Why climate tech desperately needs more financial backing and how to secure it

Climate tech can help the world reach net-zero, but new innovations need support to develop and scale. Image: Getty Images/iStockphoto

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Climate and Nature

- It’s time to supercharge the new wave of innovations critical to decarbonizing energy, mobility, heavy industry, food and land use and our built environment.

- Yet, the IEA says that 35% of the emissions reductions needed by 2050 will come from technologies not yet at commercial scale.

- Ramping up finance to scale the adoption and growth of climate tech will be complex, but with urgent action required to combat the climate crisis and ensure energy security, this is a vital step to reaching net-zero.

The recent Global Stocktake reaffirmed that the world is far off the pace of decarbonization required to keep 1.5C on track. The World Economic Forum Annual Meeting in Davos, Switzerland, is an opportunity to kick start 2024 and build on the momentum of Dubai’s COP28 agreement. The World Economic Forum Annual Meeting is famous for deal-making and partnerships. Having seen the first generation of climate tech start to demonstrate exponential adoption – solar, wind, electric vehicles - it’s now time to supercharge the new wave of innovations that are critical to decarbonizing energy, mobility, heavy industry, food and land use and our built environment.

The IEA says that 35% of the emissions reductions needed by 2050 will come from technologies under development and not yet at commercial scale. A lot of that climate tech – solutions, such as clean hydrogen, sustainable aviation and maritime fuels, waste-to-value, long-duration energy storage and carbon removal – is within our grasp, but lacks the finance and financing structures necessary to scale up.

For capital-intensive hard-tech solutions in particular, profitability is often many years away and product-to-market fit can be hampered by a green premium and a lack of buyers. This does not lend itself to the typical risk appetite of private investors, so it is no surprise there is currently a $2 trillion financing gap for climate tech.

We must get smart, creative and collaborative to unlock private capital for climate tech. This needs a whole ecosystem to come together – entrepreneurs, venture capital (VC) firms, banks, growth stage asset managers, corporate buyers and governments – which can provide the policy and fiscal environment and the public research and development finance critical to scaling.

Here are five ways to help get capital flowing towards climate tech and scaled to support a net-zero future:

1. Specialized funding

Dedicated climate tech funds and tailored financing teams within financial institutions can help apply capital into earlier stage investment of asset-light and pre-profit technology companies, as an alternative to VC firms, who may be reluctant to fund infrastructure or hardware build-outs. At HSBC we recently allocated $1 billion in venture debt capital support to early-stage climate tech companies around the world. This builds on our investment in initiatives, such as the Breakthrough Energy Catalyst, which provides project finance for deep decarbonization solutions. Venture debt is particularly important in the current macro-environment where equity valuations are challenging.

2. Coaching for founders

Project management capability and specialized financial acumen within the start-ups themselves are key to delivering confidence among potential investors, but these may not fall within the typical skillsets of innovative technologists and engineers. Scaling the business behind technology might involve supply chain build-out, engagement with regulators and policymakers, financial structuring, marketing and more. While VC firms often have resources to teach entrepreneurs how to raise capital, there is a need for more bespoke and more available education for climate tech.

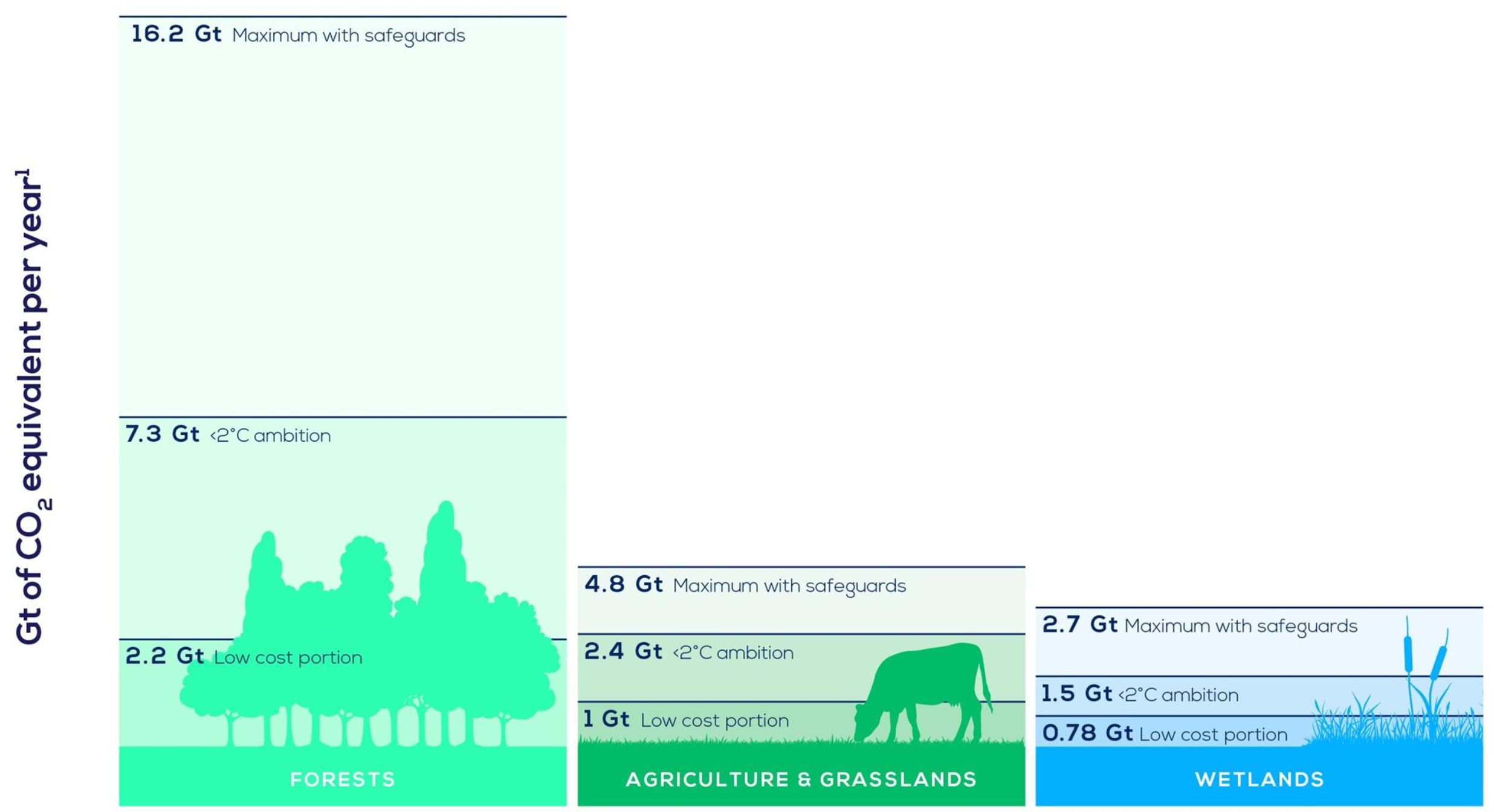

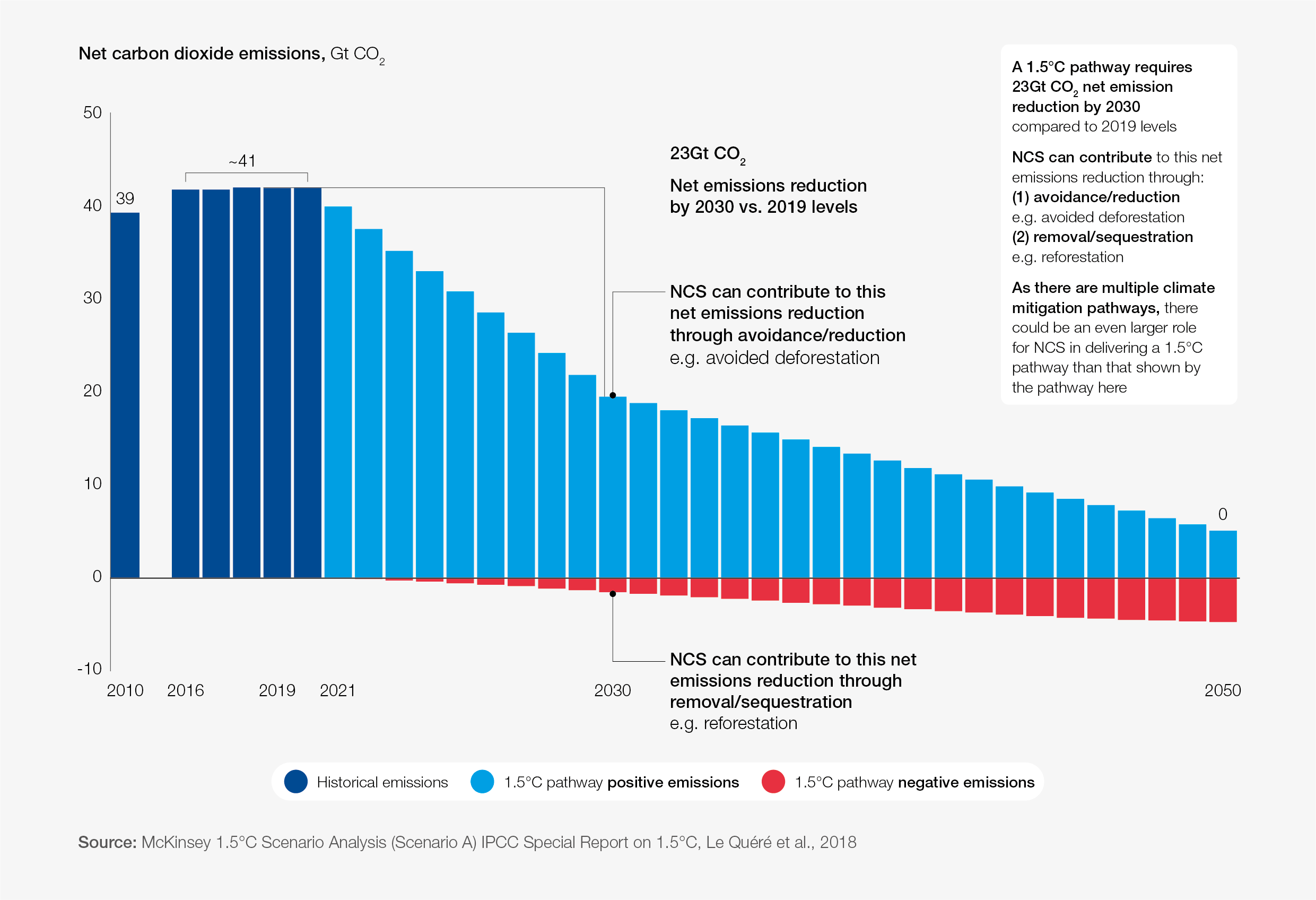

What is the World Economic Forum doing on natural climate solutions?

3. Targeted support for climate tech addressing the heaviest emitting sectors

The destination of current climate tech investment does not correspond with solutions addressing the biggest emissions sources. The industrials sector accounts for up to 34% of emissions but only 14% of climate tech investment is directed at solutions aimed at reducing that sector’s emissions. Food production and land-use make up 22% of emissions but only 8% of climate tech investment is targeted at projects tackling them. By incentivizing funding into tech that supports transition in these sectors we get a better emission-reduction-per-dollar and, ultimately, more effectively demonstrate climate tech’s value to prospective investors.

4. Leveraging of networks

Global institutions with large networks of clients across many sectors are well-positioned to connect early-stage climate tech firms with potential corporate or public sector off-takers and buyers, supply chain partners, strategic corporate or institutional investors or governments to directly support their transition. HSBC is working with other global firms, such as Google Cloud, to this end, supporting and connecting climate tech firms with potential clients – and investors – across their ecosystems.

5. Partnership to support scaling in emerging markets

Emerging economies present unique challenges and opportunities for climate tech. In addition to the technology and start-up risks present in developed economies, private capital is further hampered by political risks, construction risks and currency risks. Blended-finance partnerships led by multilateral and bilateral development banks could prove key here. Ones to watch include the World Bank’s Private Sector Investment Lab; Pentagreen Capital, launched by the Asian Development Bank, HSBC and Temasek; and, the new Alterra Fund, launched at COP28.

The climate tech entrepreneurial ecosystem is also less mature in many emerging markets than in the US and Europe. But these are the very markets with the highest business-as-usual emissions from energy, mobility, heavy industries, food and land use change and where the most infrastructure development is underway. Deployment of climate tech in these markets is, therefore, critical and fostering the local climate tech ecosystem is vital, alongside helping international climate tech pioneers to deploy their solutions into these markets to help drive down emissions growth.

Ramping up finance to scale and enhance the adoption and growth of climate tech to reshape the future of industries will be complex, but it's vital to keeping 1.5C in reach. These technologies need support to reach tipping points to outperform incumbent technologies and gain significant market share. Finance through early and scale-up stages is critical, but it must sit side by side with policy support. Well-designed policies – and ideally well-designed industrial policy – production credits, contracts for differences, carbon taxes, mandates and standards, public procurement policy, subsidies (or removal of incumbent fossil fuel subsidies) can all help shift investment and stimulate market demand and real-world scaled deployment.

This is eminently solvable. We are optimistic that with the right partnerships and cooperation we can unleash a new tech revolution to build the industries our future so desperately needs.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Nature and BiodiversitySee all

Cristen Hemingway Jaynes

April 30, 2024

Robin Pomeroy and Linda Lacina

April 29, 2024

Greg Goodwin and John Stackhouse

April 29, 2024

Diego Vincenzi

April 29, 2024

Jan Rosenow, Cristina Oyón, Natalia Zabolotnikova and Xabier Mugarza Zorriqueta

April 29, 2024