Insurance, wellbeing and social purpose: paving the way for a healthier future

Life insurance companies are well-positioned to drive the change towards preventative health by providing incentives for healthy living. Image: Kampus Production/ Pexels

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

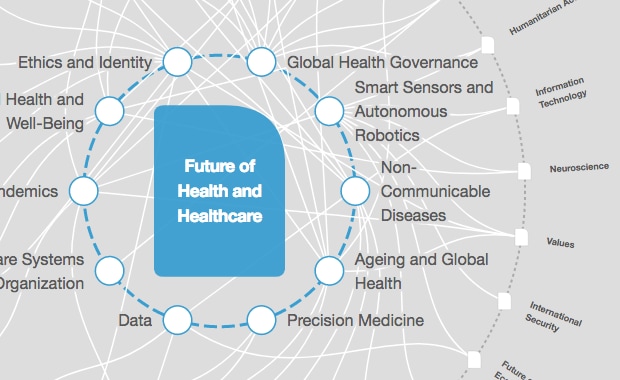

Health and Healthcare

- Chronic diseases are responsible for 74% of all deaths worldwide, yet most of them - including heart disease, stroke, and type 2 diabetes - are preventable through lifestyle changes.

- Life insurance companies are well-positioned to drive the change towards preventative health by providing incentives for healthy living.

- By championing preventative health, insurers can align their financial interests with the welfare of their clients, playing a crucial role in creating a healthier, more resilient society.

The world is grappling with a health and well-being crisis, with chronic diseases responsible for 74% of all deaths worldwide, a figure that has surged from 61% (32 million) in the last decade. Yet, an impressive 80% of these diseases, including heart disease, stroke, and type 2 diabetes, are preventable through lifestyle changes. Simple shifts in every day habits can substantially lower the risk of serious health conditions, underscoring the critical need for both individual and collective action towards healthier lifestyles.

However, bridging the gap between awareness and practice in adopting a healthy lifestyle necessitates a more dynamic and incentivized approach. Public awareness campaigns are crucial, but they must be coupled with tangible incentives that motivate individuals to make and maintain healthy choices.

In this landscape, insurance companies, particularly life insurers, emerge as pivotal players. Life insurance companies are well-positioned to drive this change towards preventative health by providing incentives for healthy living. Beyond their traditional role, they have a vested interest in the health of their policyholders. By offering incentives, they can encourage a shift towards healthier behaviours, aligning their financial interests with the welfare of their clients. Healthier lifestyles among policyholders lead to fewer claims, benefiting both the individual's wellbeing and the insurer's bottom line.

How is the World Economic Forum bringing data-driven healthcare to life?

By understanding the intricate link between insurance and wellbeing, we can better advocate for the insurance industry to finance preventative health measures and highlight the crucial role of AI and strategic partnerships in achieving this vision.

Understanding the insurance-wellbeing nexus

The insurance-wellbeing nexus is multifaceted, with life insurance being fundamentally connected to individual health and wellbeing. Healthier clients who live longer, pay more premiums, and make fewer claims. This interplay goes beyond mere financial transactions; it also fosters a societal culture shift where health and wellbeing is valued and prioritized.

In the United States, a mere 3% of the colossal $4 trillion healthcare expenditure is allocated towards prevention. Yet, preventable lifestyle behaviors are behind the majority of the disease burden and deaths globally. Life insurance companies have much to gain from their policyholders extended, healthier lives. With a healthier client base, they can minimize payouts and enhance their financial outcomes.

For example, if a life insurance policyholder with a $1 million policy were to die, the company would have to pay out this significant sum. Therefore, life insurers would likely prefer to invest a portion of this sum in maintaining the health of this policyholders to prevent high-risk illnesses.

However, until recently, life insurers have not had the means to identify such opportunities or the platform to invest in their clients' wellbeing.

There are $5 trillion of capital reserves on the balance sheet of the entire insurance sector in the US that is sitting there predominantly because life insurance risk was mispriced over the last 30 years, because there was a lack of true data and understanding individual risk. Today, insurers have the technology to unlock that massive amount of money and use it to encourage the health and wellbeing of their policyholders, which will make the bottom line of those insurance companies richer.

The right moment for a paradigm shift

Several factors converge to make this the opportune moment for life insurers to assume a more active role in preventative health. The exponential growth in AI and data analytics capabilities offers unprecedented opportunities for personalized healthcare. AI stands at the forefront of this healthcare revolution. Its ability to process vast amounts of data can lead to personalized wellbeing assessments, predicting individual health risks with remarkable accuracy. This capability is vital, allowing insurers to develop customized insurance products and preventative health strategies tailored to individual needs.

But the vision of integrating preventative health into life insurance requires more than just the willingness of insurance companies; it demands robust partnerships, particularly with technology companies specializing in health and wellness.

Over the past five years at Betterfly, we have been diligently crafting an infrastructure that combines the worlds of insurance and well-being with a purpose-driven gamification engine that encourages healthy living. By partnering with the world’s leading insurers, we protect and empower individuals to live healthier, happier lives by rewarding their daily habits and positive lifestyle choices.

A broader vision of corporate social responsibility: challenges and opportunities

The intersection of insurance and wellbeing, powered by AI and solidified through strategic partnerships with technology companies, presents an unprecedented opportunity to reshape the landscape of insurance and healthcare. Life insurers, by championing preventative health, can play a crucial role in creating a healthier, more resilient society.

This approach not only makes economic sense but also aligns with a broader vision of corporate social responsibility, where businesses contribute meaningfully to the wellbeing of the communities they serve. As we stand at the cusp of this transformative era, the collaboration between life insurers, technology firms, and other stakeholders will be key in unlocking a future where health and wellbeing are not just aspirational goals but achievable realities for all.

If executed correctly, this synergistic approach has the potential to unleash the largest pool of resources dedicated to human wellbeing and prosperity that the world has ever seen. And this monumental shift is poised to occur within the next couple of years.

The economic implications of this shift are profound. Preventative health initiatives can unlock trillions of dollars in societal value. By reducing the incidence of chronic diseases and improving overall public health, the burden on healthcare systems can be significantly alleviated. This not only translates to direct cost savings for insurers and policyholders but also contributes to a more vibrant and productive economy.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Health and Healthcare SystemsSee all

Michael Anderson, Gunnar Ljungqvist and Victoria Saint

May 15, 2024

Charlotte Edmond

May 14, 2024

Shyam Bishen

May 13, 2024

Anna Cecilia Frellsen

May 9, 2024

Angeli Mehta

May 8, 2024

Emma Charlton

May 8, 2024