What is a recession and how to tell if one is happening

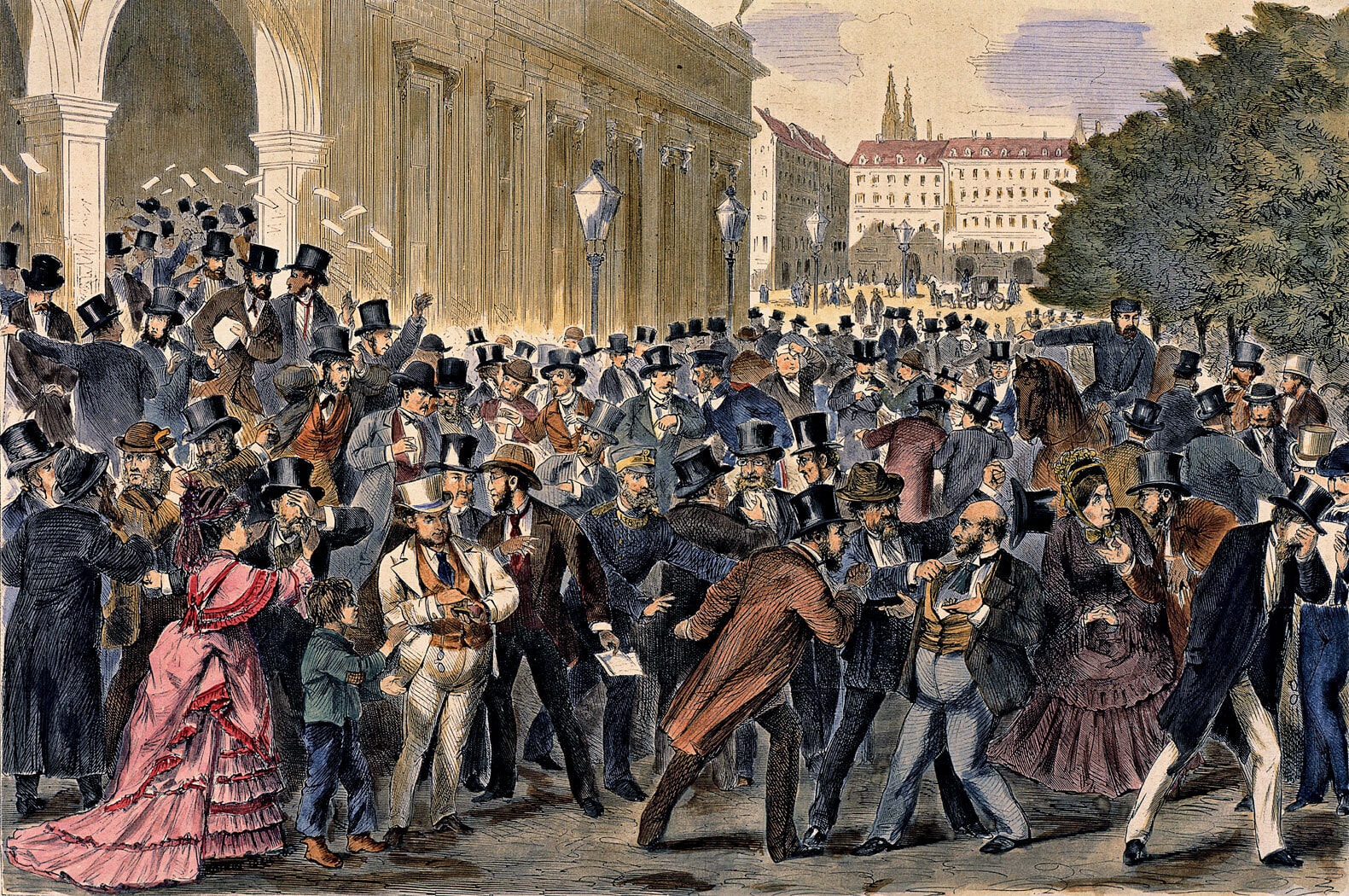

Low consumer confidence can be one sign of a pending recession.

Image: Unsplash/Jason Leung

Stay up to date:

United States

Listen to the article

This article was updated in February 2024.

- Economists predict another year of slow growth around the world in 2024.

- While the risk of a global recession is lower in the year ahead, two G7 economies dipped into recession at the end of 2023.

- And the future picture continues to be clouded by uncertainty, according to the experts polled in the World Economic Forum's latest Chief Economists Outlook.

Two G7 economies slipped into recession at the end of last year - Japan and the UK - as consumer spending slowed.

The UK saw its slowest annual growth rate since 2009, while Japan dropped from third to fourth largest economy in the world, Bloomberg reported in February.

In its Global Economic Prospects report in January, the World Bank said risks of a global recession in 2024 had receded thanks to the US economy performing better than expected in 2023.

Still, continued fallout from the COVID-19 pandemic, wars in Ukraine and the Middle East, and persistently high inflation leave the growth outlook for 2024 "sluggish", with the global economy facing its "weakest half-decade performance in 30 years", the World Bank said.

But what exactly is a recession and how do we decide if one is happening?

Have you read?

Expect the unexpected: The IMF’s Kristalina Georgieva on what's ahead for the global economy

What levers might central banks pull for the economy in 2024?

‘No shortages of headwinds’: Chief economists detail the hurdles facing the global economy

What does 2024 have in store for the economy? Leading chief economists give their views

How is a recession defined?

There is no official, globally recognized definition of a recession.

In 1974, US economist Julius Shiskin described a recession as “two consecutive quarters of declining growth”, and many countries still adhere to that.

However, the US has since opted to use a more open definition. The National Bureau of Economic Research (NBER) looks at a variety of factors when deciding whether or not America is in recession. The institution defines the event as “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in production, employment, real income, and other indicators.

"A recession begins when the economy reaches a peak of activity and ends when the economy reaches its trough."

Like national recessions, a consensus on the definition of a global recession has yet to be reached. The World Bank’s main indicator of a worldwide downturn is multiple major countries’ economies contracting at the same time, as well as other evidence of weak global economic growth.

The world economy has gone through four major downturns over the past seven decades, in 1975, 1982, 1991 and 2009. Recessions typically last for about a year in advanced economies, according to the IMF. The NBER’s data supports this: from 1945 to 2009, the average recession lasted 11 months.

Signs of a recession

Besides a prolonged decline in gross domestic product (GDP), one of the most obvious measures of a recession is the unemployment rate. When this begins to rise, it can trigger a domino effect of economic consequences as demand for goods and services slows down. During the last global recession, unemployment hit 9.5% in the US, according to the Bureau of Labor Statistics.

Although employment is high in many major economies, sentiment – another key indicator – remains low on the consumer confidence index despite having improved in 2023. This is due to factors such as the cost of living crisis leading to less spending, which can cause the economy to contract and tax revenues to decline.

Global growth has shown resilience in 2023 and inflation rates are falling faster than expected, but world trade growth – a predicted 3.3% in 2024 – is still well below its historical average of 4.9%, according to the International Monetary Fund (IMF). In fact, the IMF expects growth to decline in advanced economies this year before rising again in 2025; stable growth is expected in emerging and developing economies during 2024/5, but with regional variations.

Stock markets are also likely to struggle during recessions. As consumer confidence and spending decreases, companies may be forced to lay off workers, which can lead to poor investment performance and panic in the market. In the 12 recessions following World War II, the US index of stocks – the S&P 500 – contracted by a median of 24%, according to Goldman Sachs.

How is the World Economic Forum improving the global financial system?

How will a recession affect consumers?

Unemployment could rise. Graduates and school leavers may then find it more difficult to find jobs. Companies may struggle to pay their workforce or give their employees pay increases to match inflation, according to the Institute for Fiscal Studies. Investors could also see losses, as stock markets fall. During a recession, we may see an increase in foreclosures, and banks will be less likely to loan money to potential borrowers looking for a mortgage or a personal loan, according to Forbes.

Preparing for Recessions

Recessions can be challenging periods, but there are strategic ways for individuals and businesses to brace themselves against economic downturns. One crucial step is strengthening balance sheets to ensure a more resilient financial foundation. A diversified portfolio, including high-quality assets and investments in recession-resistant sectors, can also help protect against volatility.

Keeping informed about economic news, including shifts in fiscal and monetary policies, allows for timely adjustments. On a personal level, maintaining a clear monthly budget and exploring additional income streams can provide stability. For businesses, adopting a proactive risk management strategy, including scenario planning, can be essential. Maintaining a long-term perspective helps weather temporary setbacks and positions both individuals and companies for recovery once the economy rebounds.

How do recessions end?

Central Banks can lower short-term interest rates. This can increase consumer confidence and stimulate spending, as the cost of borrowing is lower, meaning the cost of buying items such as cars and homes is also less.

To keep unemployment at bay, governments can introduce policies such as tax cuts to help consumers, or launch infrastructure programmes, including construction of roads and railways.

Recessions end when growth resumes again, no matter how slowly this happens. During the Great Recession of 2008, for example, governments introduced a number of quantitative easing measures, pumping trillions into the global economy in an attempt to resuscitate it. Following this unprecedented level of stimulus, markets began to recover, although lingering scars like higher unemployment and lower average income levels remained many years later.

Accept our marketing cookies to access this content.

These cookies are currently disabled in your browser.

What else to expect in 2024

Elevated geopolitical risks mean prices will likely remain high for key commodities, including oil and gas, rating agency Fitch predicts.

The World Economic Forum's latest Chief Economists Outlook finds a mixed picture for the coming year, with just over half of the chief economists surveyed (56%) expecting the global economy to weaken and 43% foreseeing unchanged or stronger conditions.

However, there is more uncertainty on the horizon as it's also a major election year – for the US, the world's largest economy, and around the globe – as the Forum highlights in its Global Risks Report 2024.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Economic GrowthSee all

Juan Caballero and Ana Sampaio

July 18, 2025

John Letzing

July 17, 2025

William Dixon

July 16, 2025

Aengus Collins

July 15, 2025

Guy Miller

July 15, 2025

Aaron Sherwood

July 15, 2025