Mainstreaming Impact Investing 2014

Summary of Impact Investing Sessions at the World Economic Forum Annual Meeting 2014

Davos-Klosters, Switzerland

Background

Mainstreaming Impact Investing is a continuation of the Forum’s multi-year initiative on sustainable and impact investing. The overall project objective is to identify in what ways impact investing may be a feasible strategy for certain traditional and mainstreaminvestors and, where suitable, what factors are required to accelerate the flow of capital to impact investments from such investors.

To accomplish this objective, the World Economic Forum team will:

· Convene experts across the impact industry ecosystem to collaborate, share insight and develop an economic case for mainstream capital deployment to impact investing

· Engage traditional investors (e.g. institutional investors), policy-makers and others who are less familiar with Impact Investing to evaluate existing challenges and potential solutions

At the World Economic Forum Annual Meeting 2014 in Davos-Klosters, Switzerland, leading practitioners from the investment industry focused on the Forum’s Mainstreaming Impact Investing project to discuss and consider:

· How impact investments can be a source of differentiation and competitive advantage to investors who do not currently identify themselves as “impact investors”

· The potential for impact investments to generate positive financial return feedback loops and long-term value

· The relative suitability and attractiveness of a diverse set of impact investments through an interactive trading game designed by the Impact Invest Project Team at the World Economic Forum

Why a Trading Game?

· “Game” structure intended to increase participant engagement through interactivity and competitiveness

· Desire to win encourages participants to diminish preconceptions or entrenched opinions

· Game objective was to maximize financial return, while social impact was not actively measured* – done for three reasons:

· Prevent the session from becoming a debate on impact measurement/comparability (a known challenge)

· Closer alignment with mainstream investor thought-process in evaluating potential investments

· Manage complexity of variables for participants to consider (45 minutes allotted to the game)

· Experiencing a simulation can lead to new insight on how the impact investing space may evolve over a long-term horizon and what the strategic implications may be for mainstream investors

*We acknowledge that not measuring social impact is a substantial over-simplification for the purposes of the game. Real impact investments do in fact actively measure social impact in addition to financial returns.

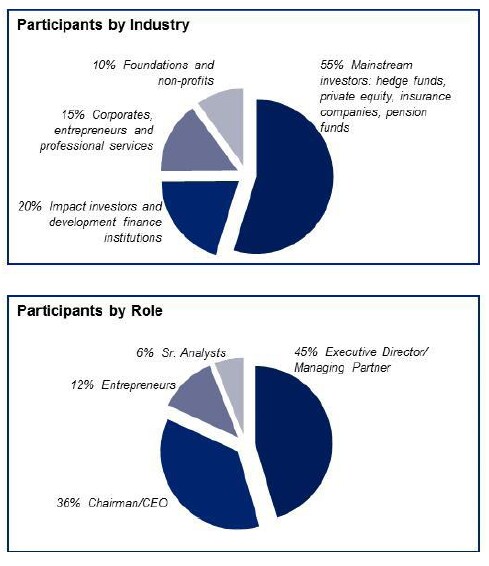

Who Participated?

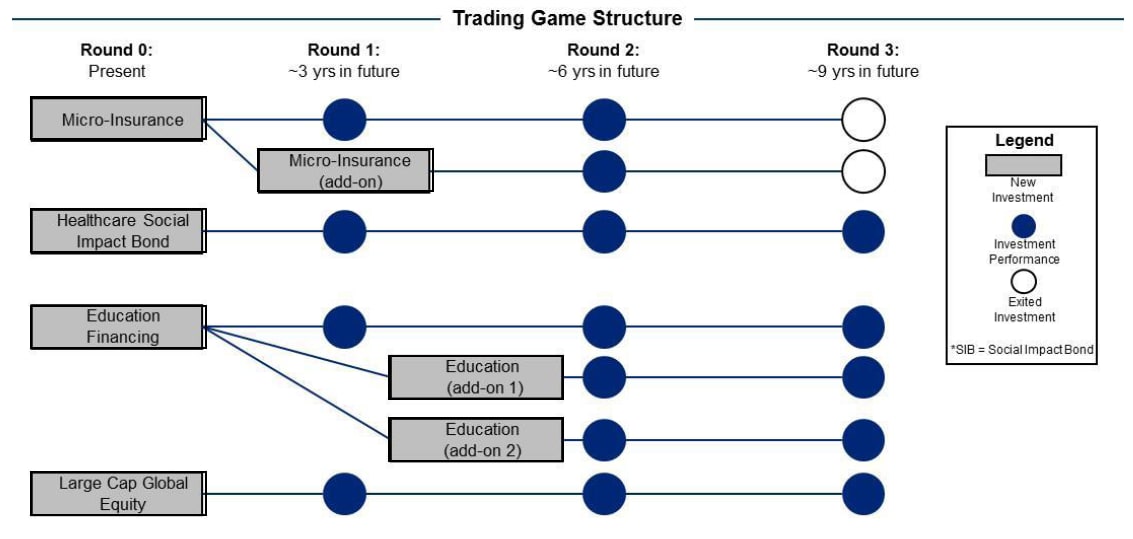

How Did the Game Work?

The game was structured to demonstrate potential scenarios of impact investments becoming sources of long-term value for investors

· Each round of the game required the teams to make investment selections (buy/sell/hold).

· Round 1 introduces investment “add-ons” only available if investment in the initial investment was made in round 0. The purpose is to demonstrate early-mover/incumbent advantage arising from local market expertise, relationship effects and positive financial return feedback loops.

· The hypothetical economic/geopolitical updates were be unveiled between rounds.

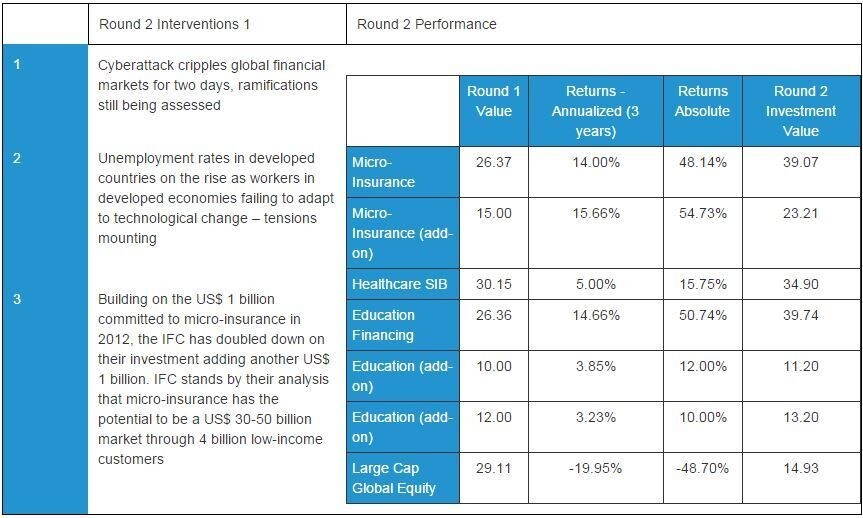

The following interventions and performance were unveiled at each round of the game

* While trading game interventions are hypothetical they are based on reasonable assumptions about events or actions that may transpire in the next 10 years.

· Throughout the trading game simulation, many of the participants noted that they found themselves discussing the relative merits of the social impact components of the investments. It was noted that ascribing relative values to social impacts for the purpose of comparison is a subjective exercise. Individual investors will likely have different assessments of the marginal value of insuring a farmer’s crops vs providing higher education, to low-income individuals vs treating malaria in African villages.

· Given the subjectivity in the relative value of social impacts, the group agreed that “how you decide” what to invest in is at least equally important to how social impact is measured. Certain impact investments may not lend themselves to quantifiable metrics, in which case they would categorically not be considered in the case that investment decisions were predicated on particular quantifiable social impact targets.

· Due to the long investment time horizon required to achieve significant social impact as well as potentially attractive financial returns, the group converged on the notion that it is best to approach impact investing through a focused approach by “adopting an issue and staying committed to it”.

· The types of risks associated with impact investments are largely different from those which mainstream investors typically evaluate and analyse. As such, the more that can be done to structure such investments in ways that mainstream investors are accustomed to may affect the flow of such capital. Examples mentioned were guarantees/principal protection or other forms of de-risking, which would make such investments look more attractive from a risk-adjusted return perspective.

· Whose money is being invested? This important question has different ramifications for different practitioners in the traditional/mainstream investing arena. Fiduciary duty, as it is currently widely interpreted, creates challenges for managers who would be interested in making impact investments. Since most traditional/mainstream investment organizations are built around scale, it is difficult to rationalize due diligence expenses for the deal sizes and associated risks that are currently in the market.

· Investment professionals will provide the services their clients demand and look to do so profitably. Accelerating the level at which impact investments included in the mainstream mix, requires ongoing and unwavering commitment to building out the market by governments, DFIs, NGOs, foundations and other parties that are not organized under for-profit principles.

Downloads

Click here to download the Excel Model used to run the trading game simulation.

If you plan to use this content for your own simulation, please let us know (ImpactInvesting@weforum.org). We are curious how the information is being used and want to know if we can provide guidance.

Contact Information

Katherine Brown

Katherine.brown@weforum.org

Global Leadership Fellow

Practice Lead – Investors Industries

World Economic Forum

Additional Information

Investment Option 1: Micro-insurance (Morosani Capital)

Economic Rationale: Financial returns derived from reducing income volatility of low-income people benefitting in turn from their own increased prosperity.

Background: Micro-insurance is the protection of low-income people (typically living on US$ 1-4/day) against various risks in exchange for premium payments. Essentially, it is the same as regular insurance with the exception that it is targeted to a very specific population that does not normally have access to insurance products. Representative product types include life, crop/livestock, theft, disability or natural disaster insurance.

Access to the safety net provided by such insurance gives the insured more confidence to make longer term investments in their businesses/farms, thus improving efficiency and productivity. Such improvements offer these individuals a greater chance for growing their businesses and alleviating the effects of poverty. In addition to social impact benefits, micro-insurance products have demonstrated the ability to generate positive reinforcing economic feedback loops. As the income levels of those insured increase, their need for additional coverage rises, leading to higher premiums.

Investment Overview: Morosani Capital is based in Germany and manages four impact funds, one of which invests in local micro-insurance companies in Malaysia with proven profitability. The Malaysia fund invested €10 million in 25 micro-insurance companies; it consistently returned 10-15% to investors per annum and led to 500,000 people having some form of insurance coverage. Based on the success of the Malaysian investment, Morosani has conducted a lengthy due diligence on similar opportunities in Indonesia. Morosani has met with Indonesian financial regulatory authorities and has received a commitment of support. Morosani is looking for Limited Partners to raise an additional €23 million from investors for the Indonesian expansion. To attract more “mainstream” investors, Morosani is offering preferred partnership terms to interested investors, meaning initial investors will get a “first-look” at future investments.

Investment Option 2: Healthcare Social Impact Bond (Intercontinental)

Economic Rationale: Financial returns generated through the savings associated with reduced healthcare costs and economic benefit of an increase in the productivity of the population.

Background: A Social Impact Bond (SIB) uses the money of private investors to accomplish socially beneficial goals and provide investors with market-competitive returns. Governments typically guarantee payment of the bonds based on the stated objectives being met. NGOs and other service providers receive the funds and scale up the work that they have been doing to bring about further change. The rationale is that cost savings to governments and productivity gains will exceed the amount of the underlying investment. This innovative structure has been successfully implemented in the US, UK and Australia, driving improved social outcomes in areas such as public safety and recidivism (re-incarceration rates), homelessness, public health and community development.

Investment Overview: In 2012, the Ministry of Health of Tanzania, along with a consortium of mining and consumer products companies, began organizing to create a SIB to fight the effects of malaria through prevention with insecticides, bed nets and spraying at-risk communities with safe pesticides. The total fund amount targeted to be raised for the bond is US$ 50 million. Of this, the consortium has committed the first US$ 25 million of capital and is looking to the private sector for the remainder of the funds. Consortium partners have a strong vested interest in the success of the programme as malaria infection has a direct and significant impact on the labour force and consumer base in the country. As such, they are offering outside investors the senior most tranche of this structure. Additionally, the African Development Bank (ADB) will serve as a liquidity provider and guarantee principal. The health ministry and the consortium will pay investors the performance/return component of the investment.

Malaria Impact on Tanzanian Economy:

Investment Facts:

Investment Option 3: Education Impact Investment Fund (Belvedere)

Economic Rationale: Financial returns derived from increased income levels and entrepreneurial outlook of university graduates that would otherwise not have been able to attend.

Background: Many developing countries suffer from chronic underinvestment in the education sector, while it is estimated that 70% of a country’s wealth is accounted for by education. For example, in Mexico only 2% of college students have access to student loans. Globally, around 88% of the world’s youth do not attend a higher education institution. Of those who are able to enroll, drop-out rates among the poor are very high, with 60% of drop-outs citing inability to pay as the primary cause for abandoning their studies. Investments in education have the potential to create economic tipping points in target countries by spurring foreign direct investment and various beneficial spillover effects resulting from a rising standard of living.

Investment Overview: Belvedere is an impact fund manager that has brought a market-based approach to address this problem through “human capital contracts” – students pay back their principal and interest as a percentage of their income after graduation. Based on experience in Mexico and Peru, Belvedere has seen that the income differential from attending university more than offsets the payments students are required to make. Throughout the course of a student’s contract, Belvedere actively encourages students to maintain a balance of financial and social considerations in their future endeavors. After nearly 10 years of experience Belvedere is targeting an expansion into Colombia and Chile and is looking to raise US$ 60 million; US$ 30 million of this is already committed from a subsidiary of a large consumer products company in Colombia looking to benefit from increased economic prosperity arising from a more educated population.

Investment Facts:

Investment Option 4: Large Cap Global Equity Fund

Economic Rationale: Financial returns are derived from capital gains of a diversified pool of large cap global equities.

Background/Investment Overview: Fund follows traditional portfolio construction methodology and looks to track the global S&P large cap index. The fund represents 70% of the float-adjusted market cap in developed and emerging economies.

Investment Facts: