Coronavirus: What does 'furlough' mean and how will it affect workers worldwide?

From 80% wage grants to a $2 trillion rescue package, how countries are supporting employers affected by COVID-19. Image: REUTERS/Hannah McKay

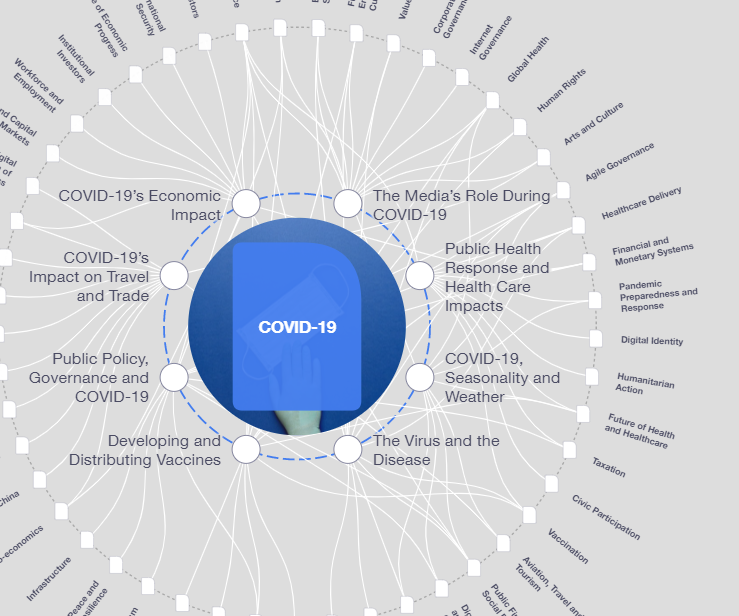

Explore and monitor how COVID-19 is affecting economies, industries and global issues

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

COVID-19

As country after country goes into coronavirus lockdown, whole industries have ground to a sudden halt. The retail, hospitality and travel sectors have been hit particularly hard as a result.

Many businesses have responded to this crisis by placing their staff on furlough - that is, unpaid leave - rather than laying them off completely. In both cases, workers are hit by a sudden loss of income; the difference is that furloughed staff remain on their employer’s payroll, ready to start work again once the economy gets back into gear.

Major employers around the world have been taking this approach. Scandinavian Airlines, for example, has furloughed 90% of its staff, while the world’s largest hotel company, Marriott International, has begun to furlough tens of thousands of its employees. US department store Macy’s, GE, the British sandwich shop chain Pret A Manger - the list goes on.

This clearly makes sense for businesses who want to get back up to speed as quickly as possible once this crisis has passed. But what does it mean for the furloughed employees themselves?

Governments across the world are intervening to support businesses and employees in coping with this unprecedented shock - but the level of support and who is eligible differs from country to country. The UK and US governments, for example, have set up schemes to pay furloughed workers 80% and 100% of their salaries for a period of three and four months respectively; the question of how sustainable these levels of support will be further down the line, however, is currently unknown.

Here's a rundown of what governments around the world are doing to help furloughed staff and their employers cushion the coronavirus blow.

UK employers have been offered government grants to cover 80% of wages for staff on their payroll who are not working because of the COVID-19 pandemic. The Coronavirus Job Retention Scheme launched on 20 March will cover pay up to a maximum of £2,500 per worker per month.

Have you read?

While the intervention is welcome news to employers, working out who qualifies and how to apply for the scheme is the next challenge. Crucial to this is understanding the idea of furlough and to whom it applies.

Under the scheme, there is no limit on how many staff can be furloughed, but employees must agree to it and it can only last for three months starting from 1 March 2020, according to People Management, which has produced an expert Q&A on the initiative. Those placed on furlough cannot continue to work for the employer, even at reduced hours, if they wish to qualify.

“If you have some work for staff, they do not qualify for furlough. But it should be fairly obvious which staff can be furloughed because you will have no work for them at this time,” Angela Brumpton, partner at Gunnercooke, tells People Management, adding that employers will need to prove the business has been negatively impacted in order to qualify for the scheme.

Part-time workers are eligible for the scheme, including those on an agency, flexible or zero-hours contracts, so long as they’ve been on the PAYE payroll since 28 February 2020. Employees made redundant since that date owing to a downturn in business relating to COVID-19 could be covered too if they are rehired by their employer, says People Management.

On 25 March, the US Senate passed a $2 trillion coronavirus rescue package. Part of this fund will be used to pay the wages of some workers who remain on companies’ payrolls or those who have lost their jobs as a result of the downturn.

The package includes a $367 billion employee retention fund for small businesses.

Companies receiving assistance could be asked to maintain employment levels at 90% of what they were pre-pandemic, according to The New York Times: "Businesses with 500 or fewer employees will get loans directly from banks to cover more than two months of payrolls and some other operating expenses, with the government paying off the balance so long as the companies either do not lay off workers or rehire ones they’ve already let go."

"The state will bear the financial burden of the people who have to stay home," French President Emmanuel Macron has said. "We won't add fear of bankruptcy and unemployment to the health crisis," Macron said.

Support for companies and workers that will cost a reported €45 billion has been promised, including ways to pay workers temporarily laid-off during the crisis and payments for parents who are looking after their children at home owing to school closures.

In Denmark, 75% of workers’ salaries (up to a maximum of 23,000 kroner or roughly £2,840 a month) will be subsidized by the government if firms promise not to fire employees. In Sweden, employees will receive 90% per cent of their wages and work reduced hours thanks to heavy subsidies from the state.

The Australian government is making AUD$130 billion (£63.5 billion) available over the next six months to support the wages of employees in businesses that have seen significant drops in turnover. As many as 6 million workers could be eligible for wage subsidies of AUD$1,500 (approximately £733) per fortnight. The provisions include workers who have been laid off since 1 March.

Eligible businesses are those who've experienced a drop in turnover of at least 30% or at least 50% for large employers with more than $1 billion of turnover. Full and part-time workers, sole traders, and casuals who have been with an employer for 12 months or more will qualify for the fortnightly JobKeeper payment.

In February, a growing number of private companies in China announced wage cuts or delays to staff pay.

"Across China, companies are telling workers that there’s no money for them – or that they shouldn’t have to pay full salaries to quarantined employees who don’t come to work," reports Bloomberg.

In Beijing, employers were allowed to temporarily suspend workers, as long as employees gave consent and those affected received 70% of the minimum wage.

Some tax relief measures have been introduced to help businesses affected by the pandemic, though these vary by region and local authority, with the hardest-hit industries often prioritized.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Health and Healthcare SystemsSee all

Katherine Klemperer and Anthony McDonnell

April 25, 2024

Vincenzo Ventricelli

April 25, 2024

Shyam Bishen

April 24, 2024

Shyam Bishen and Annika Green

April 22, 2024

Johnny Wood

April 17, 2024