Al Gore: 3 ways to scale green investment in 2024

Al Gore believes a net-zero future is within reach. Here's how to get there Image: Reuters/Kevin Lamarque

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Climate Crisis

- Green investments decreased in 2023, but to achieve net-zero greenhouse gas emissions by 2050, $5 trillion will need to be invested annually by 2030.

- Al Gore talks to the World Economic Forum about the 3 key drivers he believes will boost green investment.

- Mobilizing sustainable investment is also the goal of the Forum’s multi-stakeholder Financing the Transition to a Net Zero Future initiative.

Green investments have had a somewhat rocky 2023. At $1.3 trillion, sustainable finance issuance volumes were down substantially from their peak of $1.8 trillion in 2021, according to magazine The Banker.

Geopolitical changes and a fear of greenwashing have played a big part in this and are likely to continue to affect sustainable finance, the magazine predicts. Yet, the International Monetary Fund (IMF) has calculated that to achieve net-zero greenhouse gas emissions by 2050, around $5 trillion will need to be invested annually in climate mitigation by 2030.

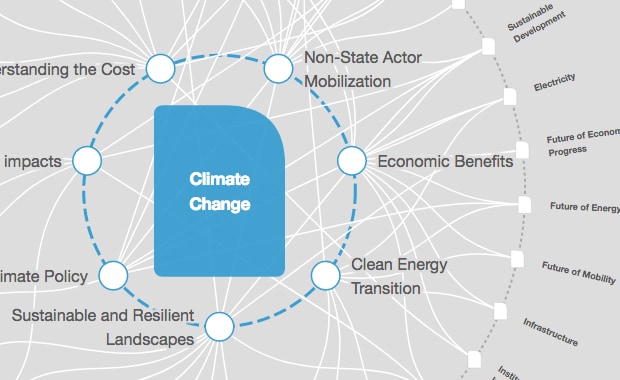

What’s the World Economic Forum doing about climate change?

The World Economic Forum spoke to Al Gore, former Vice President of the United States and one of the world’s best-known environmentalists, about what it will take to boost green investment.

Gore is a founding partner and chairman of sustainable investor Generation Investment Management, as well as founder and chairman of the Climate Reality Project, and a co-founder of Climate Trace.

Giving sustainable finance a boost

1. Stop subsidizing fossil fuels

Despite the chequered green investment landscape last year, for every dollar spent on fossil fuels in 2023, $1.7 was spent on clean energy – compared to a 1:1 ratio in 2018, according to the International Energy Agency. But the fact remains that fossil fuel investments are on the rise again.

One important factor here is fossil fuel subsidies, which the IMF says amounted to $7 trillion or 7.1% of global GDP in 2022. This was $2 trillion more than in 2020, driven by government intervention against the energy crisis.

Al Gore sees removing these subsidies as the No 1 intervention needed to bolster climate finance.

“We should motivate people in every country to demand an end to government subsidies for fossil fuels,” he told the Forum.

“The climate crisis, of course, is a fossil fuel crisis. And yet, governments around the world are subsidizing the burning of fossil fuels at a rate 42 times larger than the subsidies for renewable energy.”

Some hope may come from the launch of a new coalition at COP28, led by the Dutch government, to phase out fossil fuel subsidies. It aims to increase the transparency of subsidies, foster international cooperation to root out cross-national barriers and collaborate to set meaningful national targets for the signatories.

2. The benefits of carbon taxation

“We also need a carbon tax or a carbon fee, and we've known that for a long time, and some have given up on the possibility of that idea because it is admittedly quite difficult,” Gore explained.

“But there are some new approaches, such as the carbon border adjustment mechanism, which is attractive to many people – including in my own country, the US – that have never been friendly to the idea of a carbon tax in the past.”

Carbon taxation has indeed been controversial, leading some governments to hold off on implementation.

However, the approach has been shown to work, not least in the case of the EU’s Emission Trading System (EU ETS), which saw emissions decrease by 38% between 2005 and 2022. The ETS is currently transitioning to the new Carbon Border Adjustment Mechanism.

In conjunction with forcing down subsidies, carbon taxation is another mechanism to make fossil fuel investments unviable, freeing up funds and making a dent in the $5 trillion needed for sustainable initiatives.

“I think that when we secure policy changes of this sort, it's going to become easier to mobilize the private capital necessary to deploy the solutions to the climate crisis,” Gore added.

3. Sustainable investment in the developing world

Gore is particularly concerned about where the funding gap leaves the most vulnerable geographies.

“We have to address the access to capital available to developing countries, because there is a so-called ‘home bias’, which means that 90% of the capital raised in a country goes to projects in that country.”

He underlined that the countries most affected by climate change are low-income countries that don’t have the resources to mitigate and adapt to climate change.

“Many developing countries, which desperately need this help, don't have access to the private capital that's necessary to build out solar and wind farms, battery factories and all the other technologies that are now available.”

McKinsey has calculated that there is a $2 trillion finance gap annually by 2030 that needs to be plugged to help these nations meet the Paris Climate goals.

“And these are countries that have done the least to create the climate crisis,” Gore stressed.

“It calls upon our conscience to respect the principles of climate justice and environmental justice, to try to help people deal with these growing dangerous consequences.”

Sustainable finance will pay off

While putting these three measures in place will amount to some heavy lifting, Gore also spoke of his belief that the net-zero future is achievable and well within reach.

“It's important to understand that once we reach true net zero and stop adding to the overburden of heat-trapping pollution, temperatures will stop going up almost immediately, with a lag of as little as 3 to 5 years. That's incredible.

“And even more amazing is that if we stay at true net zero, half of the human-caused greenhouse gas pollution will have fallen out of the atmosphere in as little as 25 to 30 years. So there's abundant hope.”

In line with Gore’s call to action, the Forum’s Financing the Transition to a Net Zero Future initiative brings together a multi-stakeholder community to develop the mechanisms necessary to mobilize private capital.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Climate ActionSee all

Neeshad Shafi

May 1, 2024

Johnny Wood

May 1, 2024

Nils Aldag and Christopher Frey

May 1, 2024

Pooja Chhabria and Michelle Meineke

April 28, 2024

Lisa Donahue and Vance Scott

April 28, 2024

Kate Whiting

April 26, 2024