The finance gap for women entrepreneurs is $1.7 trillion. Here’s how to close it

Women entrepreneurs make up an important part of the micro, small and medium enterprise landscape, yet they remain underbanked. Image: Carey Wagner

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Society and Equity

- Women entrepreneurs make up an important part of the micro, small and medium enterprise landscape, yet they remain underbanked.

- Centring women in the design process of financial products will give them greater access to the capital they need in business.

- Prioritizing women’s financial needs could help add $10 trillion to the world economy by 2030.

Violeta Pacheco Mejía is an entrepreneur who owns Tejidos Peruanos, a designer, eco-friendly alpaca and cotton clothing company based in Lima, Peru. Over the past 18 years, she has expanded her business, opening a thriving factory that employs 14 women, and exports products to more than six countries. Yet each of the investments for her growing business, including purchasing a building, hiring employees, and acquiring more raw materials and equipment, were financed through a loan her husband received from the bank. As a woman, Violeta couldn’t access a loan on her own.

Like her, many women around the world don’t have the same opportunities as men; the total micro, small, or medium enterprise (MSME) finance gap for women is estimated to be valued at $1.7 trillion. Yet women entrepreneurs own 22% of micro-enterprises and 32% of small and medium enterprises (SMEs). More broadly, 740 million women globally are unbanked, according to the World Bank’s 2021 database, and 2.4 billion women worldwide lack the same economic rights as men. Unless we make conscious efforts to include women, financial interventions miss the mark.

Violeta participated in the Ignite programme in 2021, implemented by CARE and supported by Mastercard Center for Inclusive Growth, which offered training in business skills, financial management, negotiations and networking. Violeta says: “Today, it is me, Violeta Pacheco, who can access a loan from the bank. And thanks to that capital we received, we were able to have a higher production.” Soon, she hopes to export her designs under her own brand, Maywa, which means “violet” in Quechua, the Indigenous language of the Peruvian people.

What makes financial products and solutions so poorly designed for women today? Let’s unpack the (financial inclusion) problem.

Women need solutions to meet them where they are

According to the 2021 World Bank report, women are excluded from formal banking due to lacking official forms of identification, mobile device access, and informal and formal norms and structures that limit their financial capability and capacity. Narrowing these gaps means women-centred design solving real problems for users and matching them with the right product.

- Alternatives to the formal finance system, such as savings groups, are a solution in which official forms of identification are unnecessary. This is especially important for women in hard-to-reach rural areas.

- A seasonal micro, small, or medium enterprise (MSME) might need a bank loan with flexible repayment, so the owner can repay the loan on her terms.

- Banks should reduce requirements for collateral and loan co-guarantors to remove barriers that limit access for women.

- To ensure long-term business success to women, financial service providers should offer financial skills and business management training, such as the Ignite programme.

There are numerous solutions if only we centre women in the design process

Many financial service providers falsely design “gender-neutral” financial products intended for both men and women – yet they are often designed with men’s needs primarily in mind. Market research shows that women have different needs when deciding on a new financial product or service. Women entrepreneurs in Peru, Pakistan and Vietnam have told us that they need access to the right-sized loan; flexibility in terms of credit history; their husband’s debts to be ignored; flexible repayment options; shorter, seasonal loans; the ability to cover medical costs like preventative care; and banks to employ more women loan officers.

Control is critical

Financial interventions far too often fail to ensure access to capital that women can control. Increasing women's access to, and capability to use, financial resources is only one piece of ensuring women's financial inclusion. Social norms in many contexts around the globe value women and girls less than men and boys. Thus, women’s economic justice and financial inclusion programming must also include components to identify and address these harmful norms – which limit their attempts to exercise freedoms, such as increasing their financial agency and economic power, without suffering backlash and gender-based violence (GBV). Given that one in three women experience GBV, it’s one thing to get women more access to finance, but control of those resources and her income is critical. As highlighted in a recent CARE Women’s Economic Justice report, a woman in a savings group is 54% more likely than a non-member to own an asset, and 37% more likely to be able to sell that asset without asking anyone’s permission.

The stakes are high, and the opportunities are even higher

It is ever more pressing that we centre women in economic growth. CARE’s analysis of data across 113 countries suggests that improving GDP generally is not enough. The most recent figures show that when you control for inequality, economic growth that concentrates wealth at the top can lead to higher food insecurity, especially since COVID-19. Furthermore, despite rapid economic growth in many parts of the world, women continue to lag behind men in economic prosperity: In 2020, lost income for women amounted to $800 billion globally, according to Oxfam, while UN Women estimates that there will be 121 women in poverty for every 100 men by 2030. There is increasing recognition that while income growth is necessary for food security, more equitable growth is likely to result in even greater improvements on this front. Furthermore, according to the Eurasia Group, if policy-makers prioritized investments in women’s economic power, the global economy could grow an additional $10 trillion by 2030.

Women-led MSMEs are critical economic engines

In times of financial contraction, MSMEs bolster economies. Adding more women-led enterprises and financial interventions that serve them could play a substantial stabilizing role. According to the World Bank, 600 million jobs will be needed by 2030 to absorb the growing global workforce, which makes MSME development a high priority for many governments around the world – including those led by women. In emerging markets, most formal jobs are generated by SMEs, which create seven out of 10 jobs. The rate is even higher in the self-employed and micro-enterprises in low- and middle-income countries, which make up 80-90% of total employment combined.

Catalytic programmes are needed to solve the aid gap

It’s estimated that low- and middle-income countries need $4 trillion in capital to emerge fully from poverty, but only $200 billion in aid is available every year. To bridge this gap requires aid investments and interventions with catalytic impacts that can deliver lasting change at scale. For example, average income increases by $18.85 within five years for each $1 invested in a savings group. Members are 15% more likely to be in local leadership roles. We need more comparable solutions that help women earn, save, invest, and enable their family and community to thrive.

Everyone wins when we accelerate women’s economic growth

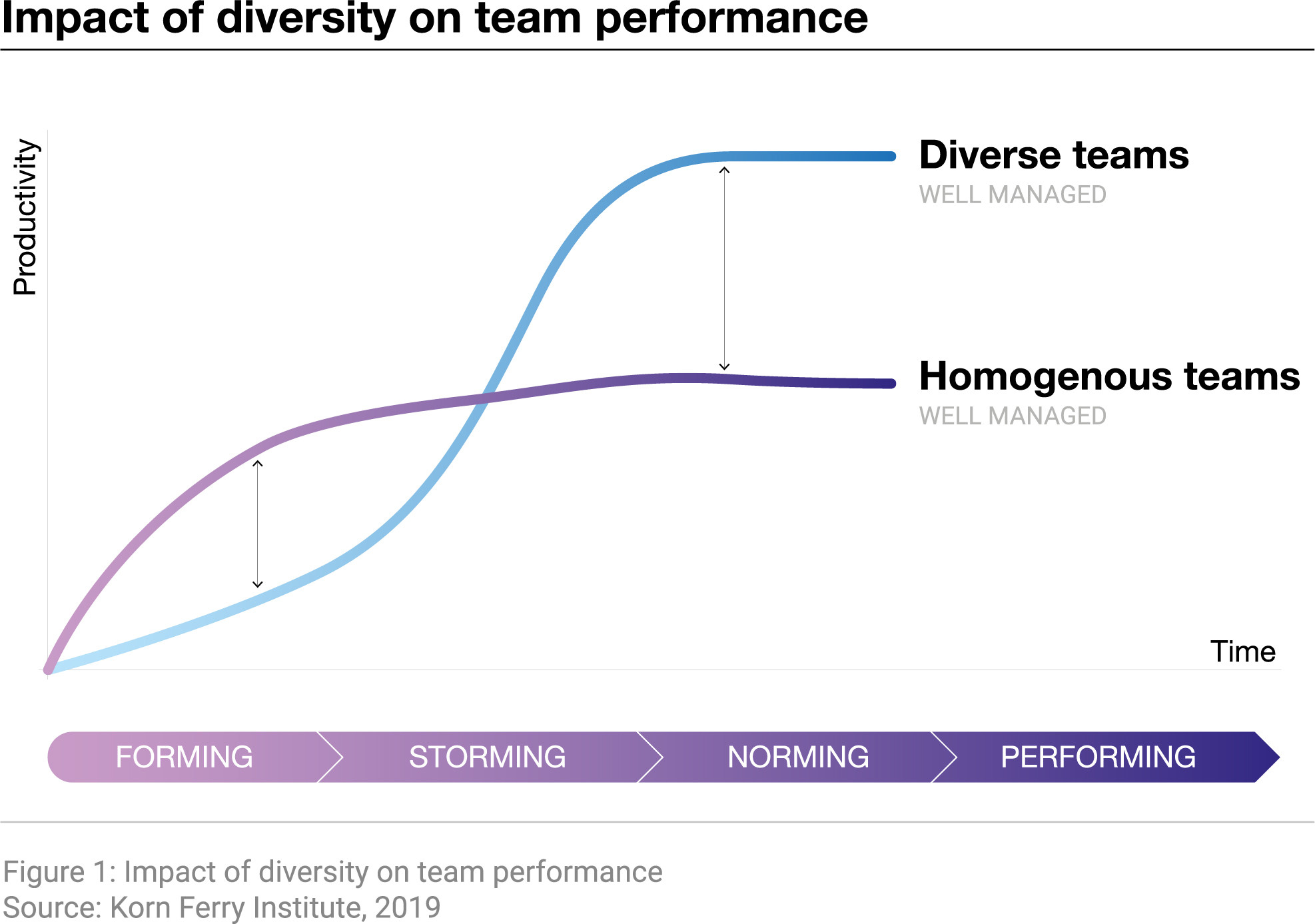

Equal gender representation in business and eliminating discrimination towards women workers and managers can increase profitability and productivity by 40%. Women-led SME enterprises demonstrate strong performance for banks. And it’s long been established that since women are more likely than men to spend resources on supporting their families and communities, an increase in women’s income has a cascading impact on the welfare of households, communities and economies.

What's the World Economic Forum doing about diversity, equity and inclusion?

The stakes are high, but so are the opportunities. As we prioritize women’s economic power, we not only advance gender equality but also unlock the full potential of our global economy. It's a win-win scenario where everyone benefits. It's time to accelerate women's economic growth, not just as a moral imperative but as a strategic and economic imperative for a better future for all.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Equity, Diversity and InclusionSee all

Annamaria Lusardi and Andrea Sticha

April 24, 2024

Claude Dyer and Vidhi Bhatia

April 18, 2024

Julie Masiga

April 12, 2024

Alex Edmans

April 12, 2024

John Hope Bryant

April 11, 2024