Balancing the manufacturing ecosystem in a globalized world

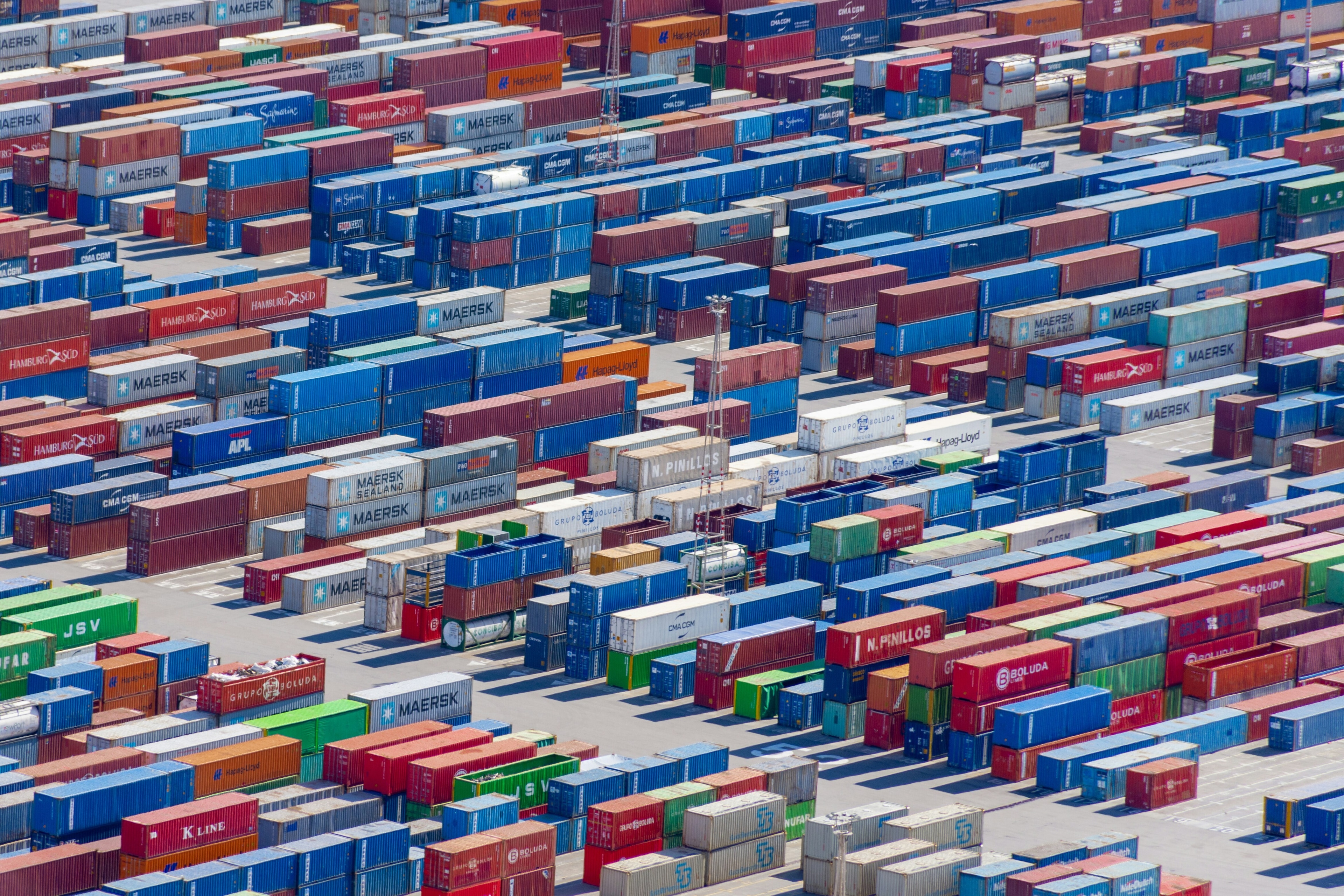

Image: REUTERS

Listen to the article

- COVID-19 disruptions forced seismic changes to global supply chains.

- Rebalanced value chains can improve resilience and sustainability while reducing costs and creating jobs.

- Public-private partnerships will be integral to building future-proof value chains.

Two years of pandemic-induced disruptions have laid bare the risks inherent to low-cost globalized supply chains. Factory shutdowns and logistical bottlenecks oceans away have disrupted access to essential goods everywhere — and continue to do so.

It is clear that we urgently need to address the risks systemic to our global value chains and reshape them instead into more resilient, equitable and cost-effective systems.

Diversifying risk

Building genuine resilience will require concerted efforts from governments around the world — their involvement is critical to making the foundational investments that will open a pathway toward creating balanced and shock-resistant supply chains.

Many have championed the reshoring of manufacturing as the centerpiece for securing critical supplies, but this is not a silver bullet. Resilient supply networks require diversifying risks across borders, while also leveraging the strengths of different geographic markets and increasing cooperation between the private and public sectors.

For example, replacing Asia’s mature manufacturing ecosystem is neither practical nor realistic. Asia will continue to be a key source of many goods and even as it seeks to move up the value chain, its manufacturing ecosystem will continue to serve the kind of production that requires low-cost scale and efficiency.

But if the goal is not to replace Asia as the world’s manufacturing hub, then what does a rebalanced value chain look like?

Rebalancing the value chain

A balanced value chain will see businesses successfully shift towards regionalized manufacturing as they move production closer to customers.

In a post-pandemic world, manufacturing will embrace automation, artificial intelligence and other Industry 4.0 tools. Competitiveness based on low-cost labor will become less relevant as manufacturing becomes increasingly technology-driven. Further, today’s rapid technological advances will pivot manufacturing towards innovative product categories that require new skill sets and conditions to build.

Rather than trying to replace Asia as a source for commodity electronic parts, there exists the opportunity to develop a different kind of manufacturing muscle — one that specializes in next-generation products.

Robust ecosystems offer new opportunities

Even before COVID-19, global value chains were under strain. Events like the 2018 tariff war had already forced businesses to reevaluate their supply chain strategies.

Some had even started to migrate their manufacturing out of Asia and closer to home, shifting to a diversified base and reducing their dependence on a single source. This also reduced the complexity of global supply networks, mitigated risks and improved visibility and velocity.

These changes also proved effective in a world of accelerated product lifecycles, which demands that goods enter markets quickly. Homeward migration of manufacturing drove faster product innovation and customization as companies tailored their products to regional consumer preferences.

What’s more, these reconstituted supply chains go a long way to reduce the carbon impact. Less fuel is required to move goods across vast distances, and less waste is generated as products are processed for recycling or reuse at local manufacturing sites.

Importantly, these changes to the supply chain system benefited local populations first, offering them jobs and creating opportunities that many missed out on during decades of globalization.

What is the World Economic Forum doing to help the manufacturing industry rebound from COVID-19?

Government leadership

While businesses can spur a reorganization of the manufacturing ecosystem into regionally-based nodes, building large-scale domestic production infrastructure capable of competing on a global level will require public-private coordination and government-led incentives and investments.

The pandemic-induced shortages made it clear that robust medical, information and communications infrastructure are all critical to national security. In manufacturing’s next chapter, states must develop strategies and accelerate new investments that guarantee they can access or manufacture those goods.

To achieve this, the international community must focus its efforts in a few key areas: building a skilled workforce, investing in critical industries, developing strategic cooperation and maintaining a focus on cost efficiency.

Manufacturing’s next chapter

Whether for programming robots or making data-driven-decisions, a reskilled workforce will be critical in a manufacturing workforce fit for the future. Public and private investment must ready workers to build emerging product categories, like automated cars and advanced medical devices. This will also create opportunities for higher-cost regions to rebuild manufacturing industries that have been eroded or exported in recent decades.

Investing in critical industries may seem obvious, but the relative decline of U.S. semiconductor manufacturing shows that this point must not be forgotten amid any future manufacturing strategy. While the U.S. leads in semiconductor R&D and design, the global share of U.S. chip-making capacity has fallen from 37 percent in 1990 to just 12 percent today — given the central role that semiconductors play in everything from high-end computers to autonomous cars, investment in critical industries like this cannot be overlooked.

Similarly, resilient supply chains must be built through cooperation. Some of this is already underway. The Pittsburgh Agreement, for instance, represents a case study in international manufacturing cooperation. And the model works for neighboring countries, too. There is significant scope to build on existing regional supply chain integrations under the US Mexico Canada Agreement to further promote North America as a competitive manufacturing platform.

But all these policies must consider the ultimate driver of manufacturing strategy: cost. Governments cannot leave it to markets to create local capacity in the absence of a skilled workforce and financial incentives. Instead, they must provide the capital infrastructure and foundation for businesses to invest in innovation, which will, in turn, create more resilient supply chains and cost-effective domestic manufacturing capacity.

Manufacturers will always gravitate towards markets that offer the most return on investment. Without incentives to invest in advanced manufacturing and capital infrastructure, and efforts to promote manufacturing among trading partners, those market forces will continue to favor long, global supply chains that have strained the global economy.

Now is a historic opportunity to combine market-based approaches and government policies to create value chains that strike a balance between national and international interests — and between growth and sustainability.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Logistics

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Supply Chains and TransportationSee all

Isabel Cane and Rob Strayer

November 13, 2025