed energy transition could hamper efforts to meet the climate goals.

- Reduced responsible mining (social risk). Mining activity could become less responsible without a focus on attaining best-in-class environmental, social, and governance (ESG) standards if the required expansion does not happen in an orderly and timely way.

- Lack of political will for the energy transition and rising geopolitical tensions (political risk). If the transition becomes more costly because of materials shortages, policy-makers could lower their ambitions to support the transition in the face of obstacles. They could also intensify the race to control the value chains for critical minerals to create competitive advantage and ensure security of supply.

Now is the time for international stakeholders to build strategic collaborations to manage and mitigate such risks. The SMET initiative has identified priority strategies for the short and medium term that could help stakeholders avoid and reduce risks arising from the supply-demand imbalance in energy-transition minerals. And just like for energy, actions both to expand supply and to improve demand-side efficiency, along with policy and innovation will matter.

Key risk-management strategies identified by the SMET initiative focus on social buy-in, standardization and governance, financing, innovation, and circularity. Examples of important issues to address include, for instance:

- Addressing ESG standards, for example by harmonizing existing frameworks and developing a unified standard for the entire mining supply chain. This could help establish an “equal playing field” across territories. This could be done by first understanding gaps in existing frameworks and harmonizing them in such a way that they are easy to adopt and track across jurisdictions.

- Leveraging alternative financing instruments in challenging markets can be crucial in the regions where traditional financing may be limited. Instruments such as concessional and blended finance, impact investing, green bonds, or public-private partnerships, can help raise funds for mining projects in challenging markets, particularly those with more prevalent environmental and social risks.

- Decreasing the resource intensity of mining activities and increasing supply through innovative solutions and business models along the value chain. Stimulating innovation and identifying “lighthouse” examples that can be scaled (such as, extracting more from lower quality ores through leaching technologies), and providing market incentives for circularity models (e.g. urban mining) can help reduce supply constraints and alleviate the environmental pressure on ecosystems.

Many of these approaches to managing the risks can also significantly contribute to closing the minerals supply-demand gap. For example, leveraging alternative financing instruments in challenging markets could unlock and increase the supply of critical minerals. Likewise, decreasing the resource intensity of mining activities through circularity could decrease the demand for primary critical minerals from now to 2050.

Beyond risk management, more collective action and collaboration will be required to secure these critical minerals. This will require cooperation among multiple stakeholders, ranging from regulators, non-profits, and researchers to industry associations and financiers. There are already some examples of public-private collaborative initiatives that are making a positive difference. For instance:

- The World Bank’s Climate Smart Mining Initiative serves as a platform to provide technical assistance and support investments for resource-rich developing countries to achieve responsible, low-carbon sourcing.

- The Global Battery Alliance is an alliance supporting collaboration across the automotive value chain to achieve goals in relation to circularity, sustainability, and responsible sourcing.

Collaborative action is needed to accelerate energy transition

Despite such initiatives, there remains a need for a collaborative effort at a global level—to increase awareness, mobilize action, and bring together relevant stakeholders to make critical minerals available in a sustainable and affordable way. There is an urgent imperative to enhance public-private dialogues for collaborative action on essential topics such as supporting investment mobilization, accelerating innovation, building skills across the value chain, and evaluating gaps in current ESG standards. Connecting key actors to raise awareness around these themes will contribute to a more comprehensive understanding of the overall landscape and help to expedite meaningful action that accelerates the pace of the energy transition.

As the window to a 1.5°C world degree world is rapidly closing, fast-moving collaboration on critical minerals has become an urgent priority. Securing a sustainable and affordable supply of minerals for the energy transition requires meaningful action now.

This blog is part of a series, written by members of the Securing Minerals for the Energy Transition (SMET) initiative, led by the World Economic Forum. The initiative seeks to identify and characterize the risks related to the increasing gap between the demand and supply of critical minerals needed for the energy transition and to propose strategies for their collective management.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Energy TransitionSee all

Robin Pomeroy and Sophia Akram

April 26, 2024

Liam Coleman

April 25, 2024

Tarek Sultan

April 24, 2024

Jennifer Holmgren

April 23, 2024