Can you answer these 3 questions about your finances? The majority of US adults cannot

The EU and the US are under-performing in terms of financial literacy. Image: Unsplash/Angie J

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Crypto Impact and Sustainability Accelerator

- In the US, financial literacy is hovering at around 50%, according to an annual survey, with the EU also under-performing.

- The World Economic Forum’s Future of Capital Markets initiative is promoting responsible investing across the retail investor ecosystem.

- April is Financial Literacy Month in the US, so here’s the latest on why our understanding of money needs to improve – and how.

Money is deeply influential in all our lives. It affects where we live, our education, our health, our careers, our romances, our families and our retirement – plus myriad other junctures along the way.

Yet, while the world of finance is always growing and changing, it appears our grasp of it is not. Surveys reveal that significant numbers of US and EU adults are financially illiterate.

Financial literacy in the US

One in-depth barometer of personal finance knowledge is 28 questions given annually to US adults, known as the P-Fin Index. The index explores eight functional areas across finance, such as earnings, savings, insuring and comprehending risk.

Data from the 2024 index reveals how financial literacy in the US has hovered around 50% for eight consecutive years, with a 2% drop in the past two years.

The results also show that Americans appear most comfortable with financial knowledge on borrowing, saving and consuming, and the least confident around comprehending financial risk.

To better understand Americans’ financial literacy, Professor Annamaria Lusardi and Professor Olivia Mitchell designed three multiple-choice questions, known as the Big Three. You can test yourself on these, below, and find out the answers here:

1. Suppose you had $100 in a savings account and the interest rate was 2% per year. After five years, how much do you think you would have in the account if you left the money to grow?

2. Imagine that the interest rate on your savings account was 1% per year and inflation was 2% per year. After one year, with the money in this account, would you be able to buy…

3. Do you think the following statement is true or false? Buying a single company stock usually provides a safer return than a stock mutual fund.

In 2021, just under 30% of Americans answered all of them correctly. Even more concerning, points out Professor Lusardi in a Cambridge University paper, was the fact that this knowledge gap was compounded by a false sense of financial knowledge by survey respondents, who gave themselves an average rating of 5.1 out of 7. “These findings raise concerns that the gap between perception and reality can cause overconfidence when it comes to critical financial decision-making,” she said.

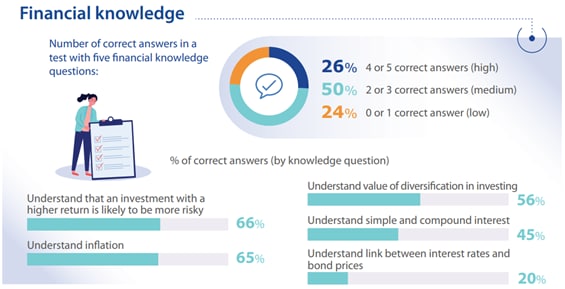

Financial literacy in the EU

The US is not alone in having a significant financial knowledge gap. In the European Union (EU) a quarter of respondents scored low for knowledge in the 2023 Eurobarometer survey on financial literacy, with 18% at a low level of financial literacy.

“This first ever EU survey on financial literacy is a wake-up call for us and Member States,” said Mairead McGuinness, Commissioner for Financial Stability, Financial Services and the Capital Markets Union. “Together we need to do more to improve levels of financial literacy in the EU. Equipping people with the confidence and skills to make informed decisions about their money is in everyone's interest.”

What is the Forum doing to improve the global banking system?

Comprehension of financial risk is particularly low

The world of money is changing significantly, so knowing how to benefit from financial markets while avoiding risk is very important. Yet, results from the P-Fin Index show that people’s comprehension of risk in the US has fallen further behind, sliding by 4% since 2017, to just 35% this year. This is a far-reaching problem, as not being alert to financial risk appears to span generations, as the chart below shows.

Being able to navigate risk is crucial, especially as we live through one of the most dynamic chapters in the history of finance. Around 1 billion people could be using cryptocurrencies by 2028, Statista data shows, and revenues in the fintech industry could grow almost three times faster between now and 2028 than those in the traditional banking sector, according to McKinsey.

The state of retirement fluency

The global economy is also struggling, which directly impacts inflation levels and therefore risk for the general population. This year is expected to be “another tough year” with “sluggish global growth”, says António Guterres, the Secretary-General of the United Nations, in the latest World Economic Situation and Prospects 2024 report.

And people are living longer than ever, which means the traditional retirement plan for nearly 2 billion people may need adjusting. By 2050, the proportion of the world's population over 60 years will reach 22%, according to the World Health Organization (WHO). For this reason, the P-Fin Index included five questions specifically aimed at retirement fluency in the US for the first time this year.

How to be financially savvy

Like any learning, understanding the ins and outs of mortgages, investments, risk profiles and other financial options takes time. But there are ways for people to develop their own financial toolkits.

The P-Fin Index recommends financial education in primary and secondary schools. Denmark already has mandatory financial education for students ages 13-15, covering budgeting, saving, banking, consumer rights and more, while the UK has incorporated it into its national curriculum. These efforts are paying off: Denmark and the UK rank first and sixth, respectively, in financial literacy worldwide, according to Standard & Poor’s Ratings Services Global Survey.

Organizations can also step forward to orchestrate learning platforms, such as the work done by partners in the World Economic Forum’s Future of Global Fintech Research Initiative. They conducted a series of multi-stakeholder regional roundtables to explore lessons learned from ongoing and recent public-private efforts to advance literacy.

Financial literacy is a journey with no end; as the world changes, so too must our knowledge. But embracing the ‘ABCs’ of money management today can help billions of people worldwide enhance their bank accounts – and in turn, their lives.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Financial and Monetary SystemsSee all

Meagan Andrews and Haleh Nazeri

May 3, 2024

Reese Epper, Brad Handler and Morgan Bazilian

April 29, 2024

Joe Myers

April 26, 2024

Lucy Hoffman

April 24, 2024