How can we stop crowdphishers?

Stay up to date:

United States

This article is published in collaboration with Project Syndicate.

If one were seeking a perfect example of why it’s so hard to make financial markets work well, one would not have to look further than the difficulties and controversies surrounding crowdfunding in the United States. After deliberating for more than three years, the US Securities and Exchange Commission (SEC) last month issued a final rule that will allow true crowdfunding; and yet the new regulatory framework still falls far short of what’s needed to boost crowdfunding worldwide.

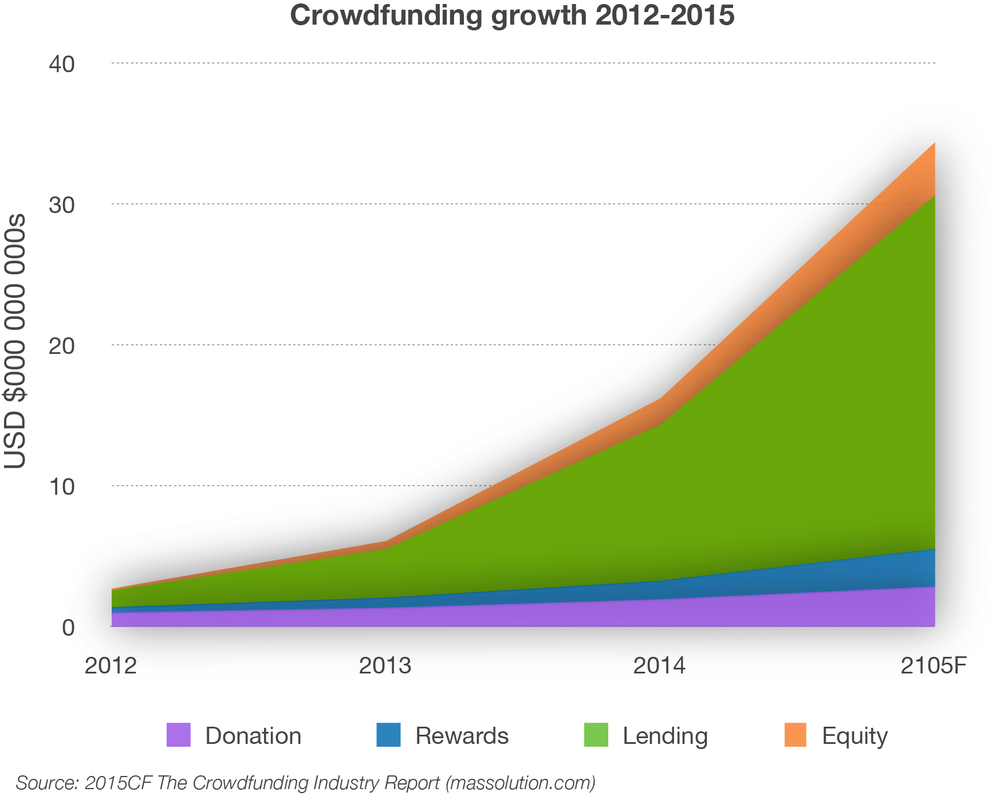

True crowdfunding, or equity crowdfunding, refers to the activities of online platforms that sell shares of startup companies directly to large numbers of small investors, bypassing traditional venture capital or investment banking. The concept is analogous to that of online auctions. But, unlike allowing individuals to offer their furniture to the whole world, crowdfunding is supposed to raise money fast, from those in the know, for businesses that bankers might not understand. It certainly sounds exciting.

Regulators outside the US have often been more accommodating, and some crowdfunding platforms are already operating. For example, Symbid in the Netherlands and Crowdcube in the United Kingdom were both founded in 2011. But crowdfunding is still not a major factor in world markets. And that will not change without adequate – and innovative – financial regulation.

There is a conceptual barrier to understanding the problems that officials might face in regulating crowdfunding, owing to the failure of prevailing economic models to account for the manipulative and devious aspects of human behavior. Economists typically describe people’s rational, honest side, but ignore their duplicity. As a result, they underestimate the downside risks of crowdsourcing.

The risks consist not so much in outright fraud – big lies that would be jailable offenses – as in more subtle forms of deception. It may well be open deception, with promoters steering gullible amateurs around a business plan’s fatal flaw, or disclosing it only grudgingly or in the fine print.

It is not that people are completely dishonest. On the contrary, they typically pride themselves on integrity. It’s just that their integrity suffers little lapses here and there – and not always so little in aggregate.

In my new book with George Akerlof, Phishing for Phools: The Economics of Manipulation and Deception, we argue that unscrupulous behavior has to be factored into economic theory in a fundamental way. The economic equilibrium we live should be regarded, above all, as a phishing equilibrium, in which small-time individual dishonesty can morph into something more systemically important when it is carried on by business organizations under intense competitive pressure. Yes, competition rewards the sharp and hardworking. But it also often compels them to keep the frontiers of subtle deception in view.

The SEC’s new rules for crowdfunding are complex, because they address a complicated problem. The concept underlying crowdfunding is the dispersal of information across millions of people. Most people, even the cleverest, cannot grasp the next breakthrough business opportunity. Those who can are dispersed. The economist Friedrich Hayek put it well in 1945:

“[T]here is beyond question a body of very important but unorganized knowledge which cannot possibly be called scientific in the sense of knowledge of general rules: the knowledge of particular circumstances and place. It is with respect to this that practically every individual has some advantage over all others in that he possesses unique information of which beneficial use might be made, but of which use can be made only if the decisions depending on it are left to him or are made with his active cooperation.”

The problem is that the promise of genuine “unique information” comes with the reality of vulnerability to deception. That’s why channeling dispersed knowledge into new businesses requires a regulatory framework that favors the genuinely enlightened and honest. Unfortunately, the SEC’s new crowdsourcing rules don’t go as far as they should.

The 2012 US legislation that tasked the SEC with rulemaking for crowdfunding platforms specified that no startup can use them to raise more than $1 million a year. This is practically worthless in terms of limiting the scope for deception. In fact, including this provision was a serious mistake, and needs to be corrected with new legislation. A million dollars is not enough, and the cap will tend to limit crowdfunding to small ideas.

Some of the SEC rules do work against deception. Notably, crowdfunding platforms must provide communication channels “through which investors can communicate with one another and with representatives of the issuer about offerings made available.”

That is a good rule, fundamental to the entire idea of crowdfunding. But the SEC could do more than just avow its belief in “uncensored and transparent crowd discussions.” It should require that the intermediary sponsoring a platform install a surveillance system to guard against interference and shills offering phony comments.

The SEC and other regulators could go even further. They could nudge intermediaries to create a platform that summarizes commenters’ record and reputation. Indeed, why not pay commenters who accumulate “likes” or whose comments on issuers turn out to be valuable in light of evidence of those enterprises’ subsequent success?

For the financial system as a whole, success ultimately depends on trust and confidence, both of which, like suspicion and fear, are highly contagious. That’s why, if crowdfunding is to reach its global potential, crowdphishing must be prevented from the outset. Regulators need to get the rules right (and it would help if they hurried up about it).

Publication does not imply endorsement of views by the World Economic Forum.

To keep up with the Agenda subscribe to our weekly newsletter.

Author: Robert J. Shiller, a 2013 Nobel laureate in economics, is Professor of Economics at Yale University and the co-creator of the Case-Shiller Index of US house prices.

Image: U.S. dollar notes are seen in this picture illustration taken at the Bank of Taiwan in Taipei. REUTERS/Nicky Loh.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Economic GrowthSee all

Gayle Markovitz and Beatrice Di Caro

July 9, 2025

Ajay Kumar, Neha Thakur and Siddharth Sharma

July 8, 2025

Rania Al-Mashat

July 7, 2025

Bright Simons

July 7, 2025

John Letzing

July 3, 2025