Global trade tensions escalate amid new US tariffs, and other international trade stories to know this month

This monthly round-up brings you a selection of the latest news and updates on global trade. Image: Unsplash/CHUTTERSNAP

- This monthly round-up brings you a selection of the latest news and updates on global trade.

- Top international trade stories: US tariff escalation and global responses; Traders race to beat Trump's 50% copper tariff; Global oil market tighter than it looks, warns IEA.

1. Trade tariff round-up: US hikes duties on EU, Mexico and others

After another rollercoaster week for global trade tariff news, Reuters has aligned the US administration's negotiation tactics with what it calls "the art of hogging headlines".

The days surrounding the 9 July deadline for trade agreements saw a rapid escalation in both rhetoric and action, as President Trump pressed ahead with sweeping tariff threats and announcements targeting some of America’s largest trading partners.

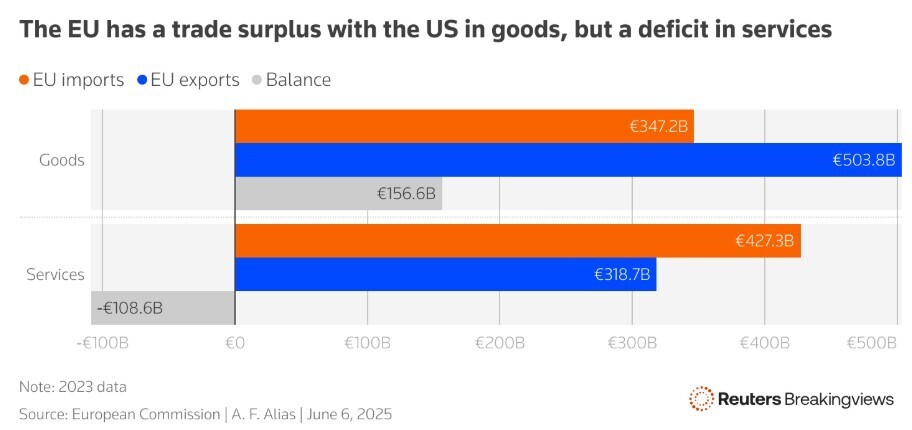

This included a 30% tariff for both the European Union and Mexico, effective 1 August. The EU warned this would effectively wipe out much of its commerce with the US, with EU trade commissioner Maroš Šefčovič stating that such a measure would make current trading conditions "almost impossible". Despite ongoing talks, the EU is maintaining its suspension of retaliatory tariffs until 1 August, while preparing additional countermeasures if negotiations fail.

Mexico also criticized the tariffs as “unfair treatment”, though President Claudia Sheinbaum expressed cautious optimism about reaching better terms with the US.

Despite the heightened tensions, global financial markets have held relatively steady, with the International Chamber of Commerce noting that they appeared "pretty sanguine" even as tariff threats intensified.

Here's how the week unfolded:

- 7 July: The White House sent letters to 14 countries – including Japan, South Korea, Malaysia and Kazakhstan – outlining new, higher tariff rates (ranging from 25% to 40%) that would take effect 1 August unless trade deals are reached.

- 7 July: President Trump officially delayed the implementation of reciprocal tariff increases until 1 August, giving countries additional time to negotiate.

- 9 July: The US administration sent a second round of letters to seven more countries warning of pending tariffs if no agreement is reached.

- 12 July: President Trump announced 30% tariffs on imports from the European Union and Mexico, effective 1 August, after talks for a broader trade deal collapsed.

- 12 July: Additional tariffs were also announced for Japan, South Korea, Canada, Brazil and a 50% tariff on copper imports.

- EU response: The EU criticized the new tariffs and signalled possible countermeasures, while internal divisions emerged over how to proceed with US negotiations.

- Economic impact: US customs duty revenue surpassed $100 billion for the fiscal year ending in June, reflecting the scale of the new tariff regime.

2. Copper imports surge as US tariff deadline triggers global trade shuffle

Against this backdrop, commodity traders are rushing to push final copper shipments into the US ahead of President Trump’s 1 August 50% import tariff. This move has created a highly profitable arbitrage opportunity, with traders netting up to $1,000 per ton by rerouting shipments originally bound for China back to the US, according to Bloomberg.

This year, more than 230,000 tons of copper have been diverted into ports such as New Orleans and Panama City, causing warehouse shortages and a surge in Comex inventories. Industry veteran David Lilley described the situation to Bloomberg as “the best physical trading opportunity I have seen”, with margins exceeding traditional levels by tenfold.

As manufacturers await clarification from US authorities regarding tariff implementation, the Financial Times noted that companies are “begging for clarity … as their stockpiles diminish”, fearing supply chain disruptions.

India, for example, a significant producer of copper components for electronics, has expressed concern that the tariff could hinder its domestic semiconductor goals. Indian officials are evaluating potential cost increases for chip and electric vehicle manufacturers, according to the Economic Times.

Some copper shipments remain at sea with uncertain delivery timelines, while others are being rerouted to faster entry points such as Los Angeles or Hawaii. “We have no idea how customers will handle it. We tried to forewarn them,” one CEO told Bloomberg.

Despite these developments, miners remain positive about copper’s long-term demand. Barrick Gold’s CEO told Reuters that demand driven by electrification and data infrastructure will continue, citing a $2 billion expansion project in Zambia as evidence of ongoing confidence.

3. News in brief: Trade stories from around the world

The global oil market may be tighter than official numbers indicate, according to the International Energy Agency. In its latest Oil Market Report, the IEA projects global oil demand growth will slow to 700,000 barrels per day in 2025, marking the weakest rate since 2009 outside of the pandemic. The slowdown is attributed to softening consumption in emerging markets, even as global supply and refinery activity continue to rise.

Amid ongoing trade tensions, gold continues to demonstrate resilience as investors weigh the potential impacts. Spot gold prices have climbed to their highest level in several weeks, supported by renewed safe-haven demand amid escalating concerns over US trade tariff policies. Meanwhile, US gold futures have also advanced in response to these developments.

Gulf stock markets were mostly subdued on 14 July amid renewed US tariff threats against the EU and Mexico. Saudi shares edged lower, while gains in clean energy helped limit losses. Dubai’s index held flat after briefly touching a 17-year high, as investors awaited key earnings updates.

The UK has launched its first trade strategy in over 30 years, aiming to support businesses facing growing global trade disruptions and new US tariffs, reports the Independent. Framed as part of the government’s post-Brexit “Plan for Change”, the strategy pledges £5 billion in support and expands UK Export Finance capacity to £80 billion.

Chinese exports rose 5.8% year-on-year in dollar terms in June, beating expectations as companies used a tariff truce with the US to ship goods ahead of the August tariff deadline for a more definitive deal. The strong trade figures came ahead of this week’s GDP data for the second quarter.

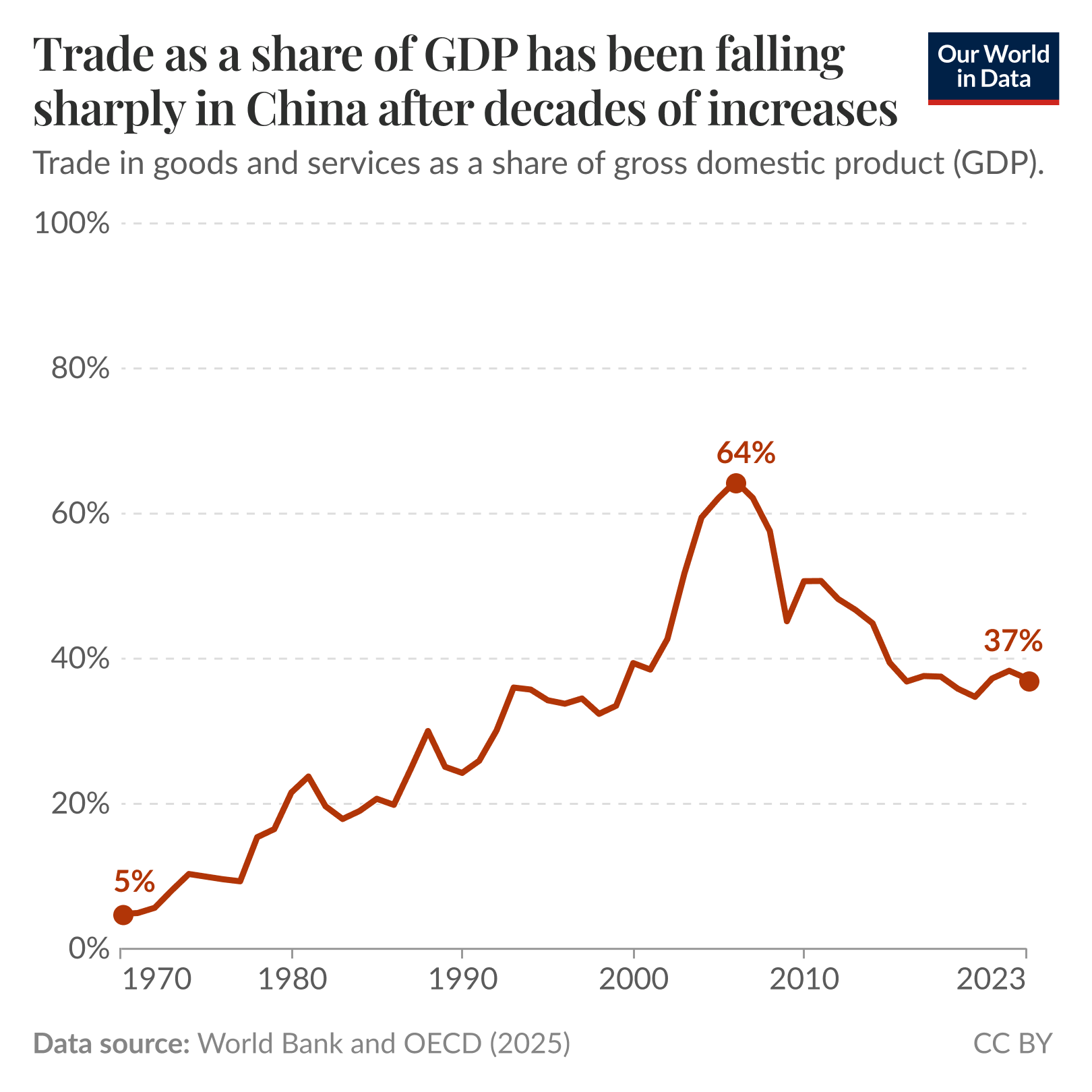

However, China’s trade-to-GDP ratio has declined sharply over the past 15 years, falling from 64% in 2006 to 37% in 2023, as the country’s economy expanded faster than its exports, according to Our World in Data.

4. More on trade on Forum Stories

West Africa stands at a crossroads, according to Yusuf Maitama Tuggar, Minister of Foreign Affairs of Nigeria. Despite vast markets, a young population and abundant resources, the region has yet to unlock its full trade potential. At the inaugural West Africa Economic Summit, leaders made one thing clear: the cost of inaction now outweighs the challenge of reform. This is not about copying other models – it's about building a trade agenda that works for West Africa, on West Africa’s terms. Read Tuggar's new article on why implementation, not intention, must now lead the way.

China is shifting from an export-led growth model to its new “Dual Circulation” strategy, which emphasizes domestic resilience and reduced external dependency. This approach focuses on industrial upgrading, market governance, social rebalancing, and risk management to strengthen the economy amid global uncertainties and support long-term development goals, writes the Forum's Erik Crouch, Digital Editor, Strategic Intelligence.

Trade is key to development, but delays and inefficiencies hold many countries back. The Global Alliance for Trade Facilitation partners with governments, businesses, and organizations to simplify customs, digitalize processes, and open global markets – especially for SMEs. Watch global leaders discuss how public-private collaboration is transforming trade to be faster, safer, and more inclusive:

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Trade and InvestmentSee all

Maira Martini and Katja Bechtel

February 24, 2026