Global Goals: where will we find $37 trillion?

In September of this year, the UN General Assembly adopted 17 Sustainable Development Goals, a universal set of targets and indicators that will frame the development agenda for the next 15 years. These goals are comprehensive and ambitious – and rightly so – aiming to end extreme poverty in all its forms in a decade and a half. They address issues ranging from health and climate to peace and justice. Implementing this, it turns out, could get expensive – figures vary but the UN Conference on Trade and Development (UNCTAD) has forecast that funding the SDGs will cost an additional $2.5 trillion a year over the next 15 years.

So where is this finance going to come from?

By far the largest source of funding for most countries are domestic resources, either from the private sector, or those raised through tax, which can be put towards public services and infrastructure.

Source: ICTD

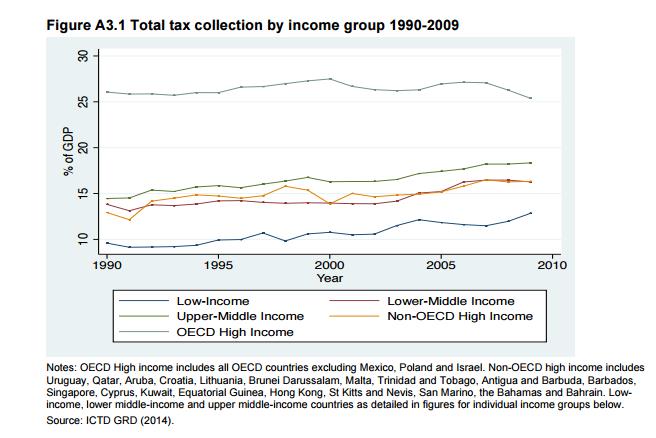

Tax revenue in developing countries has been creeping upwards over the past couple of decades: non-resource tax collection in developing countries as a whole increased from an average of about 13% of GDP in 1990 to about 16% in 2009.

However there is plenty of potential to further increase domestic resource mobilisation, bringing tax revenue closer to that of OECD countries, which average above 25% of GDP. This is often more about improving the tax system, with better taxpayer services, audits and fraud prevention, than it is about raising the tax rate. Improved tax systems mean more revenue to spend on implementing the SDGs, and will be crucial in meeting the current financing shortfall.

External finance is critical as well though.

Amongst developing countries overall, personal remittances – money transferred by expatriates to their nearest and dearest in their home countries – followed by Foreign Direct Investment (FDI), make up the largest part of external resource flows (click on the image below to explore an interactive graphic on external flows of finance).

However, this disguises considerable discrepancies between different income groups; where Official Development Assistance (ODA) makes up only 8% of external resource flows for Upper Middle Income Countries, a whopping 78% of Least Developed Countries’ external resources come from this (click on image below for more).

The sheer volume of remittances makes them an important source of finance to developing countries; remittances to Africa have increased six-fold since 2000 and are projected to reach $64.6 billion in 2015. But the high costs of sending money from one country to another, currently around 7.5% means much of the potential development impact is missed. Reaching the target set out in the Addis Ababa Action Agenda of reducing transaction costs to 3% will take a concerted international effort but would save migrants and their families billions of dollars annually.

While FDI is already a very significant contributor to financing for development, infrastructure needs across the developing world remain massive, and poorer groups of countries, with the highest development needs, see the lowest levels of investment. And the paradox is that it’s not because of a lack of finance, but instead a lack of skills to develop bankable projects, a lack of suitable investment vehicles, weak regulatory and investment environments, and a lack of capacity to analyse infrastructure investments and actual risk. Overcoming these obstacles, and improving the risk/return profile of projects, would go quite some way towards meeting development financing needs.

ODA has increased by 66% in real terms since the Millennium Development Goals were agreed in 2000 and is a critical form of finance for Least Developed Countries. But as countries become more developed, and in times of much tightening of belts in donor countries, it can only take us so far. The challenge going forward is in ensuring that aid and related forms of finance are used most strategically, as a catalyst to mobilise other resources, resulting in many times their initial value in finance for development.

Innovative forms of partnerships and blended finance draw the private sector in to investments they otherwise would not make. Multilateral Development Banks are deepening their efforts in strengthening local financial and capital markets, expanding local banking, and enhancing financial infrastructure, with the overall aim of ensuring a business environment that supports both the domestic and international private sector. When USAID put $5.8 million towards strengthening the tax system in El Salvador, it resulted in a $350 million increase in annual revenue.

So it is clear that both domestic and international, public and private financing will be needed to finance the SDGs. But that isn’t the whole picture. A report released this week by Global Financial Integrity, a US-based research and advocacy organisation, shows illicit financial flows from developing and emerging economies, much of which takes the form of trade misinvoicing, or misreporting the value of a commercial transaction on an invoice submitted to customs, surged to $1.1 trillion in 2013 – that is 4.0% of the developing world’s GDP.

Or to put that in perspective, in seven of the ten years studied more money left developing countries illicitly than entered as foreign aid and foreign direct investment combined. This gap needs to be plugged.

Have you read?

What are the Sustainable Development Goals?

3 challenges facing the UN’s Sustainable Development Goals

Stephen Hawking on the SDGs: “We are all time-travellers”

Author: Victoria Crawford, Community Lead, International Organisations and Government Affairs, World Economic Forum

Image: A woman sits under a palm tree at dusk after a block party in Abidjan, Ivory Coast, September 12, 2015. REUTERS/Joe Penney

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Infrastructure

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Economic GrowthSee all

Abraham Baffoe

November 18, 2025