From crisis to resilience: a new framework for cross-sector cooperation

Aligning global aid stakeholders enables systemic solutions. Image: iStock

- The turbulent current landscape has sparked a global debate on a future-proof aid and development system with a stronger engagement of the private sector.

- The HRI's Framework for Frontier Market Cooperation offers a new means of multistakeholder collaboration, to mobilize capital in frontier markets and deliver transformative outcomes for the world’s most vulnerable communities.

- The framework represents a shift from short-term fixes to long-term value creation.

The global development and aid communities are navigating a perfect storm of shrinking budgets and growing criticism. This has sparked urgent discussions about what a truly “future-proof” approach to development should look like and how to deliver real, lasting impact in a rapidly changing world.

Many see this moment as both overdue and much-needed, and emphasize the need to rethink global cooperation models towards ones that are more efficient, results-driven and resilient. Calls for “new” and “innovative” partnerships are growing louder, especially those with the private sector, seen as critical to unlocking new resources and innovation. Yet they are happening within a system already marked by fragmentation, siloed efforts and a weakening multilateral order.

The HRI Framework for Frontier Market Cooperation

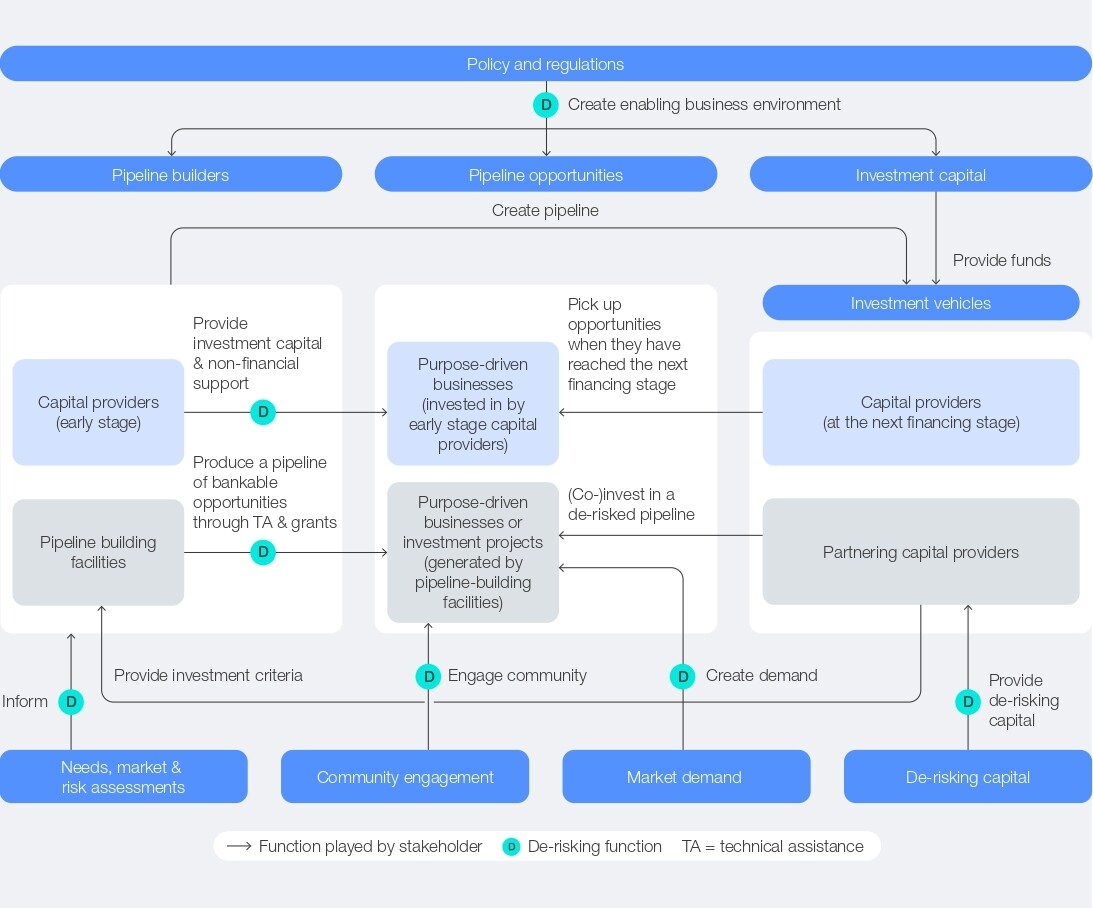

The Humanitarian and Resilience Investing (HRI) initiative has developed the Framework for Frontier Market Cooperation, which presents a new model of collaboration tailored to the complex realities of today’s development landscape. Designed to move beyond traditional aid-based approaches, the framework brings diverse stakeholders together – governments, development and humanitarian actors, investors, development finance institutions (DFIs), civil society and philanthropists – to drive long-term, inclusive impact in frontier markets.

At its core, the framework places private sector-led solutions and local inclusion at the forefront. It introduces a sequenced, practical approach for aligning public and private efforts to build “value chains for impact”, bridging two global conversations that have often operated in isolation into a coherent system: the push to mobilize private investment in fragile contexts, and the evolving dialogue on humanitarian and development cooperation.

The innovation of the model lies not in any single component, but in how it strategically integrates and sequences existing efforts and innovations, such as blended finance, and innovation-friendly procurement. It clearly defines the roles of each stakeholder group, many of which contribute to de-risking investment in frontier markets, transforming fragmented initiatives into a cohesive, high-impact system.

Here are five innovative ways the HRI Framework for Frontier Market Cooperation encourages new ways of collaboration:

1. Align investment decisions with local needs and realities

HRI places humanitarian and development actors, NGOs and community voices at the table from the start. Where traditionally, these organizations deliver aid in crises, HRI recognizes that they have deep community roots and embeds these agencies as critical advisors to help identify investment opportunities that are contextually grounded and socially relevant. This converts social insight into market intelligence, ensuring that investments are not just viable, but value-aligned.

For example, a DFI could partner with a peacebuilding organization to conduct a conflict sensitivity study in a frontier market, aiming to guide investments that minimize risks of exacerbating tensions and promote peace. This approach would ensure investment projects are both economically viable and socially responsible in fragile contexts.

2. Engage local communities and development actors post-investment

Engaging communities is essential not only for identifying investable opportunities, but for ensuring long-term accountability, trust and shared value after an investment is made. Community inclusion is not a “nice-to-have” – it is a critical risk-mitigation tool, a foundation for social licence to operate, and a key driver of sustained impact.

An example is Interpeace’s Peace Bonds project in northern Ghana and Burkina Faso, which supported the development of a 50 MW solar farm. By embedding community-led land dialogues, benefit-sharing agreements and peacebuilding partnerships into the investment process, the initiative significantly reduced perceived conflict risks, lowered financing costs by two percentage points, and enhanced investor confidence through inclusive, locally grounded governance.

3. Enhance collaboration among capital providers

Investors are recognized as a heterogeneous stakeholder group, with each capital provider placed along a continuum of financing stages (from seed to series C+) and impact (ranging from “impact first” to “commercial interest first”), that each provide an important mix of capital and support (such as technical assistance or investor guidance). If the sequence of this support is connected, the continuum can inherently be recognized as an organically functioning “pipeline-building mechanism”, with each investor providing the necessary ingredients to help a business grow and develop from one financing stage to the next.

For example, the elea blends philanthropic capital with hands-on business mentorship and strategic investor guidance to support locally driven, high-impact enterprises at the early and growth stages. By strengthening these ventures, elea enables a smoother transition to follow-on investment. Investors at the next financing stage can gain confidence knowing that a trusted peer has supported the venture in becoming investor-ready for the following phase.

4. Structure capital to de-risk investments

The framework highlights the core function of innovative financial architectures that have evolved to fit the characteristics of frontier markets, with adapted terms, timelines and architectures to invest in the large pool of MSMEs that exists in these contexts. These could include, for example, adapted fund structures (e.g. blended funds or MSME funds) or impact bonds. They become a conduit to crowd in the larger pools of investment capital (for example from institutional investors, banks, or DFIs) that exist and that otherwise would not have the opportunity to engage.

An example includes Acumen’s Hardest-to-Reach initiative, which is mobilizing $250 million in blended finance to expand clean energy access in sub-Saharan Africa’s most under-served markets, with backing from a coalition of DFIs, impact and commercial investors.

5. Leverage procurement as a de-risking mechanism

HRI reframes procurement from logistics to a powerful de-risking tool for investment. When humanitarian and development actors procure goods and services from local impact businesses (e.g. those manufacturing clean cooking solutions, water filters, or decentralised wastewater management systems), they provide a stable demand signal and a runway to scale. This purchasing behaviour legitimizes ventures and builds market confidence, becoming a form of catalytic capital.

Innovation Norway is leading important work in this area. Through its Humanitarian Innovation Programme, it works to support humanitarian agencies to transform traditional tendering processes so that they can de-risk and accelerate innovations coming from the private sector.

From short-term fixes to long-term value creation

The HRI Framework for Frontier Market Cooperation requires advanced coordination among a diverse group of stakeholders, including governments, development and humanitarian actors, investors, development finance institutions (DFIs), civil society and philanthropists. This complexity is both a strength and a challenge.

On one hand, aligning these stakeholders unlocks complementary strengths and enables systemic solutions to long-standing barriers, particularly the difficulty of channelling capital toward social business models that deliver measurable benefits to communities facing fragility and crisis. On the other hand, such multistakeholder collaboration is inherently difficult. It demands a sophisticated coordination including not only the alignment of diverse priorities, incentives and funding streams, but also a fundamental shift in mindset – from short-term fixes to long-term, shared value creation.

The consequences of today’s shifting development landscape are becoming increasingly visible, with UN agencies announcing significant staffing cuts and programme reductions in countries that depend on humanitarian aid for essential services such as health and nutrition. In this context, the HRI initiative is accelerating efforts to operationalize this framework as a viable, long-term alternative to aid-dependent models.

With continued support from the IKEA Foundation and in collaboration with a growing network of over 100 partners, the initiative will begin testing and scaling ways to put the framework into practice. These new approaches will be designed to support and enable structural, ecosystem-wide cooperation, moving beyond fragmented, one-off partnerships toward systemic and scalable solutions.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Humanitarian and Resilience Investing

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Global CooperationSee all

Sadaf Hosseini

February 12, 2026