The affordable housing crisis could get worse before it gets better, and other city-focused stories you need to read now

Despite housing prices falling in cities around the world, this isn't easing the affordability crisis, says Goldman Sachs. Image: Unsplash/Breno Assis

Jeff Merritt

Head of Centre for Urban Transformation; Member of the Executive Committee, World Economic ForumListen to the article

- This monthly round-up brings you some of the latest news on cities and urbanization.

- Top stories: The affordable housing crisis will take years of sustained effort to solve; shockwaves of the Silicon Valley Bank run are not over, especially for commercial real estate.

- For more on the World Economic Forum’s city-focused work, visit the Urban Transformation Hub.

1. Why falling home prices won’t fix housing affordability

Housing prices in cities around the world are falling and predicted to come down by as much as 20% in some countries, according to Goldman Sachs, but this isn’t easing the affordability crisis.

In fact, the housing shortage is likely to get worse before it gets better. High inflation due to lack of supply, leads to higher interest rates, which in turn impacts supply, according to a February US Housing and Urban Development (HUD) paper.

“The resulting decline in the housing market disincentivizes developers from building more housing, setting the stage for the next round of unaffordability after the overall economy has improved and interest rates again decline.”

The housing crisis in the US is further exacerbated by investor purchases of single-family homes. The ubiquity of “We Buy Houses” signs in many American cities is the subject of a recent report that quantifies the detrimental impact of “off-market” sales.

There are many contributing factors to the global housing crisis, depending on location – from too much parking to a lack of building materials and foreign investors (to name just a few). While targeted solutions will be localized, a comprehensive approach to the housing shortage is universally needed.

“Over the long run, implementing policies that target densification and increased supply is the only way to break the cycle of decreasing affordability and the resulting downstream challenges it poses for governments,” said the HUD report.

Building more mixed-use, mixed-income walkable neighborhoods would not only ease the affordable housing crisis, but would also help cities thrive in general.

A recent report by Smart Growth America shows that only 1.2% of landmass in the largest 35 US metro areas are considered “walkable” mixed-use districts, yet they account for 20% of GDP.

Cities that have increased density, such as Arlington in Virginia, have seen significant increases in tax revenue, which pays for better schools, parks and public space.

2. Looming crisis for US commercial real estate

Ongoing stress in the New York City commercial real estate sector is still creating economic headwinds for the region as it nears a complete recovery from the coronavirus pandemic, according to the New York Fed. And it’s unclear when or if the sector will return to its prior strength.

“While the residential rental market has bounced back, the retail and office markets have remained slack – largely due to the shift to remote work and online shopping,” the bank said in a posting on its website.

While more workers are coming into the office, they’re not doing it in great enough numbers to help lift up all the companies that once supported them, the New York Fed noted.

“It's very clear that the absence of office workers is continuing to put strains on the New York City economy,” said Jaison Abel, Head of Urban and Regional Studies at the bank, in a press briefing. When workers don’t come into the office, that means they’re not hitting shops and leisure firms, impairing employment in those parts of the service sector.

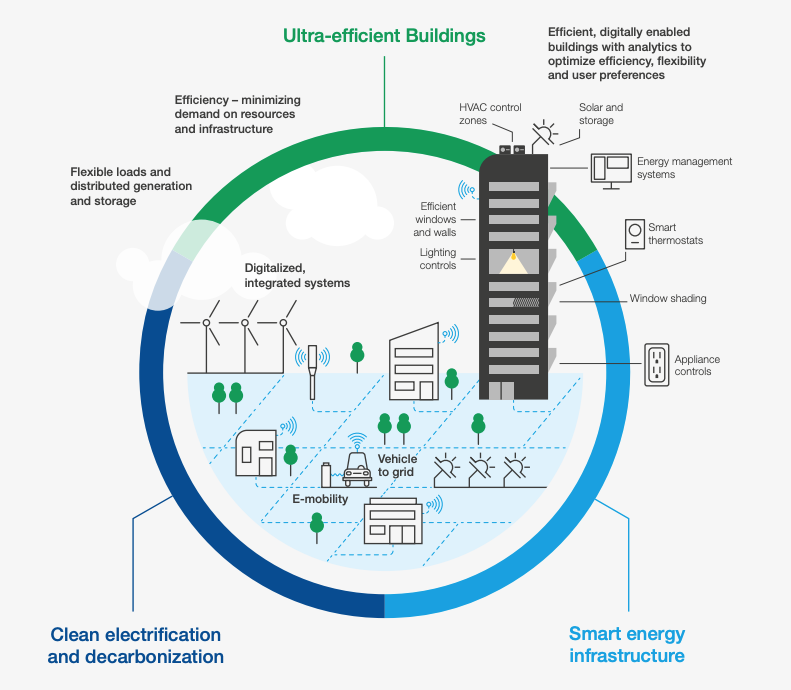

What is the Forum doing to help cities to reach a net-zero carbon future?

These findings on the city’s economy come as fears are mounting over the fate of the commercial real estate sector, which is heavily dependent on borrowing to function. The Fed has raised rates aggressively, increasing the cost of financing commercial properties at a time when there is also a reduced need for them, which has hit rent levels.

In March, a real estate executive serving on the Board of Directors of the New York Fed warned of a coming crisis for the sector and called for the industry to create a programme that would enable the “leeway and the flexibility from regulators to work with borrowers to develop responsible, constructive refinancing plans”.

The challenges faced by commercial real estate are further exacerbated by the troubles now hitting smaller banks in the wake of the failure of Silicon Valley Bank last month. These firms may be less able to lend in the current environment and may be more exposed to defaults from commercial property borrowers.

3. News in brief: other top cities and urbanization stories this month

China's new home prices rose in March at the fastest pace in 21 months, official data showed on 17 April. This suggests the market is out of the doldrums amid a flurry of support policies, but there is uncertainty on the strength of the momentum. New home prices in March edged up 0.5% month-on-month after a 0.3% rise in February, marking the fastest pace since June 2021 and the third consecutive monthly rise, according to Reuters calculations based on National Bureau of Statistics (NBS) data.

This news comes as China's commercial capital Shanghai saw its population fall in 2022 for the first time in five years. The densely-packed hub had 24.76 million people last year, compared with 24.89 million people in 2021. China's population fell last year for the first time in six decades, weighed down by rising living costs – especially in big urban hubs – weak economic growth and changing attitudes towards raising a family.

Shared mobility – such as ride-sharing services and e-scooters – could be key tools in the pursuit of net-zero emissions in our cities, but outdated attitudes are holding back its growth. Three industry experts share the changes that would bolster the mobility sector in cities everywhere.

The IPCC's latest findings highlight the role of cities in climate change action, but there is a missing link between global climate goals and local action in cities. WWF Cities Global Lead Jennifer Lenhart explains why cities need greater support to find sustainable solutions for urban ecosystems.