Are financial markets less liquid than they seem?

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Banking and Capital Markets

Low interest rates and other central bank policies in the United States have sent investors looking for higher returns on their investments. Money is pouring into mutual funds and exchange-traded funds, which is fuelling a mispricing of credit and a build-up of risks to liquidity in the markets—the ability to trade in assets of any size, at any time, and to find a ready buyer.

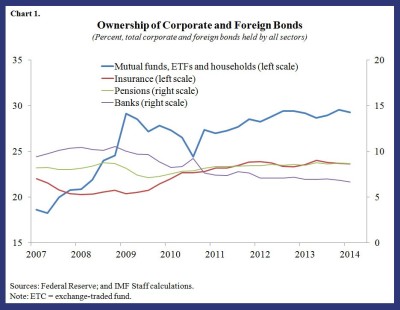

Mutual funds and exchange-trade funds are the largest owners of U.S. corporate and foreign bonds (Chart 1). This means they provide a lot of credit to grease the wheels of the financial system because they have taken investors’ money and lent it to corporates.

In our latest Global Financial Stability Report, we analyze this trend, which can create an illusion of liquidity. It turns out what we face is really a liquidity mismatch because investors can sell their mutual funds or exchange-traded fund investments almost anytime, but these funds have in turn invested their money in instruments that don’t trade quite as often, such as high-yield bonds.

While this is not a problem in good times, markets can turn volatile when the U.S. Fed starts to raise interest rates, particularly if this happens in an unexpected way. If that were the case, there is a risk that many investors would want to start selling all their holdings at once, causing asset prices to drop, which would then lead to further selling by investors, which may in turn create a vicious circle of further losses and more selling.

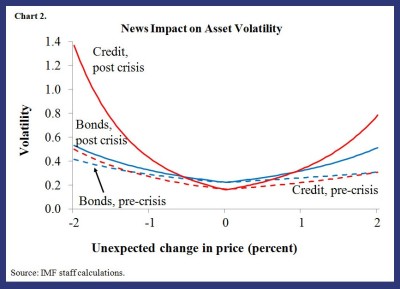

All this would complicate the task of a smooth exit from these monetary policies because of the risk of a bumpier exit associated with greater losses and volatility in fixed income markets. We’ve already seen an increased sensitivity of financial markets to price shocks since the crisis (Chart 2), especially for credit products, which can lead to faster selloffs.

More ingredients

To complicate matters, all this money flowing into mutual funds and exchange-trade funds may have created this illusion of liquidity at a time of other changes across financial markets:

- Inflows into these vehicles have enhanced “inflow’ liquidity, or the capacity to trade assets cheaply, but other structural measures of liquidity in markets, such as its depth and breadth, have deteriorated.

- A few fund managers hold large amount of assets, and there is what we call a “brand risk” stemming from high concentration in the decision making across funds, as well as increasing concentration of holdings of individual bond issuers.

- There is a reduction in the liquidity available from banks, which are traditional “shock absorbers,” as well as increasing sensitivity of hedge funds to asset price changes, and institutional investors playing less of a countercyclical role.

$3.8 trillion up in smoke

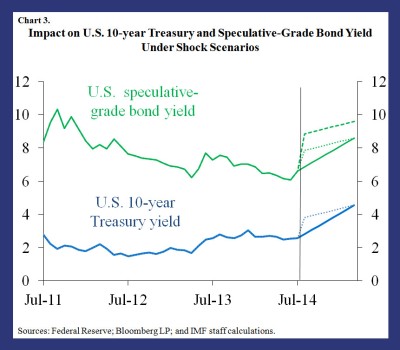

The result of a rapid switch to highly volatile markets would drive a faster rise in term premiums, and widening credit spreads would spill over to global markets. For example, we estimate that an unexpected market adjustment that causes term premia in bond markets to revert to historic norms (a 100 basis points increase) and credit risk premia to normalize (a repricing of 100 basis points) could rapidly push up bond yields (Chart 3), reducing the market value of global bond portfolios by over 8 percent—that’s $3.8 trillion.

These risks to exit mean officials need to address the existing liquidity mismatches. They can do this through prudential policy measures such as removing incentives of asset owners to run—by aligning redemption terms of funds with the underlying liquidity in the assets invested.

Published in collaboration with iMFdirect Blog.

Authors: Fabio Cortes is an Economist in the IMF’s Monetary and Capital Markets Department. David Jones is a senior financial sector expert in the Monetary and Capital Markets Group and the New York Representative. Evan Papageorgiou is a Financial Sector Expert in the Global Markets Monitoring & Analysis Division of the IMF’s Monetary and Capital Markets Department.

Image: U.S. one dollar bills are displayed in this posed photograph in Toronto. REUTERS/Mark Blinch.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Financial and Monetary SystemsSee all

Joe Myers

April 26, 2024

Lucy Hoffman

April 24, 2024

Michelle Meineke

April 24, 2024

Annamaria Lusardi and Andrea Sticha

April 24, 2024

Emma Charlton

April 24, 2024

Piyachart "Arm" Isarabhakdee

April 23, 2024