Investing in plastic waste can reap rich rewards

Image: Photo by Nick Fewings on Unsplash

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

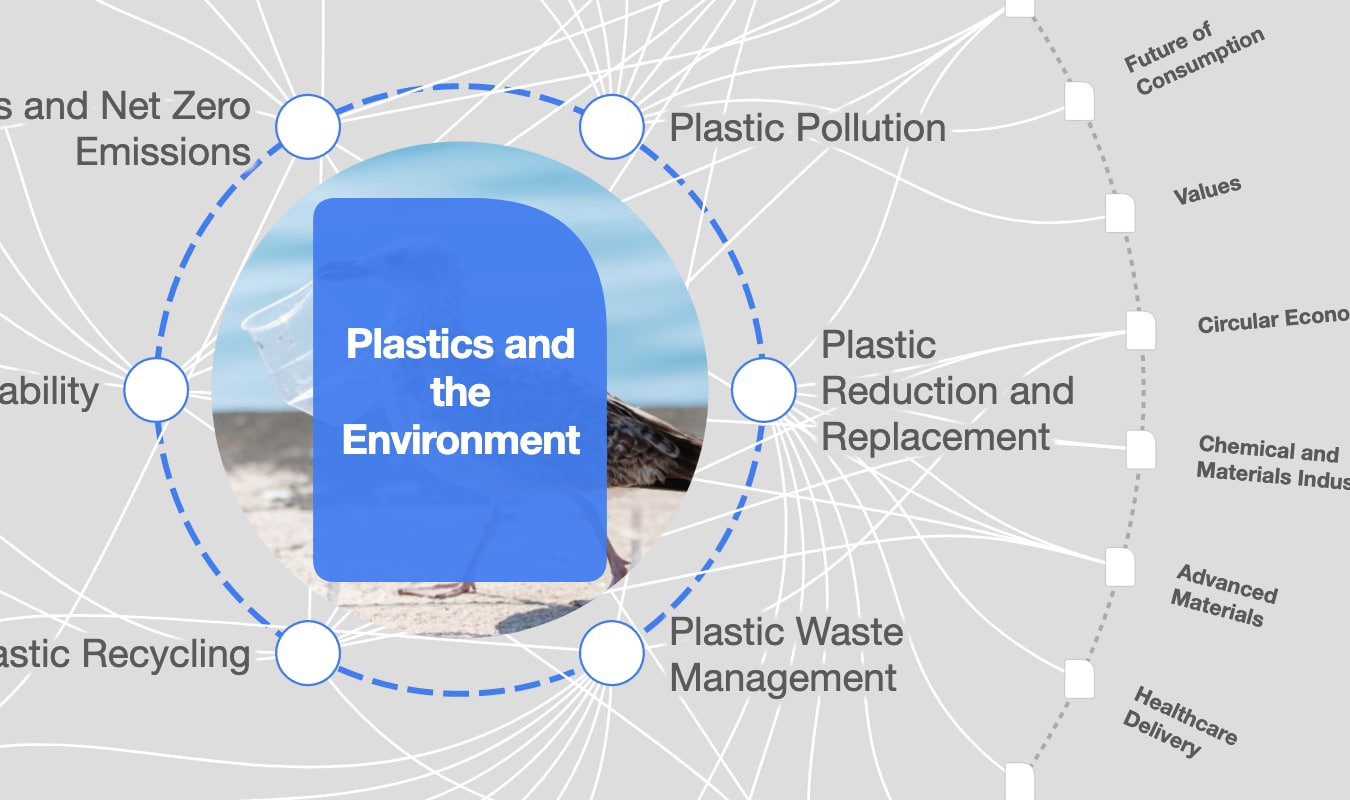

Plastics and the Environment

- Solving the plastic pollution issue will require systemic change.

- Financing these solutions will require a collective, public-private approach.

From the Mariana Trench to the summit of Mount Everest, plastic waste has become ubiquitous. Identifying a stretch of the planet that has not been impacted by the plastic pollution crisis is difficult, yet even more challenging to conceptualise is the magnitude of financing needed to solve the problem.

Globally, solving the plastic pollution issue will require systemic change. This includes a shift of funds from the production and consumption of virgin plastic toward new models for reuse, substitution and collection – which is estimated to cost US$1.2 trillion over the next two decades.

Financing at this scale cannot be put forward by a single government or an individual bank. It requires a collective, public-private approach to mobilise capital and close the financing gap.

What is the World Economic Forum doing about the circular economy?

Public-private solutions

To date, infrastructure for plastic collection and recycling has not been a top investment priority for governments faced with a multitude of competing choices on how to spend taxpayer money.

Despite limited financial resources, governments have a critical role to play in creating a market for investment by private actors, who can close the financing gap. A myriad of options exist for the public sector to attract investment and support governments’ infrastructure needs. Targeted tax policies and incentives are a few of many possibilities.

Investors, for their part, can begin by pursuing investment opportunities through vehicles that combine philanthropic or development funds to offset risk – while generating financial returns alongside environmental benefits.

"Financial institutions must realise this unique prospect to generate returns while eliminating plastic waste."

”Investing for profit and planet

The market is ripe for investment to end plastic pollution.

Over the last two years, financial institutions’ engagement in the circular economy – a system that decouples resource consumption from value creation and redefines how goods are made and used – has risen. Across numerous sectors, including plastics, circularity is driving higher risk-adjusted stock performance for European listed companies. Attractive investments in emerging markets also exist, but to date remain largely untapped.

From material and business model innovation to waste collection and recycling infrastructure, profitable investment opportunities are present across the plastics value chain. Financial institutions must realise this unique prospect to generate returns while eliminating plastic waste and governments must act to attract such investments through enabling policies. Doing so will not only create a business opportunity, but it will also deliver a critical investment in the health and future of the planet.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Climate ActionSee all

Lisa Donahue and Vance Scott

April 28, 2024

Kate Whiting

April 26, 2024

Santiago Gowland

April 24, 2024

Amanda Young and Ginelle Greene-Dewasmes

April 23, 2024

Andrea Willige

April 23, 2024

Agustin Rosello, Anali Bustos, Fernando Morales de Rueda, Jennifer Hong and Paula Sarigumba

April 23, 2024