Why fintech is here to stay

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Financial and Monetary Systems

There are 200 million small and medium-sized enterprises (SMEs) worldwide that have no access to formal financial services. This represents a $2 billion gap of funds for capital investments and working capital to increase their growth prospects.

Why does this gap exist and who is stepping in to service the SMEs?

Even before the financial crisis of 2008, the SMEs already had difficulty getting a loan from financial services institutions who concentrated their efforts on large corporations, leaving the very small companies to the microfinance institutions. SMEs fell between those two groups with little to no formal financial sector financing.

Now that the financial crisis is behind us, it has become even more difficult for SMEs to secure their funding needs for growth as regulation and enhanced capital requirements have made such loans even more expensive and less interesting to the regulated financial institutions.

This gap is being filled with companies who use technology to decrease cost and measure risk in a new and efficient way. These companies have created an entire new industry called “fintech” (a contraction of “finance” and “technology” defined as the use of technology and innovative business models in financial services). Through their agility to adapt to the ever-changing financial environment, these companies are disrupting the financial services industry and filling the gap providing financial services to SMEs.

From 2013 to 2014, equity investment into fintech companies has quadrupled from $4 billion to more than $12 billion, fueling innovation in the sector.

Fintech companies have made a small dent in the SME lending space with an estimated $60 billion to $70 billion outstanding volume in marketplace lending compared to $14 trillion to $18 trillion of total bank lending to SMEs. But the growth is promising as hedge funds, pension funds and institutional investors are showing interest in the space by providing funding to these fintech lending platforms, allowing them to grow.

But fintech companies are not only about credit and lending:

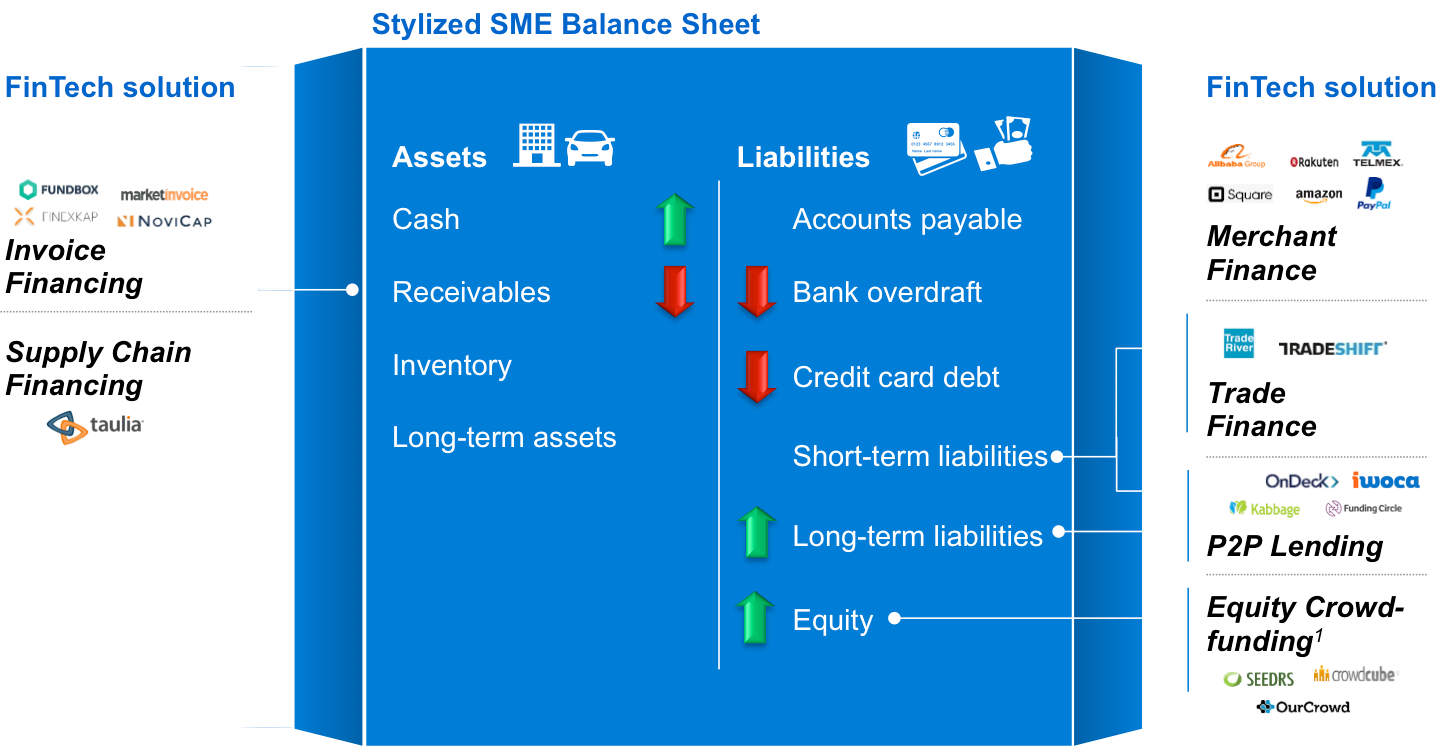

- Looking at a typical SME balance sheet, fintech companies touch all line items including receivables financing, short and long term liabilities, as well as equity. Fintech companies are innovating in the way they provide low cost payment solutions and novel ways of collecting data for credit analysis.

- Through data collection, fintech companies such as Finexkap are able to decrease the time between billing and payment dramatically by automating the transfer of billing information from the SME to the lender, thus creating invoice financing, an alternative to the traditional receivable financing and factoring.

- Merchant and e-commerce financing companies attached to retailer outfits such as Amazon or Alibaba, using internal algorithms based on seller data points such as the frequency at which merchants run out of stock, the popularity of their product and inventory cycle, have successfully provided lending to their sellers to expand their business.

The World Economic Forum Global Agenda Council on the Future of Financing and Capital has released The Future of FinTech, a white paper outlining how SMEs are able to access financial services through the innovative fintech sector.

Traditional banks will continue to play a large part in the financial services industry, including providing loans to SMEs. But fintech companies, with their agility to adapt quickly and use of technology to lower costs and provide novel credit analysis systems, will continue to increase access to funds for SMEs.

The report, The Future of Fintech, is available here.

Author: Michael Koenitzer, Project Lead, Financial Inclusion, World Economic Forum

Image: A man holding his mobile phone sits as pedestrians walk past in Tokyo October 1, 2015. REUTERS/Toru Hanai

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Financial and Monetary SystemsSee all

Lucy Hoffman

April 24, 2024

Michelle Meineke

April 24, 2024

Annamaria Lusardi and Andrea Sticha

April 24, 2024

Emma Charlton

April 24, 2024

Piyachart "Arm" Isarabhakdee

April 23, 2024

Kate Whiting

April 23, 2024