China is an innovation superpower. This is why

China is investing more money into research and development, helping it become a superpower in innovation.

Image: REUTERS/Kim Kyung-Hoon

Stay up to date:

Innovation

Last year President Xi Jinping outlined his vision to make China the global leader in political, economic, military and environmental issues over the next three decades.

Now, comprehensive data from the National Science Foundation reveals that China is already well on its way to becoming a superpower in the key areas of science and innovation.

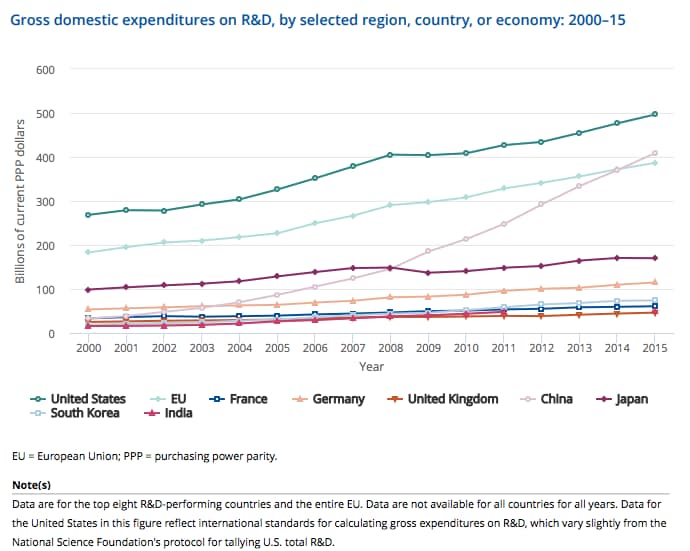

China is the second-largest spender on research and development (R&D) after the US, accounting for 21% of the world’s total of nearly $2 trillion in 2015.

China’s spending on R&D grew by an average of 18% per year between 2010 and 2015 – more than four times faster than US spending.

And, although the US still spends more on R&D, China’s rapid growth means it is likely to take the lead within the next five to 10 years.

Research and development is an indicator of investment in technology and future capabilities, and therefore plays a critical role in the innovation process and the creation of new products, processes and services.

Student power

Another key measure of innovation and technological advances is the number of students studying science and technology. Here too, China is excelling and has already overtaken the US, partly because of the size of its population.

Between 2000 and 2014, the annual number of Chinese graduates in science and engineering went from about 359,000 to 1.65 million. Over the same period, the comparable number of US graduates went from about 483,000 to 742,000.

An innovative, knowledge-based economy requires a workforce with high levels of science and engineering skills and an education system that can produce these workers in sufficient numbers, according to the National Science Board’s report.

China’s new generation of scientists is also venturing into more demanding and high-tech areas, such as supercomputers and smaller jetliners, as well as its more traditional expertise in assembling sophisticated components made elsewhere.

Turning innovation into reality

There are two other key measures of innovation: patents – which show the number of inventions; and venture capital – which provides the financial backing to turn those inventions into products.

In both these areas, China is gaining ground, although still lagging behind the US.

The US Patent and Trademark Office grants patents to inventors worldwide, with over 300,000 patents granted in 2016, primarily to the US, Japan and the EU.

But US patents to inventors from developing countries have risen from under 1% in 2000 to 6% in 2016, with China (4%) and India (1%) accounting for the bulk of these.

Access to finance – through venture capital investment – is the last piece of the jigsaw needed to spur innovation.

The US attracted slightly more than half of the $131bn of the venture capital funds available worldwide. Nevertheless, its share of the pot is in decline while China’s share continues to rise sharply.

Investment in China rose from a low base between 2006 and 2013, and then leapt from $3bn to $34bn in 2016. This means that China’s global share of venture capital funds has now risen to 27%.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Geographies in DepthSee all

Yusuf Maitama Tuggar

July 10, 2025

Kaiser Kuo

June 24, 2025

Kaiser Kuo

June 19, 2025

Aimée Dushime

April 18, 2025

Samir Saran and Anirban Sarma

April 17, 2025

Nada AlSaeed

April 16, 2025