6 ways the pandemic has changed businesses

Food for thought: The pandemic has closed restaurants and boosted delivery services Image: REUTERS/Ints Kalnins - RC2E0K93SQE4

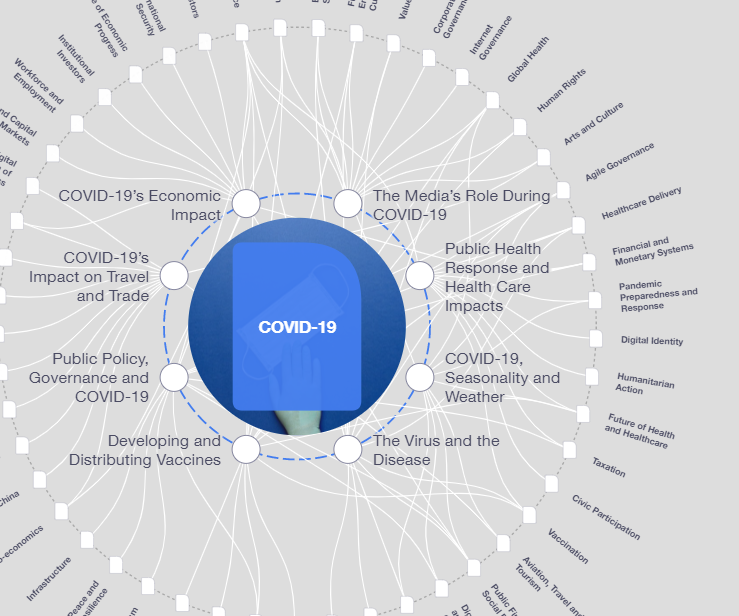

Explore and monitor how COVID-19 is affecting economies, industries and global issues

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

COVID-19

- Sectors like healthcare and banking are battered but not beaten by COVID-19 disruption, McKinsey analysis finds.

- Digital delivery features large in the post-pandemic futures of six sectors.

- The World Economic Forum’s ‘Pioneers of Change Summit’ will showcase solutions for a ‘Great Reset’ across industries and regions.

Even with the promise of a vaccine edging closer, economic recovery could be years away for some sectors.

Yet companies that reimagine their operations will perform best in the next normal, according to management consultancy, McKinsey & Company.

In its executive briefing on COVID-19, McKinsey takes a look at how things might develop in six sectors.

1. Auto industry – down, but not out

Pandemic disruption will wipe $100 billion off the auto industry’s profits, McKinsey predicts, with sales expected to drop by 20 to 30% in 2020. But automakers were already facing disruptions before COVID – including driverless cars, automated factories and ridesharing – and the industry can bounce back, it says.

Opportunities include the huge shift to online shopping and the rise of software-subscription services, which enable people to pay for programmes that unlock features like heated seating or full self-driving capabilities, McKinsey says.

Restaurant industry – innovation still on the menu

Indoor dining in restaurants may not return to pre-crisis levels for months – or possibly even years, McKinsey warns. For full-service restaurant operators, it means developing a new long-term economic model.

There are opportunities to optimize takeaway and drive-through operations and re-engineer menus and pricing. This might include finding the right balance of special offers and "high-margin items such as appetizers, sides, desserts and beverages,” McKinsey suggests.

Banking industry – digital decision-making pays off

For banks, the pandemic has changed everything. “Risk-management teams are running hard to catch up with cascades of credit risk, among other challenges,” McKinsey says. The company expects that automated underwriting will come into force for retail and small-business customers and that this will reduce losses.

Calculating the creditworthiness of a small business using software, rather than having staff make these decisions, could raise margins by 5-10%, McKinsey says.

4. Insurance industry – merger partners at a premium

Mergers and acquisitions (M&A) – particularly in the insurtech (insurance technology) space – will be a key strategy for traditional insurers, McKinsey says.

Insurtechs and fintechs (financial technology companies) have been among the most responsive to customers during the COVID-19 crisis and were the first to launch products focused on the pandemic.

“For example, one Chinese insurtech released an array of such products that covered nearly 15 million people after only a few months on the market,” McKinsey notes.

5. Healthcare industry – delivering at a distance

COVID-19 has hugely accelerated the growth of digital healthcare. In 2019, 11% of US customers used telehealth. Now, 46% are using it to replace cancelled healthcare visits, McKinsey notes.

India’s Apollo Hospitals, which comprises more than 7,000 physicians and 30,000 other healthcare professionals, launched a digital health app, Apollo 24/7, in early 2020. Within six months, the app had enrolled four million people, with around 30,000 downloads a day.

Public-private partnerships are also working well and have the potential to “influence the future of healthcare,” McKinsey says.

6. Education – learning to adapt

In education, the pandemic has amplified existing challenges around inclusion, inequalities and drop-out rates. For example, lower-income students are 55% more likely to delay graduation due to the COVID-19 crisis than their higher-income peers, McKinsey warns.

With remote and online learning here to stay, institutions have a “once-in-a-generation chance” to reconfigure their use of physical and virtual space.

“They may be able to reduce the number of large lecture halls, for example, and convert them into flexible working pods or performance spaces,” McKinsey suggests. “Or they could reimagine the academic calendar, offering instruction into the summer months.”

Moving forward

The World Economic Forum’s inaugural Pioneers of Change Summit on 16-20 November will convene innovative leaders and entrepreneurs from around the world to showcase their solutions, build meaningful connections and inspire change across the Forum’s diverse multi-stakeholder communities.

The digital event is an opportunity to share and develop mechanisms for driving a Great Reset across industries and regions.

Individuals can sign up to follow the event, while companies can participate in the summit by becoming a member of the Forum’s New Champions Community of high-growth companies.

What is the World Economic Forum doing to manage emerging risks from COVID-19?

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Health and Healthcare SystemsSee all

Katherine Klemperer and Anthony McDonnell

April 25, 2024

Vincenzo Ventricelli

April 25, 2024

Shyam Bishen

April 24, 2024

Shyam Bishen and Annika Green

April 22, 2024

Johnny Wood

April 17, 2024