The global supply of equities is shrinking – here's what you need to know

Fewer companies are choosing to list their shares on global stock exchanges. Image: REUTERS/Staff

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

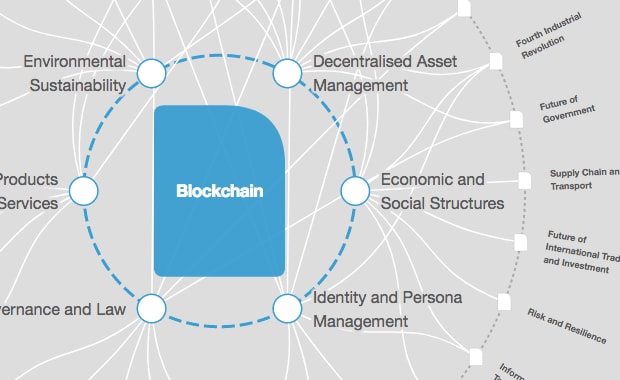

Blockchain

- Fewer companies are choosing to list their shares on global stock exchanges.

- There’s been a $120 billion reduction in public equities this year, a third consecutive year of decline.

- One of the factors is the clouded economic outlook, which the latest World Economic Forum survey of chief economists says is being compounded by geopolitical risks.

Investing in shares can be a rewarding way to build wealth over time.

Anyone who is fortunate enough to have a bit of spare cash can consult the financial pages, pick specific companies to invest in and buy shares in certain companies with the hope that their value will increase. It’s an enticing way to generate returns that outpace inflation.

But that dynamic has changed in the past few decades, with fewer companies choosing to list their shares on stock exchanges, and make them available to a wide audience. This shift means savers have fewer options to choose from, and risk losing out on opportunities to invest in some of the world’s most innovative and fastest growing companies.

Why is the supply of public equity shrinking?

There’s been a net reduction of $120 billion in public equities this year, according to JPMorgan analysts, a figure that dwarfs last year's $40bn decrease and marks the third consecutive year of decline.

JPMorgan's data suggests persistent uncertainty among companies worldwide. Share buybacks – when companies repurchase their own shares from shareholders in the market – have stayed stable, while share offerings have fallen, meaning there are fewer shares available overall.

What is the Forum doing to improve the global banking system?

Less incentive to list shares on an exchange

There’s also a global trend of a decline in the number of companies listing on stock exchanges, according to Duncan Lamont, Head of Strategic Research at Schroders.

There has been a drop of nearly 75% of companies listed on the main market of the London Stock Exchange between the 1960s and the end of 2022, he says. Similar data for public companies in Germany shows a drop of more than 40% since 2007, and in the US, there’s been around a 40% drop since 1996.

London’s stock market has lost 25% of its companies in the past decade, according to Bloomberg, citing data from the London Stock Exchange that includes the main and junior markets.

One of the factors is that there’s a much larger pool of alternatives for company executives to turn to when they need money.

The Alternative Investments market, that includes hedge funds, real estate, digital assets, private credit and private equity, grew to $26.1 trillion in the first quarter of 2023, up from $25.5 trillion at the end of 2022, according to JPMorgan's Nikolaos Panigirtzoglou.

And that means there’s more for company managers to weigh when deciding where to look for investment. Listing on the stock market comes with both positive and negative factors.

Global uncertainty makes executives cautious

Global economic prospects remain subdued and fraught with uncertainty, according to the latest World Economic Forum survey of chief economists. Geopolitical risks are compounding that uncertainty as fragmentation clouds the outlook, the report said.

Almost seven out of ten (69%) of chief economists are expecting the pace of geoeconomic fragmentation to accelerate this year.

“Uncertainty that dominated the outlook over the last year continues to cloud near-term economic developments,” the Forum report said. “56% of chief economists expect the global economy to weaken over the next year, but another 43% foresee unchanged or stronger conditions.”

It seems that the factors underpinning the shrinking availability of stocks are likely to persist.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Financial and Monetary SystemsSee all

Meagan Andrews and Haleh Nazeri

May 3, 2024

Reese Epper, Brad Handler and Morgan Bazilian

April 29, 2024

Joe Myers

April 26, 2024