A global tipping point: Half the world is now middle class or wealthier

Five people a second are entering the middle class. Image: REUTERS/Carlos Barria

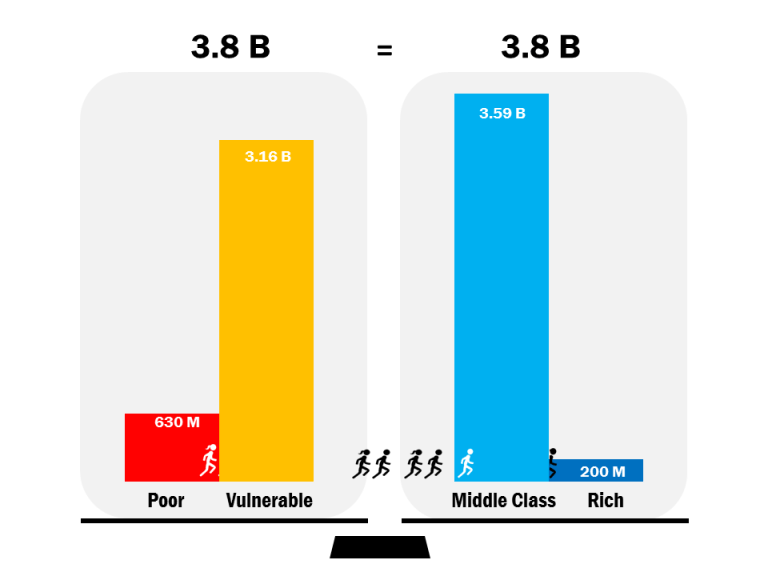

Something of enormous global significance is happening almost without notice. For the first time since agriculture-based civilization began 10,000 years ago, the majority of humankind is no longer poor or vulnerable to falling into poverty. By our calculations, as of this month, just over 50 percent of the world’s population, or some 3.8 billion people, live in households with enough discretionary expenditure to be considered “middle class” or “rich.” About the same number of people are living in households that are poor or vulnerable to poverty. So September 2018 marks a global tipping point. After this, for the first time ever, the poor and vulnerable will no longer be a majority in the world. Barring some unfortunate global economic setback, this marks the start of a new era of a middle-class majority.

We make these claims based on a classification of households into those in extreme poverty (households spending below $1.90 per person per day) and those in the middle class (households spending $11-110 per day per person in 2011 purchasing power parity, or PPP). Two other groups round out our classification: vulnerable households fall between those in poverty and the middle class; and those who are at the top of the distribution who are classified as “rich.”

Our “middle class” classification was first developed in 2010 and has been used by many researchers. While acknowledging that the middle class does not have a precise definition that can be globally applied, the threshold we use in this work has the following characteristics: those in the middle class have some discretionary income that can be used to buy consumer durables like motorcycles, refrigerators, or washing machines. They can afford to go to movies or indulge in other forms of entertainment. They may take vacations. And they are reasonably confident that they and their family can weather an economic shock—like illness or a spell of unemployment—without falling back into extreme poverty.

By classifying all households in the world into one of these four groups, using income and expenditure surveys from 188 countries, we are able to derive measures of the global distribution of income. Our social enterprise World Data Lab—the maker of World Poverty Clock—has refined these estimates and created a new interactive data model to estimate all income brackets for almost every country for every point in time until 2030 by combining demographic and economic data.

A lot has been written about the world’s progress in reducing the number of people living in extreme poverty, as highlighted in the recent Goalkeepers report put out by the Bill and Melinda Gates Foundation. We believe that another story relates to the rapid emergence of the global middle class. This middle class story is probably bigger in terms of the number of people affected. In the world today, about one person escapes extreme poverty every second; but five people a second are entering the middle class. The rich are growing too, but at a far smaller rate (1 person every 2 seconds).

Figure 1. September 2018 – The global income tipping point

Why does it matter that a middle-class tipping point has been reached and that the middle class is the most rapidly growing segment of the global income distribution? Because the middle class drive demand in the global economy and because the middle class are far more demanding of their governments.

Consider the structure of global economic demand. Private household consumption accounts for about half of global demand (the other half is evenly split between investment and government consumption). Two-thirds of household consumption comes from the middle class. The rich spend more per person, but are too few in number to drive the global economy. The poor and vulnerable are numerous, but have too little income to spend. For most businesses, the sweet spot to target is the middle class. This has long been true in individual advanced economies; it is now true on a global scale.

Targeting the global middle class is not easy. The middle class like differentiated products, and their tastes will vary from country to country. The new middle class is predominantly Asian—almost nine in 10 of the next billion middle-class consumers will be Asian—but they are spread out in China, India, and South and South East Asia. It’s no accident that the latest Hollywood hit is Crazy Rich Asians or that Asian multinationals are emerging that have built a domestic brand and now look to compete abroad.

The middle class is already the largest segment of demand in the global economy. What makes it interesting for business is that it is also the most rapidly growing segment, projected to reach some 4 billion people by end 2020 and 5.3 billion people by 2030. Compared to today, the middle class in 2030 will have 1.7 billion more people, while the vulnerable group will have 900 million fewer people. Trends for the poor and the rich and more modest, at -150 million people and +100 million, respectively.

By our calculations, the middle-class markets in China and India in 2030 will account for $14.1 trillion and $12.3 trillion, respectively, comparable in size to a U.S. middle-class market at that time of $15.9 trillion.

Figure 2. Middle class dominance in 2030

In most countries, there is a clear relationship between the fate of the middle class and the happiness of the population. According to the Gallup World Poll, new entrants into the middle class are noticeably happier than those stuck in poverty or in vulnerable households. Conversely, individuals in countries where the middle class is shrinking report greater degrees of personal stress. The middle class also puts pressure on governments to perform better. They look to their governments to provide affordable housing, education, and universal health care. They rely on public safety nets to help them in sickness, unemployment or old age. But they resist efforts of governments to impose taxes to pay the bills. This complicates the politics of middle-class societies, so they range from autocratic to liberal democracies. Many advanced and middle-income countries today are struggling to find a set of politics that can satisfy a broad middle-class majority.

The tipping point in the world today offers opportunities for business but complications for policymakers.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Economic Growth

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Economic GrowthSee all

Rishika Daryanani, Daniel Waring and Tarini Fernando

November 14, 2025