Governments want to make green good for business locally, without stalling economic progress globally

Inaugurating a carbon capture project in Texas; a domestic clean tech investment drive in the US has spurred similar efforts around the world. Image: REUTERS/Arathy Somasekhar

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Climate Crisis

- The US Inflation Reduction Act has prompted related clean-energy initiatives elsewhere.

- These follow suit by zeroing in on domestic resources and production.

- But policies aiming for an extra push to hit climate goals at home risk hardening global economic divides.

Familiar with the US Inflation Reduction Act? If not, that’s okay, because neither are most people in the US. President Joe Biden may regret the confusing name attached to legislation meant to modernize the country’s economy in step with climate change, but he’s happy to offer it up for scrutiny. Seriously, he’d really like you to take a look.

That’s because the numbers suggest that, in some ways more than others, it’s working. Domestic investment in making clean energy technology increased by 153% last year. Electric car sales boomed. And the country has doubled its carbon emissions-reduction momentum.

The CEO of America’s biggest bank has heard of the IRA. His annual letter to shareholders has been described as a playbook for pugnacious neoliberalism, but this year it praised a programme many see as a harbinger of the end of the neoliberal era; the IRA is a “good” example of using government resources to fund industry, he wrote.

Companies around the world have also heard of it. Within a year after the legislation’s approval in late 2022, plans for 91 new battery manufacturing sites, 65 new or expanded electric car factories, and 84 new wind and solar plants were announced nationwide.

An electric battery company in Norway, Freyr, was so intrigued that it pulled off a painful about-face to focus on a new factory in a small American town in Georgia – a location near major highways that’s long made it a distribution hub for discount retailers, though it’s probably recognizable to most people as a backdrop for episodes of “The Walking Dead.”

Other governments are equally aware. The IRA has functioned a bit like a starting gun for like-minded efforts in Canada, the EU, Japan and Australia.

It’s not hard to see why naming the IRA, which is expected to provide $1.2 trillion in government incentives by the end of 2032 (tax credits galore), wasn’t a straightforward task. Everyone hates higher prices. It’s not clear that they’re as worked up about higher global temperatures. In the US, anyway.

In Canada, climate concern is a bit more widespread. Like other countries, it was also initially wary of the aggressively self-serving IRA, which requires part of what participating companies use and make to originate in the US. But it has since formulated its own response.

According to an IMF working paper, Canada has now added similar tax incentives on top of an existing carbon-pricing scheme, putting it on track to cut emissions by 29% and make 89% of its electricity green by 2030. And there are some direct synergies; the tight-knit US trade partner qualifies as a “domestic” source of critical minerals needed to build electric cars using IRA credits.

Europe’s initial take on the IRA: this is really going to hurt for a while, but future generations may thank us. A trans-Atlantic strategy shift like the Norwegian battery firm’s was exactly the kind of thing policy-makers there worried about.

EU members already had subsidies for renewables that by some measures outstrip what the IRA offers. Still, the bloc’s response to the US law has come in the form of added funding for everything from its own sustainable infrastructure to green steel startups.

The EU may not deploy tax credits like the IRA, but directionally it’s headed to a similar place – one with more homegrown (or close to it) green manufacturing, as opposed to buying from countries that aren't necessarily traditional geopolitical allies.

Yet, free trade is core to the EU’s identity. The place has been described as a neoliberal dream come true, after all.

What’s ‘neo’ about falling short on climate goals?

Expecting the EU to abruptly shed its neoliberal ethos might be a bit like anticipating a country album from Beyoncé. A jarring new direction that makes some people queasy, while a lot of others will be more than happy with the end result.

To be sure, defining exactly what neoliberalism is can be a bit difficult.

If the idea is that the freer markets are from political interference, the more prosperous everyone will be, then the neoliberal era arguably peaked somewhere after end of Cold War. Probably around the time China joined the World Trade Organization in 2001.

And if its time is now up, there may be many reasons to miss it. That’s because it’s received credit for helping millions of people in less-affluent places escape poverty and relative scarcity. Break the system, no matter how good your climate intentions, and these people may start falling further behind again.

The only thing experts can seem to agree on about the thing replacing neoliberalism is that it’s still struggling to be born. Ultimately, it may be just as nuanced. Never just business versus government, all Mao or Milton Friedman. Because in reality, some degree of partnership between the public and private sectors will always be necessary – especially when a crisis is brewing.

When it comes to the climate crisis now scorching sea life and sending global temperatures to new heights, critics might point out that relatively uninhibited trade doesn't seem to have translated into reassuring progress.

In Australia, just one of many recipients of an “insufficient” climate action rating, when an iron-ore giant now branching out into clean energy unveiled plans last year for a $35 million battery factory, it was in the US state of Michigan – in direct response to the IRA.

Last week, Australia announced its own version of the IRA. “Strategic competition is a fact of life,” the prime minister said.

Another fact of life: the prodigious output of China’s own, inwardly focused clean energy industry. Its surplus of subsidized solar panels and electric cars has played no small part in the creation of the IRA and corresponding efforts among US allies, forming a sort of alternative supply chain.

Earlier this week, the IMF warned about potentially grave, cost-of-living consequences of forming such politically aligned trade blocs.

But IRA proponents argue that dwelling too much on the need for global integration risks missing the bigger picture.

Being aggressively self-serving, at least in ways that spread climate benefits, might be what we need right now.

More reading on greening and government initiative

For more context, here are links to further reading from the World Economic Forum's Strategic Intelligence platform:

- It hasn’t all been smooth sailing from Norway to Georgia for that electric battery company. In this interview with its CEO, he describes how the IRA upended its business plan and abruptly shifted its focus to the US. (Inside Climate News)

- “The EU’s prosperity depends on worldwide trade.” If trade in green technology and other goods becomes significantly less worldwide due to geopolitical considerations, that could have serious repercussions, according to this analysis. (Carnegie Endowment for International Peace)

- This study found that the Industrial Revolution actually started in Britain about a century earlier than is generally believed. One of the main reasons? The country had relatively few trade restrictions. (Science Daily)

- A recently launched green-tech subsidies probe is evidence of the EU attempting to adjust to a “new world” focused on economic security, according to this piece. (The Diplomat)

- In January, Chinese electric car maker BYD outsold Tesla in Australia for the first time, according to this piece – a potential geopolitical wrinkle just as government incentives start to boost adoption. (Australian Institute of International Affairs)

- Your bourbon’s carbon footprint may be shrinking. Recent recipients of $6 billion in US government clean energy funding include a Kentucky distillery, according to this report. (GreenBiz)

- When government subsidies for clean energy and water scarcity collide – a company in Texas wants to supply a fuel alternative to oil and gas, according to this piece, but it has to tap into a dwindling local water supply to do it. (Inside Climate News)

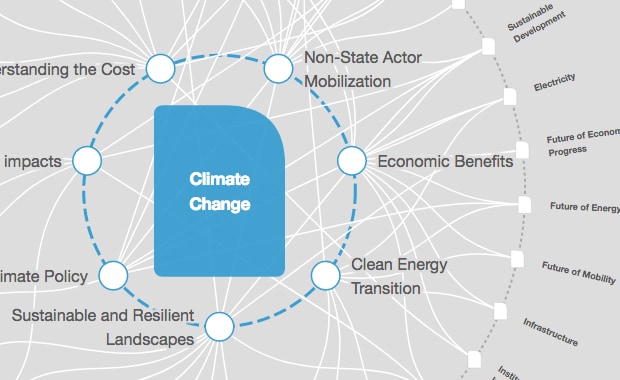

On the Strategic Intelligence platform, you can find feeds of expert analysis related to Trade, Governance, Climate Change and hundreds of additional topics. You’ll need to register to view.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Trade and InvestmentSee all

Spencer Feingold

May 13, 2024

Michael Eisenberg and Zlatan Plakalo

May 6, 2024

Nils Aldag and Christopher Frey

May 1, 2024

Maria Mexi and Mekhla Jha

April 30, 2024

Chido Munyati

April 28, 2024

Matthew Stephenson

April 23, 2024