This is the trade impact of rail services between Europe and China

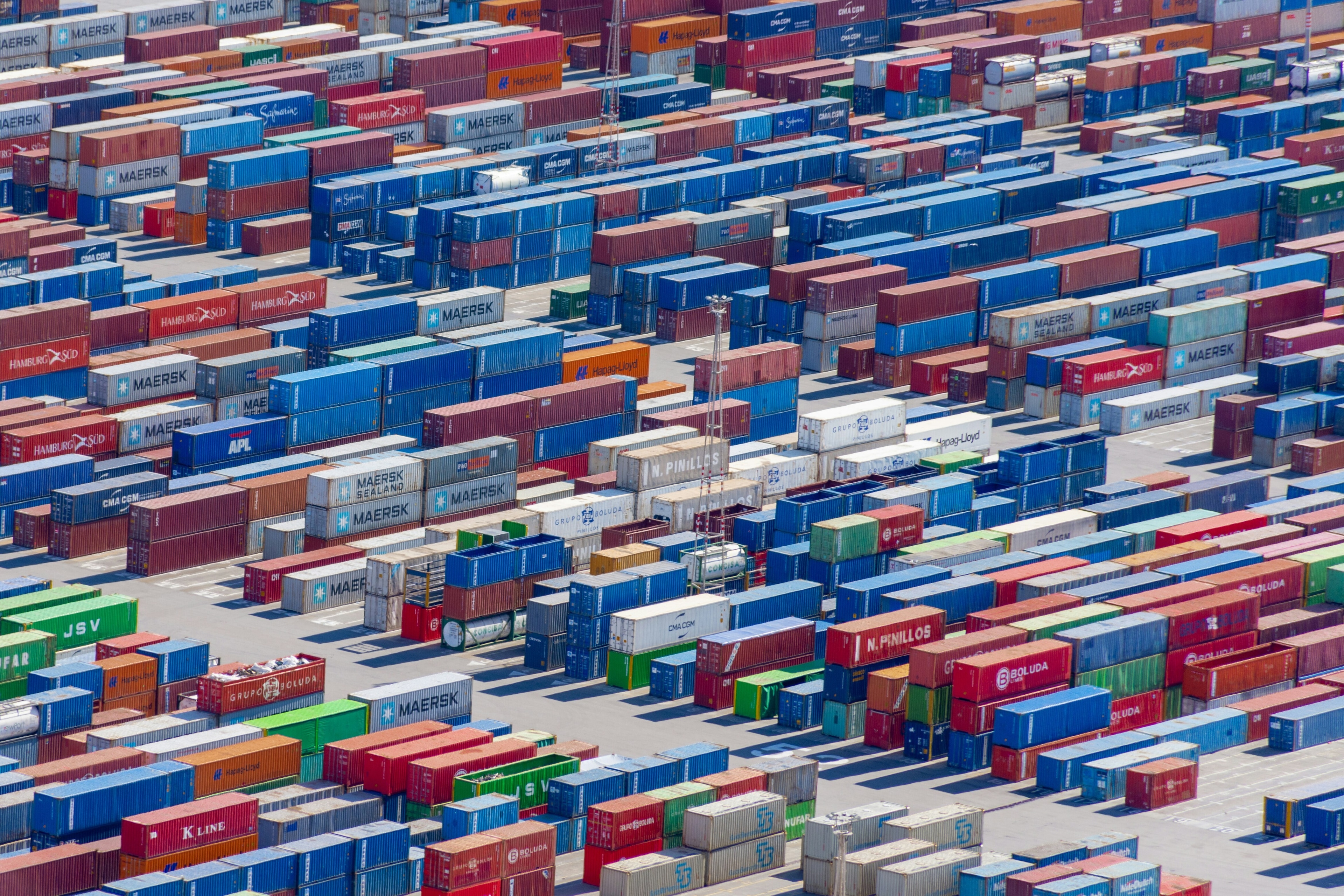

Landbridges are helping drive European-Asian trade. Image: REUTERS/Peter Nicholls

A dramatic development in the 2010s has been establishment of overland rail freight services between the EU and East Asia. Coverage of the phenomenon has tended to focus on ‘firsts’ (the first train from China to Spain, to France, to England), and academic debate has placed the Landbridge in the context of China's One Belt, One Road initiative as an instrument to increase Chinese influence. This emphasis ignores the underlying economic forces, and the significance of the Landbridge for understanding the nature of global value chains (GVCs) and the role of service providers.

A common finding is that most GVCs are regional, with three centres in North America, Europe, and East Asia (Baldwin 2016). The catalyst behind the Eurasian Landbridge was demand from global firms seeking to link their European and Asian value chains. National rail companies and other service providers responded by reducing the costs of connecting the chains by rail, which is faster with more precise delivery times than maritime transport. Little investment in physical capital was required because the track was already in existence before the 21st century. Once the Landbridge had been created, growth was driven by freight forwarders, courier firms and other companies providing services that made the rail route attractive to a larger number of potential users. The dynamic scale effects created a virtuous circle of reduced costs, more frequent service and increased route choice generating additional customers and making further service innovations profitable.

China-Europe rail links before and after 2011

Overland trade between China and Europe dates back more than two millennia, until discovery of sea routes from Europe to Asia around 1500 destroyed overland trade. After China's ‘open door’ reforms of 1978/9, transport of exports from eastern China travelled by sea and, to a much lesser extent, air freight. By 2015 the largest ships could carry over 20,000 twenty-foot-equivalent (TEU) containers through the Suez Canal.

Several rail links were constructed in the 20th century, but none was a significant carrier of China-Europe freight before 2011. Occasional block trains of flat trucks carrying containers were run along the TransSiberian Railway on an ad hoc basis for German car companies seeking to ship components to their joint-venture assembly factories in northeast China (VW/Audi in Changchun and BMW in Shenyang). Similar block trains carried Korean car components from Lianyungang to the UzDaewoo joint-venture factory in Uzbekistan (now GM Uzbekistan). Such journeys to and through China showed that long-distance international rail services to serve GVCs were feasible, but they were commissioned by firms as bespoke services for their own use and were not availed by other potential users.

The catalyst behind new rail services was China’s Go Westpolicy launched in 2001 to provide incentives for firms to produce in China's inland provinces. The policy's impact was minor, until a bonded train link between Shenzhen and Chongqing was opened in 2010. The bonded train brought imported components from Southeast Asia and elsewhere to the factory gate in Chongqing without border-crossing problems, highlighting the nature of the assembly facilities which Foxconn, Hewlett-Packard and others built in Chongqing as the final stage of Apple laptop or HP printer GVCs.

The new investors may have planned to export via the Yangtze River to Shanghai, but increased shipping along the Yangtze led to congestion. HP encouraged the railway companies of Germany, Poland, Belarus, Russia, Kazakhstan and China to provide a solution in the form of a Chongqing-Duisburg block train. Deutsche Bahn and China Railway Corporation provided overall quotes to clients and organised loading and unloading at the termini, while the Polish, Belarus and Kazakh rail companies collected transit fees and organised the change of gauge at the China-Kazakhstan and Belarus-Poland borders. Policy coordination among the six countries' governments was necessary to ensure smooth passage, essentially a simple transit agreement to respect seals on bonded containers. The containers returned with components for German car factories in China.

Figure 1 The route of the Chongqing-Xinjiang-Europe International Railway

The Chongqing-Duisburg block train was a commercial response by service providers to demands from two of the leading GVC sectors: cars and electronics. It was successful because, although rail was more expensive than sea, it took less than half the time (16 days between Chongqing and Duisburg, compared to a minimum 36 days and typically over 40 days by sea from Shanghai to Rotterdam) and promised reliable delivery times, both of which are important considerations for GVC participants.

The success of the Chongqing-Duisburg train led to a classic tournament. Between 2011 and 2015, at least nine different routes were trialled (Table 1). Some of these routes used the TransSiberian Railway (e.g. Harbin-Hamburg or Suzhou Warsaw), but most took the route across Kazakhstan, as in Figure 1. The trial-and-error process was a market discovery exercise to find routes on which customers were willing to pay for rail service between China and Europe. The initiative on the European side came from Deutsche Bahn (and its logistics subsidiary, DB Shenker, and the Trans Eurasian Logistics joint venture between DB and the Russian rail company), and from freight forwarders such as Vienna-based Far Eastern Landbridge and Swiss-based Interrail Group. On the Chinese side, local governments took the initiative either directly or by pushing a local company such as Yiwu Timex to establish services.

Table 1 Railway routes from China to the EU, to end of 2015

The trial process continued after 2015 and regular services were established on successful routes. In April 2016 the first China-France train went from Wuhan to Lyon in 15 days. In January 2017 the first China-UK train went from Yiwu to London. By the end of 2017, the Landbridge had connected 35 Chinese cities and 34 European cities by rail. Some connections were one-off trials, while other routes flourished. By 2018 the Duisburg-Chongqing-Duisburg route ran on a daily schedule.

The role of service providers

The original drivers (car and electronics GVCs) remain important as they wish to transform what have largely been regional value chains in Asia or in Europe into Eurasian value chains. They also benefit from increased scale and reduced costs, as schedules become more frequent and competing routes have incentives to become more efficient in reducing transit times and increasing the range of services.

Amajor reason behind the wider success of the post-2011 routes has been the early and increasing involvement of intermediaries. Freight forwarders and courier companies arranged multimodal connections, consolidated part-container loads and offered additional servicessuch as refrigerated containers. Through such service provision, hubs such as Duisburg, Łódź, and Yiwu have become popular termini. Over 300 freight forwarders and other facilitators have offices at the Duisburg hub, which provides access to rail, river, road and air transport and is within short distance of tens of millions of people in Germany, France, Belgium, Luxembourg, and the Netherlands. Poland is a centre for ecommerce fulfilment, and Łódź has become an eastern Europe hub. Yiwu in Zhejiang Province, famous as the world's largest market for small goods, has become a rail hub for the Yangtze Delta.

Multimodal hubs with a greater range of specialised service-providers are convenient places of origin or destinations for many customers. The added services appeal to GVCs, such as agribusiness, where goods may be perishable and require refrigeration, or to non-GVC traffic with part-container loads.

The role of governments

Emergence of the Landbridge after 2011 reflected a conjuncture of demand, service-provider response, and governments willing to facilitate transit trade. Time cost and predictability of border crossings are crucial, and all countries along a route must agree to simple transit procedures. Against that backdrop, the Landbridge has largely been driven by commercially motivated state-owned and private companies.1

A striking feature of the story so far is the absence of major investment. The Landbridge runs on 20th century rail-track. The main infrastructure investment has been in facilities where change of gauge is necessary between China and Kazakhstan and between Belarus and Poland. The container transfers at the change-of-gauge border are simple procedures: the incoming train and the outgoing train are lined up side by side, and a crane moves the containers from one to the other. At Khorgos, on the Kazakhstan-China border, the transfer for a 40+ container train can be done in 47 minutes. This investment has contributed to shaving the time (e.g. Chongqing-Duisburg took 16 days in 2011 and 12 days in 2017), but most of the time-saving is associated with better logistics and prioritising the profitable service.

Reduced transport costs have net benefits, but as with most economic changes there are potential losers as well as gainers. Reduced trade costs make exporters more competitive in foreign markets but subject import-competing firms to greater competition. If Eurasian value chains displace regional value chains in East Asia and Europe, then successful GVC participants in Europe and Asia may find new opportunities in the larger Eurasian GVCs while coming up against more competitors for GVC tasks.

Conclusions

As the GVC phenomenon has flourished, value chains are becoming longer and more complex. Following from sub-regional zones such as Sijori or the Pearl River Delta in the 1980s and 1990s to ‘Factory Asia’ in the 2000s (Pomfret 2011), the next step is to link the regional value chains of East Asia and Europe. This requires low trade costs (in time, money and uncertainty) across Eurasia.

The catalyst for the Landbridge rail services was car and electronics firms seeking to reduce their trade costs between German component suppliers and VW, Audi and BMW assembly plants in China and between Apple, HP and Acer assemblers in China and distribution centres for consumers of their electronics products in the EU. Production along these GVCs relies on minimising the need for inventories by securing just-in-time delivery of components to the next-stage producer and prompt delivery of the final product to distribution centres and final retailers. At current transport costs, auto components and laptops/printers fit into an intermediate category of goods for which a rail link between China and Europe offers a useful niche; the goods are too bulky for air transport, but the firms want faster and more reliable delivery than intercontinental maritime transport can provide and are prepared to pay for the time-saving that rail transport offers over maritime transport. As an added social benefit, per tonne of freight, rail is much more environmentally friendly than road or air.

Service providers have responded by reducing trade costs. Since 2011 the number of trips along the Landbridge has mushroomed to 6,235 by December 2017, and over half of those were in 2017. The freight has diversified, including two-way trade in.[2] To keep perspective, traffic on the rail Landbridge is still small compared to China-EU maritime trade. In 2016, 42,000 containers passed through Kazakhstan, a big increase over the 2,000 in 2011, but they would fit on four container freighters that can pass through the Suez Canal. Nevertheless, the rail Landbridge appears to be firmly established, with potential for further service improvement and implications for GVCs across Eurasia.

Author’s note: This column is based on a longer paper “The Eurasian Landbridge: The role of service providers in linking the regional value chains in East Asia and the European Union“ presented at the ERIA services and GVC workshop on 2-3 March in Jakarta and circulated in the ERIA Discussion Paper Series as REITI Working PaperERIA-DP-FY2018-01. It draws on material in Chapter 11 of Pomfret (forthcoming).

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Logistics

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Supply Chains and TransportationSee all

Isabel Cane and Rob Strayer

November 13, 2025