In North America, renewables are steadily gaining ground on oil

At present, solar is the third largest renewable source in the power sector after hydropower and wind. Image: REUTERS/Bing Guan

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

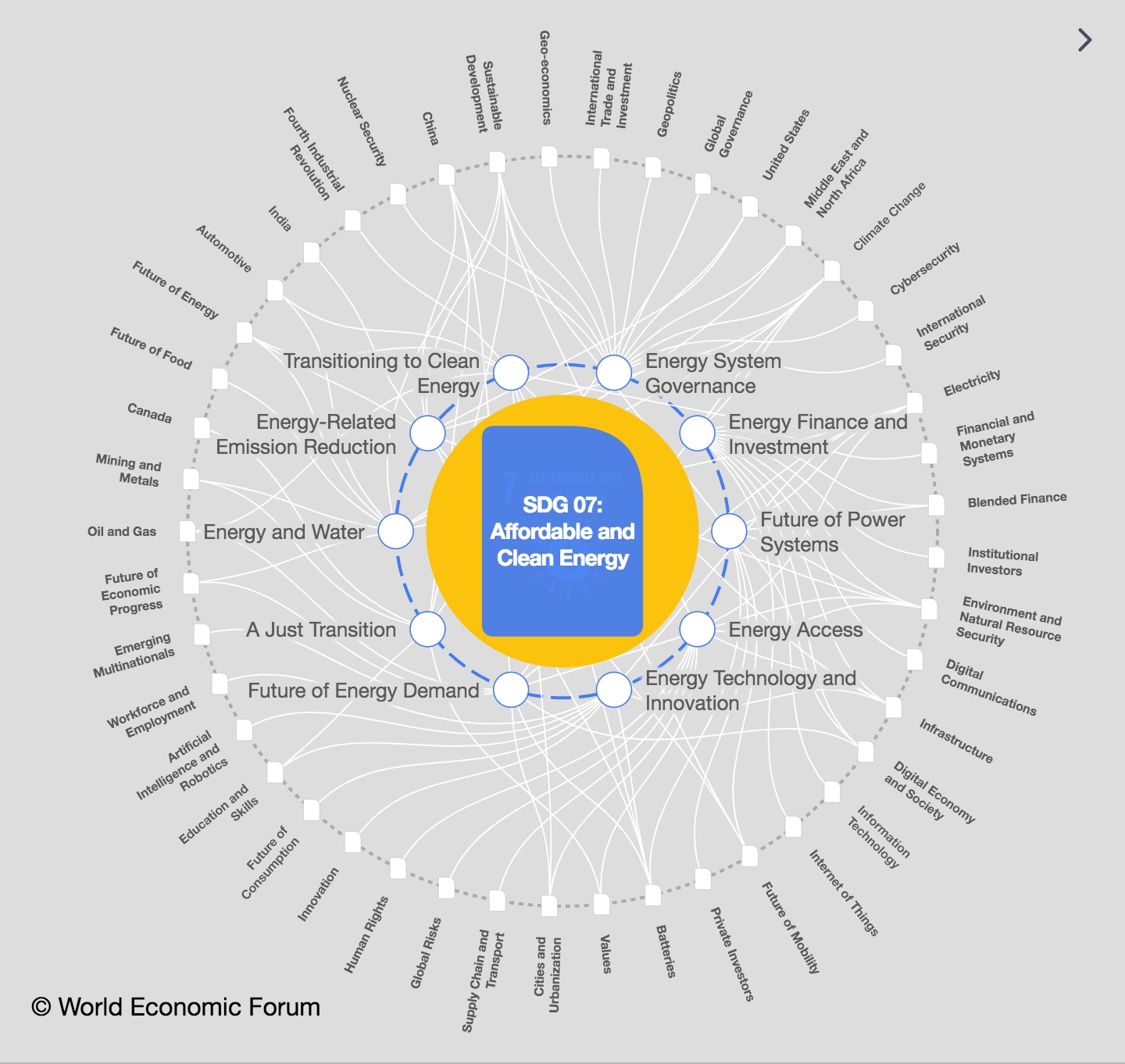

SDG 07: Affordable and Clean Energy

- Fossil fuels make up 80% of the domestic energy supply in Canada and the US combined.

- But that is slowly changing, and new predictions have revealed the pace of that change.

- Domestic consumption in North America is predicted to fall by 75% between now and 2050, which equates to almost half of the reduction of global oil demand.

The interests of the oil and gas industry run deep in North America. From Highland Park Ford Plant in Michigan, the Model T became the world’s first mass-produced car, with a gasoline-powered four-cylinder engine at its heart. And in the US and the wider world, the rest was history. But today, we are staring down a new global-scale transition: away from fossil fuels and toward renewable energy production.

Today, the US is still the largest oil consumer in the world — as it has been for much for the last 100 years — and fossil fuels make up 80% of the domestic energy supply in Canada and the US combined.

Yet, so potent are the efficiencies of solar and wind power, that in the space of a generation, the energy mix in North America and beyond will be transformed.

A deep dive on North America's energy transition

DNV has taken a deep dive into the energy transition in the US and Canada, forecasting the most likely energy future in 2050. The model used has been honed over the seven years since the company started forecasting the global energy transition.

The overall story for North America is one of domestic decarbonization. The 80% fossil fuel make up of energy supply will drop to just under half by 2050. This will primarily be driven by rapid electrification, particularly road transport and in homes, and the increase in solar and wind as a means to generate that electricity.

Domestic consumption in North America will fall by 75% between now and 2050, which equates to almost half of the reduction of global oil demand. All things considered, oil production in the US and Canada was about 17 million barrels per day (Mbpd) in 2022, and DMV’s forecast foresees it plateauing until 2024 then ultimately declining to just 7 Mbpd by 2050. The land of big oil, though, will remain a leading producer of the black stuff — even if the market will be much smaller. Export volumes of oil will grow until 2030 and then stabilize, while export volumes of natural gas will remain stable at the present volumes.

Electricity’s share in final energy demand will grow to 41% in 2050, from 21% in 2022. At present, solar is the third largest renewable source in the power sector after hydropower and wind. By 2050, solar PV will have grown 15-fold from today’s levels and will account for almost half of all electricity generated in North America and will be the region’s leading source of power.

The wind story is complicated, in the short term at least, by inflationary pressures hitting supply chains. However, boosted by the Inflation Reduction Act (IRA) and the 2023 Canadian Clean Energy Plan, DMV forecasts that wind will grow 8-fold and account for 35% of electricity generation in the two countries by midcentury.

The role of policy in the energy transition

Policy is important in changing the way energy is supplied and consumed across North America. The IRA is accelerating the energy transition in the US, largely by giving stability to technologies essential to the transition.

The development of wind power in the US, for example, has largely been driven by the Production Tax Credit originally enacted in 1992, but it was implemented in fits and starts in one- or two-year increments. The IRA has provided a ten year window of support for not only wind, but also for less mature industries like hydrogen and direct air capture, the technology used to extract carbon from the atmosphere.

Even if the IRA is accelerating the energy transition, the same administration approved the development of the massive Willow project in Alaska which holds up to 600 million barrels of oil. It is a reflection of how governments, even when they are keen to increase green energy supply, are prioritizing energy security — and oil is still seen as a way to achieve this goal.

Even if the IRA hastens the energy transition in the US, more is needed for it to hit net zero by 2050. In the present forecast, North American emissions per capita will likely be three times Europe's in 2050. For the transition to accelerate, policy that more actively reduces fossil fuel use must be added to the present support for renewables.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Climate ActionSee all

Neeshad Shafi

May 1, 2024

Johnny Wood

May 1, 2024

Nils Aldag and Christopher Frey

May 1, 2024

Pooja Chhabria and Michelle Meineke

April 28, 2024

Lisa Donahue and Vance Scott

April 28, 2024