What’s the future of blockchain?

This article is published in collaboration with Quartz.

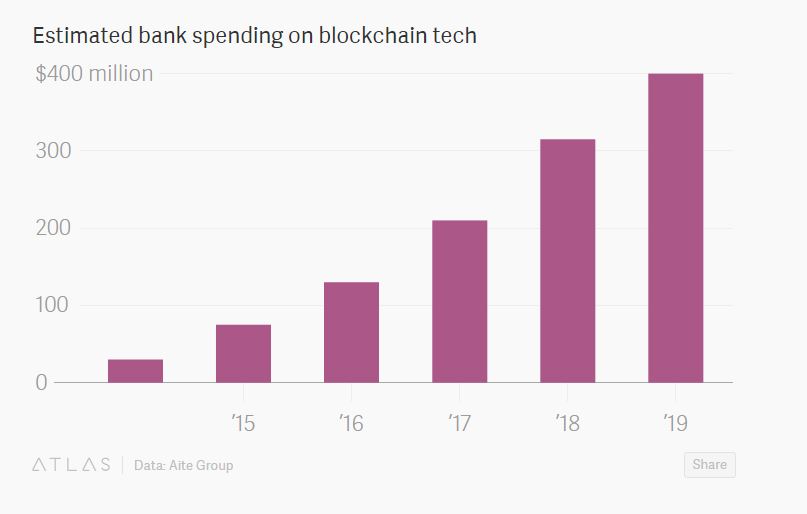

Blockchain technology, the tech that powers cryptocurrencies like bitcoin, is all the rage on Wall Street. A recent report from financial technology consultant Aite estimated that banks spent $75 million this year developing the technology. But Silicon Valley venture capitalists appear even more eager to make bets on blockchain.

To keep up with the Agenda subscribe to our weekly newsletter.

Author: Ian Kar is a contributor for Quartz.

Image: A Bitcoin (virtual currency) paper wallet with QR codes and a coin are seen in an illustration picture. REUTERS/Benoit Tessier.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.