We’re living longer. Here’s how that will change retirement

Younger generations want to retire earlier, one of many reasons why “longevity literacy” will be critical to strengthen financial security. Image: Unsplash/aaronburden

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Health and Healthcare

Listen to the article

- Life expectancy is increasing globally, which means people are living longer and a 100-year life is now a real possibility for many.

- This could change the age of retirement with people living a multistage life into their later years.

- The World Economic Forum and Mercer conducted a poll of people’s responses to living longer and retirement prospects for a new report.

- It found there’s a need for “longevity literacy” and an approach to retirement that goes beyond financial security.

What excites you most about living longer?

“The opportunity to see grandchildren grow to a more mature stage of their life than prior generations did. Retiring healthily enough to be engaged in my extended family’s lives; time to contribute to my local community.”

This was one of the responses to a Pulse Poll from Mercer and the World Economic Forum for their recent report Living Longer, Better: Understanding Longevity Literacy.

A 100-year life is now within reach for many people, with children born today in middle-income countries having over a 50% chance of living for more than a century.

Life expectancy is increasing globally, according to the report. In the two decades between 2000 and 2019, it went from 66.8 years to 73.4 years.

Almost a third of the population of Japan (28%) is now aged over 65, while developing countries are expected to see a jump of 140% in over 65s by 2030, compared to 51% in more developed countries.

Those additional years of life will require a different mindset to our later years, ensuring we're maximizing our health and our chance at a healthy retirement.

Living longer, better

The Pulse Poll found that while people value living longer, there are some genuine concerns. For instance, four in 10 polled want to have a better understanding for what their financial situation in retirement might be. Only 45% of people polled think they have saved enough.

Beyond finances, health was the top concern for 43% of respondents, with social inclusion and maintaining independence with dignity until the end of their life also featured in survey responses.

Ultimately, what’s needed is “longevity literacy” that goes beyond financial planning to empower people to live a healthy, resilient and sustainable life, says Richard Nuzum Executive Director, Investments, and Global Chief Investment Strategist, Mercer.

Haleh Nazeri, Platform Curator, Financial and Monetary Systems, World Economic Forum, agrees. “People will need to think differently, and more holistically, to fully prepare for their later years.”

The World Economic Forum and Mercer partnered on this report, the result of a 400-person pulse poll of their networks and communities. While this sample is not representative of populations as a whole, it does offer an important window into some of the issues shaping modern retirement and can kickstart new conversations for what is needed next.

“As individuals consider what is needed to be successful in a potentially 100-year life, they need to focus on three core principles: quality of life, purpose and financial resilience.”

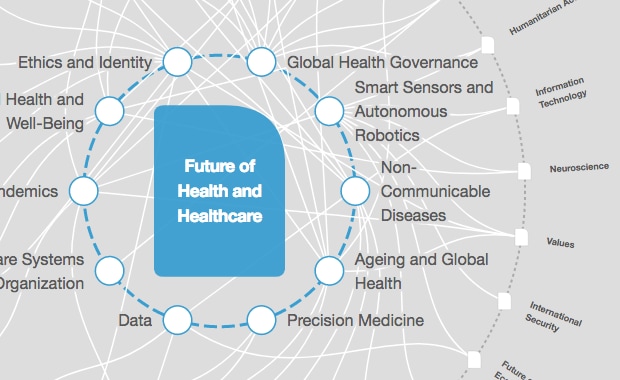

What is the World Economic Forum doing to improve healthcare systems?

Responding to retirement changes

The traditional three-stage life: education, career, retirement, is likely to become a “multistage life”, according to the report, with lifelong learning, career breaks and new occupations built into later life.

Here are some of the key shifts in retirement and recommendations for what three critical stakeholders – government, the private sector and individuals – can do to plan and respond accordingly.

- Change 1: Health will become the top priority, so people can live longer, better lives

What’s needed: Planning for good health will be even more critical, with individuals improving healthy life expectancy through good nutrition, exercise and early screening, while governments can introduce health campaigns to increase “health span”. Employers can offer high-quality and more accessible advice about longevity and health.

- Change 2: Children are more likely to support parents

What’s needed: The “Bank of Mum and Dad” may be closing, with 45% of under-40s expecting they will need to support elderly relatives, compared to 32% of those over that age. Governments can strategize to increase the caregiving workforce and improve the financial rewards, while businesses can provide flexible work programmes and training for caregivers re-entering the workforce.

- Change 3: Reskilling to work longer

What’s needed: With more than half of people either having not saved enough for retirement or unsure, many people will either need to accept a lower standard of living or work for longer. Reskilling will be required to keep skills relevant to the workforce, with governments driving upskilling efforts and discouraging ageism.

- Change 4: Younger generations want to retire earlier – but may not have the funds

What’s needed: The Pulse Poll found 44% of under-40s wanted to retire by 60. More educational programmes are needed from governments and employers to show the impact of different working arrangements and retirement ages on pay and pension. Auto-enroll pension schemes can ensure younger workers have more money saved

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Health and Healthcare SystemsSee all

Kate Whiting

May 3, 2024

Kiran Mazumdar-Shaw

May 2, 2024

Johnny Wood

May 1, 2024

Prakash Tyagi

May 1, 2024

Katherine Klemperer and Anthony McDonnell

April 25, 2024